Growth was the place to be through the covid-19 pandemic while value managers couldn't catch a break.

Mentioned: Hyperion Global Growth Companies B (42173), GQG Partners Emerging Markets Equity (43156), Lazard Select Australian Equity W Cl (10702), Hyperion Australian Growth Companies (3344), Robeco Emerging Conservative Equity AUD (40081), Hyperion Small Growth Companies (4242), Investors Mutual WS Future Leaders (8741), SPDR® S&P Global Dividend ETF (WDIV).

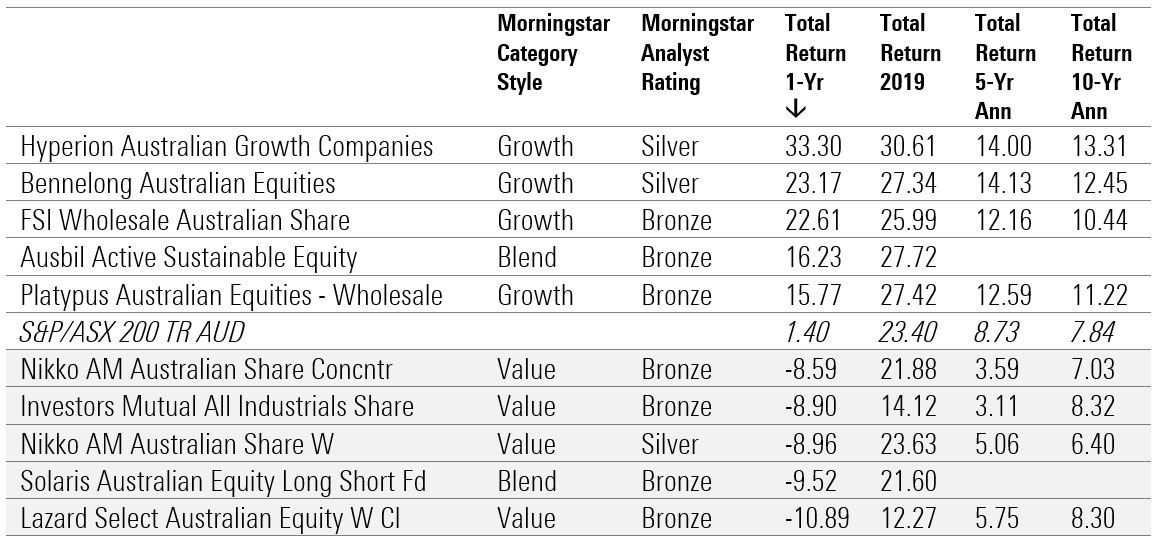

This is a round-up of the best and worst performing equity funds under Morningstar coverage for 2020. Morningstar fund analysts conduct reviews of over 480 flagship Australian funds, exchange-traded funds and listed investment companies. Data is not available for LICs. Performance of all funds over the calendar year is available via the Morningstar Adviser Research Centre Fund Screener.

Brisbane-based growth manager Hyperion Asset Management has swept several categories after taking strong bets on highly quality tech firms which benefited from the pandemic.

The boutique manager topped three Morningstar categories – Australian Equity Large Cap, Australian Equity Small/Mid cap and Global Equity Large Cap – delivering returns well above the index.

Morningstar senior fund analyst Christopher Franz said Hyperion portfolio managers Mark Arnold and Jason Orthman had a spectacular year, taking positions in companies that thrived from people staying indoors. The managers’ global fund features several US megacaps like Amazon, PayPal Holdings, Facebook Inc and Salesforce, while locally it holds sizeable positions in CSL Ltd,

Xero Ltd, HUB24 and Domino’s Pizza.

“Hyperion’s highly concentrated growth portfolios delivered yet again in 2020 across domestic and global markets,” Franz says.

“The manager’s preference for disruptive structural growth names have long pointed them towards technology, healthcare, and discretionary names, which were either unfazed or quick to recover from the early year selloff and pushed the portfolios to top-decile performance across the board.”

