Introduction

Financial professionals know that market volatility is inevitable—what goes up must come down—and, accordingly, we prepare for it in the investing decisions we make for ourselves and our clients. But the severe shock brought on by COVID-19 brought unprecedented volatility and repercussions that have reverberated through our daily lives. How can we make sure our clients’ emotions don’t get in the way of their better judgement when making financial decisions? And how can we plan ahead, when things are calmer, for the emotional rollercoaster that comes with future market movements?

Questions like these are the ones behavioral science tries to answer. We know that our minds can lead us astray, especially when making financial decisions, but there are ways that advisors can help clients stay on track. This guide explores behavioral principles and techniques you can implement to help investors stay on track during market turmoil. We begin by explaining why our minds can be our own worst enemies during volatile times, and then we dive into a framework that advisors can use to help investors avoid mental missteps.

A Behavioral View of the Mind

Researchers sometimes characterize the complexity of our minds as two stylized “Systems:” System 1 and System 2.1 Both are essential and important in their own right, but they operate quite differently. System 1 helps us make everyday decisions and react quickly when we need to, while System 2 helps us make more deliberate decisions and work on more complex tasks. For both our intuitive reactions (System 1) and conscious thought (System 2), our minds try to save energy by using shortcuts to make decisions more quickly. Normally this works well, but biases pop up when our natural shortcuts lead us to the wrong conclusions. When they affect our finances, many biases can have big implications.

Volatile times can also make us more prone to behavioral mistakes. The emotional rollercoaster that comes with extreme volatility can cause distraction that nudges us to depend on our System 1 more often. Because of COVID-19 containment efforts, the everyday schedule and habits that help us make daily, easy decisions—like what time to eat lunch or get up in the morning—aren’t there anymore, so our minds must work overtime. On top of that, our minds may be largely occupied by other worries—the health, safety, and economic troubles of loved ones and ourselves.

An overworked, tired, and distracted mind is bound to take more shortcuts than usual, forcing us to depend on System 1 more often and increasing the chance we’ll be swayed by behavioral biases.2

Behavioral science research has documented over a hundred different biases that can lead us astray when making decisions. This paper focuses on a few select biases that are particularly pernicious when it comes to market volatility.

Recency Bias

When we predict what’s going to happen in the future, our minds naturally reach for what happened most recently.3 In part, that is because our brains have an easier time remembering what just happened versus what occurred further in the past. Although this shortcut usually works out for us in everyday life, it can result in us placing undue importance on recent events when we make investing decisions. For many investors, this means that when their portfolio drops 10%, recency bias convinces them that it will continue dropping.

Herding Behavior

When you’re choosing which restaurant to order takeout from, you might consider looking at their reviews online. If one restaurant has plenty of rave reviews, while the other has only a few subpar comments, you will choose the restaurant with plenty of rave reviews. With restaurants and many other parts of our lives, it can be a good idea to follow the crowd. During market volatility however, many investors are overreacting, so the crowd’s usually going in the wrong direction.4 And going against the crowd, especially during times of uncertainty, can feel extremely unnatural.5

Action Bias

“Well, at least you tried.” This common consolation can be comforting and justified in many decisions. Prior research has found that the urge to take dramatic action can trick us in cases where the statistically correct choice is thoughtful inaction.6 During times of volatility, sometimes resisting the urge to “Sell! Sell! Sell!” could be the right decision.7 Doing nothing while markets are dropping is extremely hard for us, however, because it goes against our instinct to take action. In our minds, it hurts less to try something and lose, compared with doing nothing and losing the same amount. If investors don’t calmly think about the appropriate course of action, and give in to action bias instead , it can make their losses objectively worse, but, to them, it can feel subjectively better.

Overconfidence Bias

Do you believe you are an above-average driver? If you said yes, you have agreed with about 90% of all drivers in a famous study of everyday people who said they were above-average drivers.8 Even though we know we all can’t be above-average drivers, our minds tell us that we must be better than the rest. This is overconfidence bias. We all tend to be unrealistically optimistic about our chances of success.9 When it comes to making investing decisions, this can result in investors making rash choices and believing that, when push comes to shove, they will be spared the pain others will experience.