Growth managers dominated overall thanks in part to the low interest rate environment and global lockdowns, which fuelled the strength of remote working stocks such as Zoom and Slack, stay-at-home winner Amazon and music streaming service Spotify. The top-5 mega US tech companies – Microsoft, Apple, Amazon, Alphabet and Facebook – now make up over 20 per cent of the S&P 500 Index, with their market share increasing 25 per cent in the first six months of this year. Australian investors were drawn to a local version of growth darlings as names such as Afterpay, Xero and Kogan continued their growth streak.

Source: Morningstar Direct

Hyperion’s punchy approach delivers periods of feast and famine however, says Malseed.

"The strategy fell 38.92 per cent in 2008 - worse than the market. It had a peer-beating resurgence of 59.25 per cent in 2009 thanks to sold-down mid-cap names recovering.

"In 2010 and 2011, it was again lacklustre, before stellar returns in each of the following three calendar years, in both absolute and relative terms.

"Though the performance history is undoubtedly top-draw, Hyperion is not immune to mistakes."

Morningstar senior fund analyst Ross Macmillan says Lazard Select Australian Equity's underperformance in 2020 can be summed up in two words: concentrated and value.

"It's not a place you wanted to be last year," he says.

"The fund was exposed to coal and energy with investments in Whitehaven Coal and Woodside Petroleum and to AMP. These three were in top ten holdings for most of year."

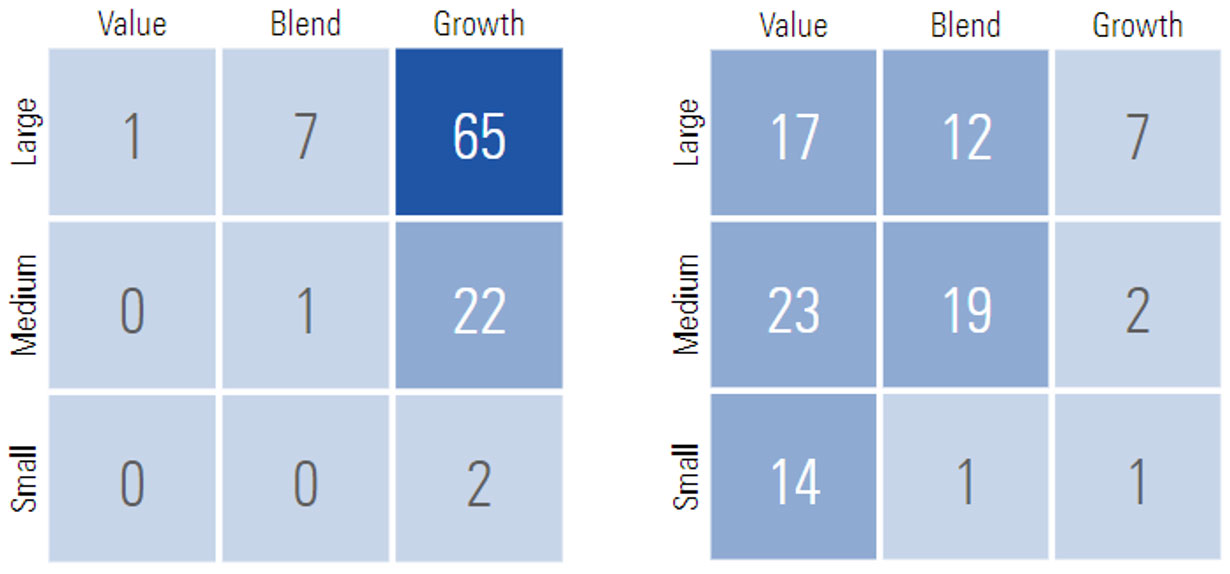

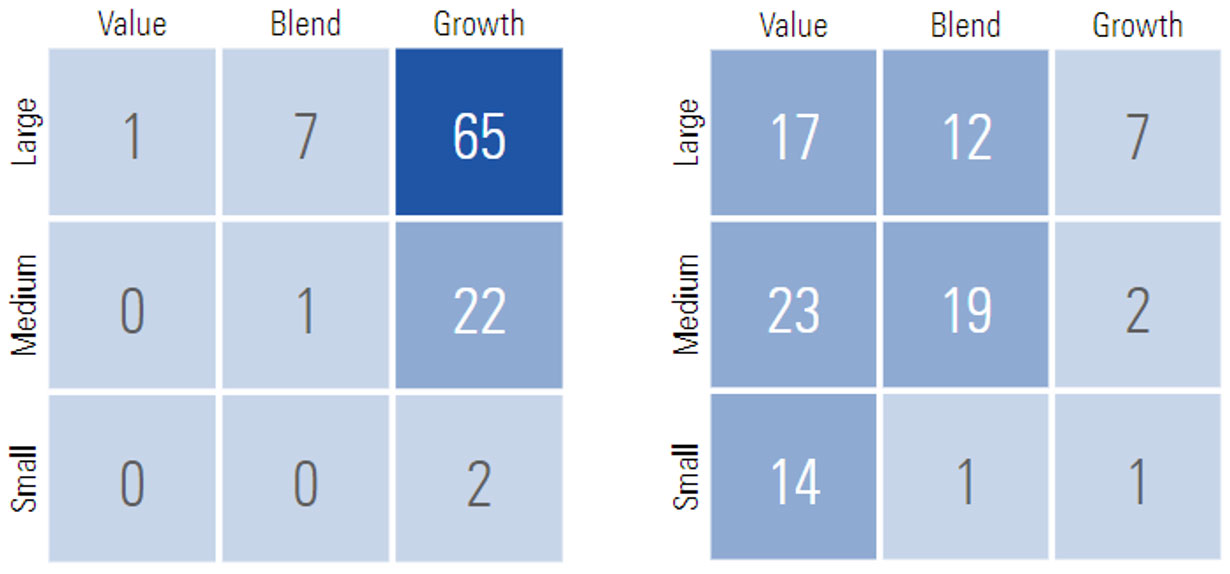

Stock style | Hyperion v Lazard (current portfolio)

Source: Morningstar Direct

Hyperion’s punchy approach delivers periods of feast and famine however, says Malseed.

"The strategy fell 38.92 per cent in 2008 - worse than the market. It had a peer-beating resurgence of 59.25 per cent in 2009 thanks to sold-down mid-cap names recovering.

"In 2010 and 2011, it was again lacklustre, before stellar returns in each of the following three calendar years, in both absolute and relative terms.

"Though the performance history is undoubtedly top-draw, Hyperion is not immune to mistakes."

Morningstar senior fund analyst Ross Macmillan says Lazard Select Australian Equity's underperformance in 2020 can be summed up in two words: concentrated and value.

"It's not a place you wanted to be last year," he says.

"The fund was exposed to coal and energy with investments in Whitehaven Coal and Woodside Petroleum and to AMP. These three were in top ten holdings for most of year."

Stock style | Hyperion v Lazard (current portfolio)

Source: Morningstar Direct

The Bronze-rated manager returned -10.89 per cent in 2020, underperforming the S&P/ASX 200 index by -12.29 per cent. The portfolio managers run a high-conviction value strategy with a portfolio of just 12-30 stocks, adopting a long-term approach will inherently incur volatile annual returns through the cycle.

"The fund is placed in the first quartile among category peers, over 10 years to 31 Aug 2020, though this disguises an occasionally rocky ride," Macmillan says.

"The strategy’s value skew saw it struggle in the global financial crisis, falling 35 per cent in 2008, and even though it recovered strongly in 2009, it still landed in the fourth quartile that year. However, the team had a great run from 2011 to 2014 when it outperformed the index and the category average in each calendar year."

Nine of the ten worst performing funds are value-orientated funds.

Source: Morningstar Direct

The Bronze-rated manager returned -10.89 per cent in 2020, underperforming the S&P/ASX 200 index by -12.29 per cent. The portfolio managers run a high-conviction value strategy with a portfolio of just 12-30 stocks, adopting a long-term approach will inherently incur volatile annual returns through the cycle.