Confirmation Bias

Even if we try to engage in proper research before making a decision, our minds will automatically pay more attention to information that supports our current beliefs. Confirmation bias is our tendency to find and interpret information in a way that supports our opinion, and it can derail even the most wellmeaning investor who is trying to keep up with the news.10

Loss Aversion

One of the most well-known and often-cited behavioral biases, loss aversion, also comes into play with investing. Specifically, a 10% portfolio loss feels a lot worse than a 10% gain for many investors because we are loss-averse: Experiencing a loss generally feels twice as bad as gaining the same amount.11 As market volatility continues, investors may experience strong emotional reactions that cloud judgment. Those are six of the most important biases that come into play during times of volatility. Here are ways advisors can effectively work with clients as they encounter these biases and more in their practice.

Where to Intervene: The Five Steps From Information to Action

Volatility itself is just data: numbers going up and down. A few things happen between a person seeing those numbers and reacting, and at each step there are ways to help change that emotional response for the better. We mapped out the decision-making process during volatility into the following five steps:

1. Investments

2. Information

3. Emotion

4. Decision

5. Action

At each step, we can examine what may be going on in an investor’s mind in those moments, what it can mean for their finances, and behavioral techniques you can use to guide investors in the right direction. Each step contains two sections: One focused on what can be done to prepare before volatility and another focused on interventions that can be implemented while volatility is in full swing.

Investments: Selecting and Setting Expectations

Before

Use bucketing and mental accounting. Even though money is fungible, our minds sometimes assign a purpose to each dollar we generate and spend. We subconsciously place our money into separate accounts, or buckets, intended for a planned purpose ranging from something simple, like gas money, to something meaningful and important, like a child’s education.

One way to help investors manage their emotions during volatility is to help bring out the meaning behind each dollar—such as with a bucketing strategy. Labeling accounts with the investing goal that this money will achieve makes it easier for investors to stay connected to that purpose when volatility arises. A reminder that selling investments from a particular bucket means taking money out of the college fund may be the nudge investors need to stay invested.

Understand risk tolerance. The common approach to preparing clients for volatility is to ask them about their risk tolerance and create a portfolio accordingly. Many investors, however, may not know how they’ll react when losses begin. It’s hard to predict just how strong our emotions will be when markets take a turn for the worse. This is, in part, a limitation we all need to plan for: We should assume that self-reported risk tolerance changes over time, especially now. We can dig deeper by using simulators to help people experience volatility beforehand and looking at past behavior—with data if available.12

Set realistic expectations. It may be worth reminding investors that a well-constructed portfolio that has substantial equity exposure will lose value about one-third of the months in its lifetime. Some investors may not realize that this kind of volatility is normal and should be expected. Helping people understand what “normal” turbulence looks like can help them better understand the journey. Where possible, advisors should make this expectation visual and vivid—don’t just show statistics, but paint a picture to help clients feel the experience of volatility.

During

Focus on goals. We have all seen how focusing on short-term prices can lead to bad choices. While a longer-term focus can help, it's not always clear how to create that focus. So, we developed a three-step process that can help investors slow down and reconnect with their long-term goals. The process first asks investors to write down their top three investing goals. After that, they’re given a master list of common investing goals and asked to check off the goals they think are important but forgot to mention in the previous round. After that, investors are asked to revisit their top three goals to see if the process has given them new insights into their true priorities. Because it helps investors systematically understand their own preferences when it comes to their financial goals, our research found that most investors end up changing at least one of their top three goals after going through the exercise, so in the context of volatility, it can help investors reconnect with and commit to their goals.

Information: How Much Is Too Much?

Constant market updates can put anyone on edge, especially during market volatility. This tendency to be impacted by the mere frequency of receiving information is called myopic loss aversion. It’s a combination of loss aversion—our heightened sensitivity to losses than to gains—and a narrow focus on the “now,” which can be amplified by how often people check their performance. Every time a client checks their portfolio, they are slicing results into smaller timeframes and giving themselves more opportunities to make bad choices.13 In a study run with experienced financial traders, researchers found that even financial professionals are not immune to myopic loss aversion.14 The more often traders saw price changes, the more risk averse they became, prompting them to repeatedly adjust their risk exposure and undermine overall performance.

Before

Set a regular schedule. How often do you think your clients check their portfolios? Even if your client doesn’t check their portfolio frequently under normal circumstances, their behavior may change when things get rough. You can’t prevent your client from checking their investments, but you can help them focus on long-term performance instead of daily changes. Explain to your client that you will meet with them on a regular basis to discuss their progress towards their goals. Though there may be price changes in the meantime, during those check-ins, you will make sure they are still on track to meet their goals. This long-term, goal-centric view is one of the most valuable nudges an adviser can provide.