"The fund is placed in the first quartile among category peers, over 10 years to 31 Aug 2020, though this disguises an occasionally rocky ride," Macmillan says.

"The strategy’s value skew saw it struggle in the global financial crisis, falling 35 per cent in 2008, and even though it recovered strongly in 2009, it still landed in the fourth quartile that year. However, the team had a great run from 2011 to 2014 when it outperformed the index and the category average in each calendar year."

Nine of the ten worst performing funds are value-orientated funds.

Source: Morningstar Direct

Source: Morningstar Direct

Source: Morningstar Direct

Source: Morningstar Direct

Source: Morningstar Direct

Source: Morningstar Direct

Source: Morningstar Direct

Source: Morningstar Direct

Style wars

Value managers continued to test the faith of their investors, extending their underperformance. Growth-at-any-price became the mantra for 2020, while traditional value areas of the market such as energy and financials languished. Managers who didn't participate in the strong tech run struggled to outperform even the index. "Value is a word on many people's lips at the moment, and it's for some been quite a dirty word in investment terms over the last couple of years because so-called value managers have performed pretty poorly," says Morningstar Investment Dan Kamp. "That's because people have become very enthusiastic about growth stocks, technology stocks, so-called working-from-home stocks that are expected to benefit from the current environment. "These were already expensive coming into the pandemic and really the pandemic has just heightened the price of some of these growth, technology, working-from-home stocks." However, the tide could be turning. If 2016 was a value year, then November 2020 was a value month. While global equities as a whole rose 8.8 per cent over the month, there was a wide disparity between styles: the value index soared 11.1 per cent while the global growth index climbed 6.8 per cent. Kemp believes that growth is poised to underperform value over the next year as "valuations reassert themselves back to something approaching normality."Australia Equity Large Cap

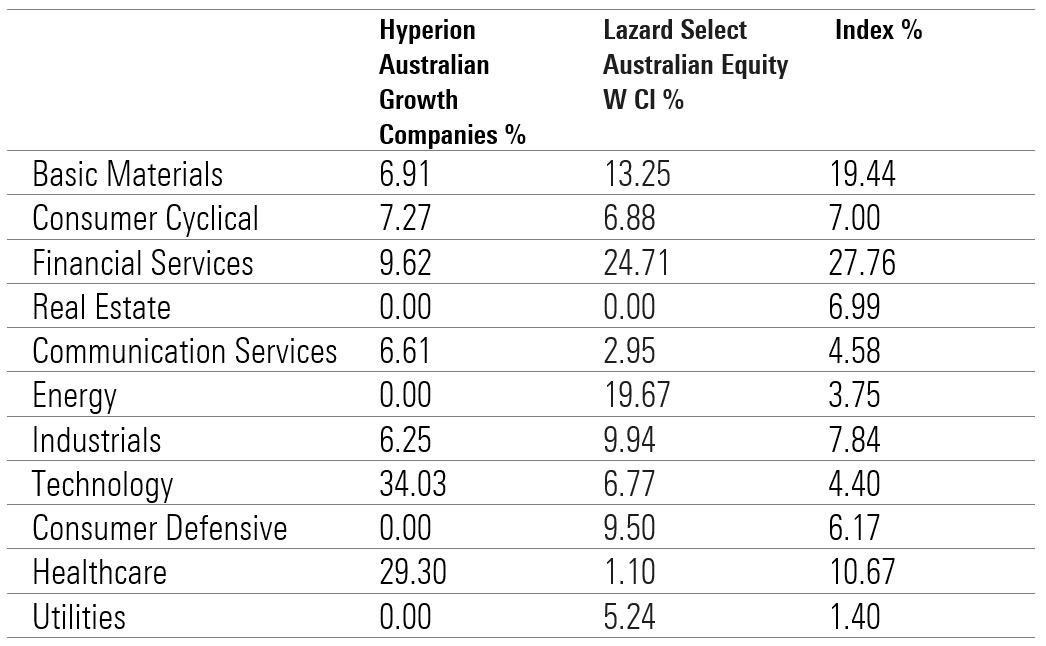

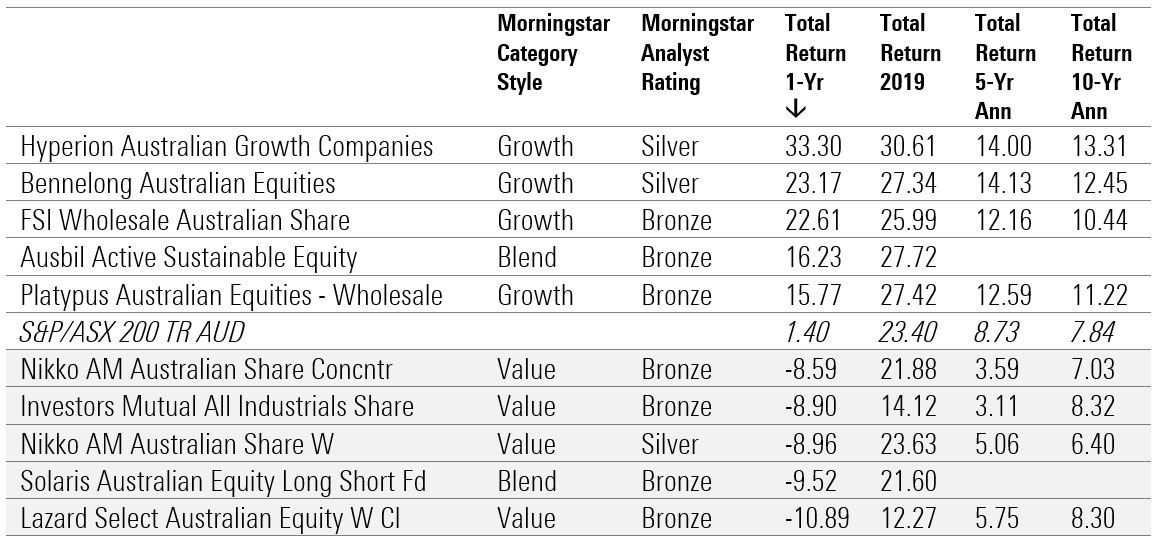

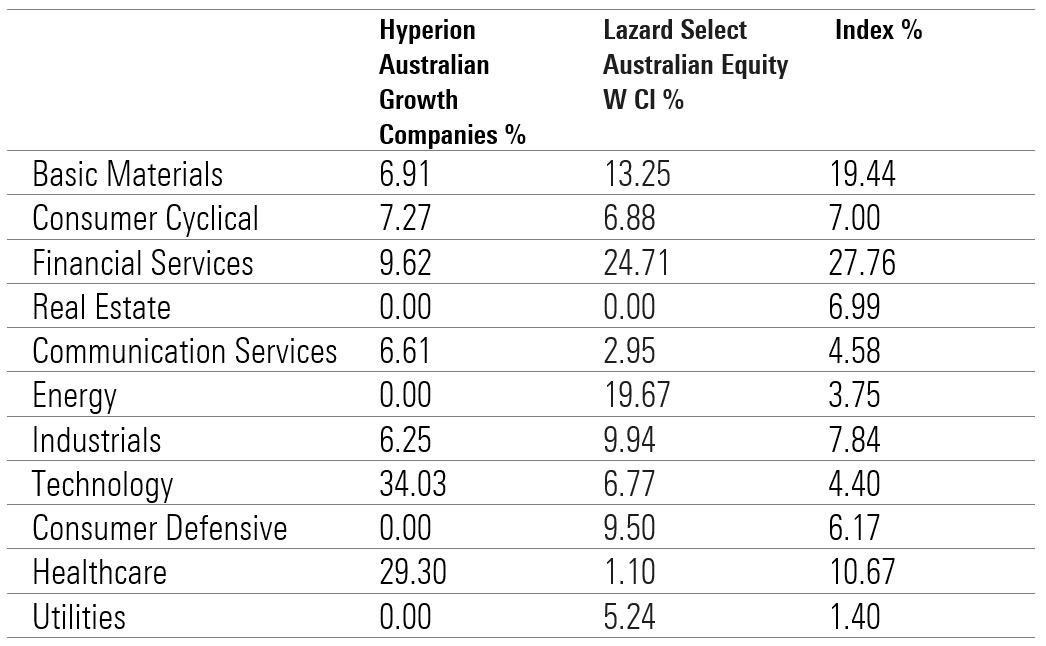

Silver-rated Hyperion Australian Growth Companies led the Australian equity large cap category for a second year in a row, delivering a return of 31.90 per cent above the S&P/ASX 200 Index. 2020 has been a banner year for the fund, outperforming the benchmark in both the coronavirus-driven sell-off and subsequent rebound. Morningstar director, manager research, Michael Malseed says the portfolio managers are willing to look past expensive near-term earnings multiples, as well as any short-term trading weakness, as long as the long-term thesis remains intact. The portfolio is highly concentrated (15-30 holdings) and skews heavily to certain sectors such as technology and healthcare. Major wins for the fund in 2020 include an overweight position in information technology, healthcare and consumer discretionary sectors. Leading contributors to performance included tech firms Afterpay and Xero, fast-food chain Domino's Pizza and global building materials company James Hardie Industries. Hyperion typically holds no materials and energy stocks, reflecting managers’ lack of confidence in the sectors’ earnings predictability and pricing power. Hyperion also prefers nonbank financials, with strong organic growth prospects such as Netwealth and Hub24, and since late 2018 has held none of the big four banks. Sector exposure | Hyperion v Lazard v S&P/ASX 200 (current portfolio) Source: Morningstar Direct

Hyperion’s punchy approach delivers periods of feast and famine however, says Malseed.

"The strategy fell 38.92 per cent in 2008 - worse than the market. It had a peer-beating resurgence of 59.25 per cent in 2009 thanks to sold-down mid-cap names recovering.

"In 2010 and 2011, it was again lacklustre, before stellar returns in each of the following three calendar years, in both absolute and relative terms.

"Though the performance history is undoubtedly top-draw, Hyperion is not immune to mistakes."