During

Set a crisis schedule. As volatility happens, you can also actively encourage clients to avoid checking portfolios every day (or even more often). Prices change with such velocity during volatile times that some clients may even need a reminder that they shouldn’t constantly refresh their portfolio performance page or tap at their cell phones. These are the times when you can work with your client to structure how often they check their portfolios or look at market news. Start off by encouraging your client to catch up on the news only once at the end of the day, or even just once a week.

Emotion: Understanding Our Biases

Many investors don’t appear to recognize that their investing decisions are impacted by their emotions. Our research found that investors don’t understand the importance of advisors helping them manage their emotions.15 This blind spot can be dangerous, especially during market turmoil when our emotions take the driver’s seat more than ever. Nevertheless, advisors can help. Here are some techniques advisors can use to handle the emotional response to market volatility.

Before

Educate about biases. Before volatility hits, clients may benefit from understanding the psychology behind their emotions. Research finds that educating people about the biases we all face, as investors and human beings, helps them recognize the impact of biases in their own decisions.16 In the adviser-client relationship, this can mean discussing behavioral concepts with your client and explaining prevalent biases, such as recency bias, herding behavior, and action bias. A "we all have this" approach avoids judgment and condemnation to help investors (and advisors alike) recognize the challenges we all face.

During

Set the narrative. Market volatility typically presents many opportunities that arise from mispricing, where quality investments sell for low prices, but this may be hard for clients to recognize. This is a time for advisors to re emphasize to clients that logical investing decisions should be made based on the quality and value of the investment, not just price. Helping your clients think about market volatility using this framework gives them a narrative they can depend on during downturns.

Anxiety reappraisal. We can’t completely erase our biases, but we can find ways to accommodate our biases when it comes to investing decisions. Instead of trying to suppress our biases, we can harness those emotions and rename them. Research suggests that the physiological basis of anxiety—like a faster heart rate or wobbly knees—is actually very similar to that of excitement.17

Anxiety reappraisal

Takes feelings of anxiety and calls them by a new name: excitement.18 Instead of letting investors give in to the anxiety that can come with market fluctuations, advisors can help clients get excited about the possibility of buying some securities at a discount and maybe reaching some of their stretch goals.19

Look to help others. There are also ways to help us manage the emotions around our finances in ways that don’t concern our finances at all. Recent events have left many people struggling, and encouraging clients to see what they can do to help their communities and fellow human beings during tough times may help them control their own emotions.20

Decision: Intervening at the Right Moment

Even if an investor’s panic can’t be reframed or avoided, there are ways to prevent emotions from impacting their final decisions.

Before

Pre-commitment devices. These devices are techniques that help investors persevere through future moments of weakness by locking in decisions during moments of strength.21 When you’re developing a financial plan with your client and they’re optimistic and at ease, ask your client to write a letter to their future self. This letter should explain what they really care about, what matters to them in their finances, and why they’re going through all this trouble in the first place. Once your client is finished, ask them to commit to and sign the document, then give it back to you. When there’s volatility and your client calls you, panicked, send them this letter. There on the page, in their own words, is a reminder that explains why staying on track is important to them personally.

During

Add friction. There are also other ways to introduce friction during those crucial moments to prevent your client from making a hasty decision. When clients make a sale decision with Betterment, an online investment company, clients are presented with a gentle reminder of that trade’s tax consequences. Betterment found that people hate paying taxes even more than they dislike the prospect of losing value in a further market downturn.22 This layer of friction prevents clients from falling prey to recency bias by prompting them to think twice about their actions and nudging their “System 2” brains into action.

Explain the opposite. Another nudge that may help turn investors around can be to ask them to explain the opposite.23 If they’re starting to lean toward selling most of their investments to avoid future losses, ask them to explain why someone else might buy those same investments. This technique is a great way to combat confirmation bias. If your client mentions that many of their acquaintances have cashed out, ask them to think about why it might be a bad choice to follow them.

This lesson—of looking for opposing opinions—can also help investors when they’re looking at information online and may need help getting a balanced picture. If they keep coming across sites and articles that support their opinion to sell now, for example, challenge them to provide data that convincingly shows the opposite. Some investors may need an explicit reminder to keep an eye out for perspectives that differ from their own.

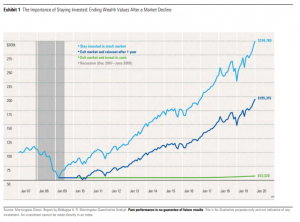

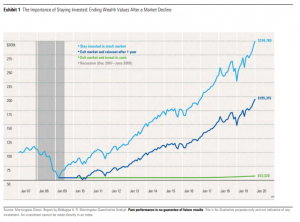

Vividly remember lessons from history. Amid panic, it’s easy to fall prey to recency bias and believe that the market’s going to continue dropping. At the same time, it can be hard to remember what happened last time. We can’t predict the future, but historically, markets have always recovered. Many investors may benefit from being reminded of this fact. For example, Exhibit 1 shows how investors who got out of the market during the Great Recession of 2008/2009 were a lot worse off after just a few years than those who weathered the storm. Looking back at previous examples of volatility can help investors make more-prudent decisions when it matters most.

Action: Setting Up Barriers

Despite your best efforts, there will always be clients who still want to take action by pulling out of the markets during a downturn. At this point, advising your client not to sell off will only fall on deaf ears, or, in the worst-case scenario, anger them to the point where you lose their business. Though it seems like your hands are tied, advisors can still help their clients thoughtfully reevaluate their plans by slowing down the action.

Before

Cool-down periods. Setting up barriers to action can give your client time to take a step back from their emotions and engage their “System 2” brains.24 One way to create these barriers is to come to an agreement with your client beforehand that says regardless of their decision, you, as their adviser, cannot act on it for three days. Or you could agree that a loved one or a spouse must sign off on decisions before you can make any changes. These tactics create a built-in cool-down period that gives your client time to move past their own biases and see if they have made a logical decision.

During

Take a strong (different) action. As previously mentioned, we can be prone to action bias during volatility: As our portfolios hemorrhage money, we want to do something to stop the bleeding. Instead of trying to suppress that urge to take action, a better strategy may be to redirect it. When an investor wants to make a move, guide them toward taking the right action instead of simply telling them not to take the wrong one. Times of volatility can be opportunities to rebalance an investor’s portfolio—when stocks are down and bonds are up, we maintain our asset allocation by selling high and buying low25— increase their savings rate to take advantage of market weaknesses, take advantage of tax-saving opportunities, and capitalize on lower interest rates. As advisers, you can help clients redirect their attention and need for action toward moves that can help them take control of the finances, even during times of market volatility.

Working Around Investing Biases During Times of Volatility

We all know to expect market volatility, but the emotions we feel during it can be even more dangerous than market movements themselves. When stress and anxiety are high, it’s easy to give in to our biases and let them cloud our better judgments. This is when we must remember that our biases are fundamental to who we are, and we can never completely erase them.

Interventions such as changing the frequency of information or reframing market volatility can help your clients overcome their biases, not do away with them. Using techniques from behavioral science, we can also plan for times of stress and volatility. We can work to prevent biases from derailing financial plans, by making it easier for clients to make the right decision when it counts, stay focused on the long-term, and help them successfully reach their financial goals

Action: Setting Up Barriers

Despite your best efforts, there will always be clients who still want to take action by pulling out of the markets during a downturn. At this point, advising your client not to sell off will only fall on deaf ears, or, in the worst-case scenario, anger them to the point where you lose their business. Though it seems like your hands are tied, advisors can still help their clients thoughtfully reevaluate their plans by slowing down the action.

Before

Cool-down periods. Setting up barriers to action can give your client time to take a step back from their emotions and engage their “System 2” brains.24 One way to create these barriers is to come to an agreement with your client beforehand that says regardless of their decision, you, as their adviser, cannot act on it for three days. Or you could agree that a loved one or a spouse must sign off on decisions before you can make any changes. These tactics create a built-in cool-down period that gives your client time to move past their own biases and see if they have made a logical decision.

During

Take a strong (different) action. As previously mentioned, we can be prone to action bias during volatility: As our portfolios hemorrhage money, we want to do something to stop the bleeding. Instead of trying to suppress that urge to take action, a better strategy may be to redirect it. When an investor wants to make a move, guide them toward taking the right action instead of simply telling them not to take the wrong one. Times of volatility can be opportunities to rebalance an investor’s portfolio—when stocks are down and bonds are up, we maintain our asset allocation by selling high and buying low25— increase their savings rate to take advantage of market weaknesses, take advantage of tax-saving opportunities, and capitalize on lower interest rates. As advisers, you can help clients redirect their attention and need for action toward moves that can help them take control of the finances, even during times of market volatility.

Working Around Investing Biases During Times of Volatility

We all know to expect market volatility, but the emotions we feel during it can be even more dangerous than market movements themselves. When stress and anxiety are high, it’s easy to give in to our biases and let them cloud our better judgments. This is when we must remember that our biases are fundamental to who we are, and we can never completely erase them.

Interventions such as changing the frequency of information or reframing market volatility can help your clients overcome their biases, not do away with them. Using techniques from behavioral science, we can also plan for times of stress and volatility. We can work to prevent biases from derailing financial plans, by making it easier for clients to make the right decision when it counts, stay focused on the long-term, and help them successfully reach their financial goals

Action: Setting Up Barriers

Despite your best efforts, there will always be clients who still want to take action by pulling out of the markets during a downturn. At this point, advising your client not to sell off will only fall on deaf ears, or, in the worst-case scenario, anger them to the point where you lose their business. Though it seems like your hands are tied, advisors can still help their clients thoughtfully reevaluate their plans by slowing down the action.

Before

Cool-down periods. Setting up barriers to action can give your client time to take a step back from their emotions and engage their “System 2” brains.24 One way to create these barriers is to come to an agreement with your client beforehand that says regardless of their decision, you, as their adviser, cannot act on it for three days. Or you could agree that a loved one or a spouse must sign off on decisions before you can make any changes. These tactics create a built-in cool-down period that gives your client time to move past their own biases and see if they have made a logical decision.

During

Take a strong (different) action. As previously mentioned, we can be prone to action bias during volatility: As our portfolios hemorrhage money, we want to do something to stop the bleeding. Instead of trying to suppress that urge to take action, a better strategy may be to redirect it. When an investor wants to make a move, guide them toward taking the right action instead of simply telling them not to take the wrong one. Times of volatility can be opportunities to rebalance an investor’s portfolio—when stocks are down and bonds are up, we maintain our asset allocation by selling high and buying low25— increase their savings rate to take advantage of market weaknesses, take advantage of tax-saving opportunities, and capitalize on lower interest rates. As advisers, you can help clients redirect their attention and need for action toward moves that can help them take control of the finances, even during times of market volatility.

Working Around Investing Biases During Times of Volatility

We all know to expect market volatility, but the emotions we feel during it can be even more dangerous than market movements themselves. When stress and anxiety are high, it’s easy to give in to our biases and let them cloud our better judgments. This is when we must remember that our biases are fundamental to who we are, and we can never completely erase them.

Interventions such as changing the frequency of information or reframing market volatility can help your clients overcome their biases, not do away with them. Using techniques from behavioral science, we can also plan for times of stress and volatility. We can work to prevent biases from derailing financial plans, by making it easier for clients to make the right decision when it counts, stay focused on the long-term, and help them successfully reach their financial goals

Action: Setting Up Barriers

Despite your best efforts, there will always be clients who still want to take action by pulling out of the markets during a downturn. At this point, advising your client not to sell off will only fall on deaf ears, or, in the worst-case scenario, anger them to the point where you lose their business. Though it seems like your hands are tied, advisors can still help their clients thoughtfully reevaluate their plans by slowing down the action.

Before

Cool-down periods. Setting up barriers to action can give your client time to take a step back from their emotions and engage their “System 2” brains.24 One way to create these barriers is to come to an agreement with your client beforehand that says regardless of their decision, you, as their adviser, cannot act on it for three days. Or you could agree that a loved one or a spouse must sign off on decisions before you can make any changes. These tactics create a built-in cool-down period that gives your client time to move past their own biases and see if they have made a logical decision.

During

Take a strong (different) action. As previously mentioned, we can be prone to action bias during volatility: As our portfolios hemorrhage money, we want to do something to stop the bleeding. Instead of trying to suppress that urge to take action, a better strategy may be to redirect it. When an investor wants to make a move, guide them toward taking the right action instead of simply telling them not to take the wrong one. Times of volatility can be opportunities to rebalance an investor’s portfolio—when stocks are down and bonds are up, we maintain our asset allocation by selling high and buying low25— increase their savings rate to take advantage of market weaknesses, take advantage of tax-saving opportunities, and capitalize on lower interest rates. As advisers, you can help clients redirect their attention and need for action toward moves that can help them take control of the finances, even during times of market volatility.

Working Around Investing Biases During Times of Volatility

We all know to expect market volatility, but the emotions we feel during it can be even more dangerous than market movements themselves. When stress and anxiety are high, it’s easy to give in to our biases and let them cloud our better judgments. This is when we must remember that our biases are fundamental to who we are, and we can never completely erase them.

Interventions such as changing the frequency of information or reframing market volatility can help your clients overcome their biases, not do away with them. Using techniques from behavioral science, we can also plan for times of stress and volatility. We can work to prevent biases from derailing financial plans, by making it easier for clients to make the right decision when it counts, stay focused on the long-term, and help them successfully reach their financial goals