Morningstar senior fund analyst Ross Macmillan says Lazard Select Australian Equity's underperformance in 2020 can be summed up in two words: concentrated and value.

"It's not a place you wanted to be last year," he says.

"The fund was exposed to coal and energy with investments in Whitehaven Coal and Woodside Petroleum and to AMP. These three were in top ten holdings for most of year."

Stock style | Hyperion v Lazard (current portfolio)

Source: Morningstar Direct

Hyperion’s punchy approach delivers periods of feast and famine however, says Malseed.

"The strategy fell 38.92 per cent in 2008 - worse than the market. It had a peer-beating resurgence of 59.25 per cent in 2009 thanks to sold-down mid-cap names recovering.

"In 2010 and 2011, it was again lacklustre, before stellar returns in each of the following three calendar years, in both absolute and relative terms.

"Though the performance history is undoubtedly top-draw, Hyperion is not immune to mistakes."

Morningstar senior fund analyst Ross Macmillan says Lazard Select Australian Equity's underperformance in 2020 can be summed up in two words: concentrated and value.

"It's not a place you wanted to be last year," he says.

"The fund was exposed to coal and energy with investments in Whitehaven Coal and Woodside Petroleum and to AMP. These three were in top ten holdings for most of year."

Stock style | Hyperion v Lazard (current portfolio)

Source: Morningstar Direct

The Bronze-rated manager returned -10.89 per cent in 2020, underperforming the S&P/ASX 200 index by -12.29 per cent. The portfolio managers run a high-conviction value strategy with a portfolio of just 12-30 stocks, adopting a long-term approach will inherently incur volatile annual returns through the cycle.

"The fund is placed in the first quartile among category peers, over 10 years to 31 Aug 2020, though this disguises an occasionally rocky ride," Macmillan says.

"The strategy’s value skew saw it struggle in the global financial crisis, falling 35 per cent in 2008, and even though it recovered strongly in 2009, it still landed in the fourth quartile that year. However, the team had a great run from 2011 to 2014 when it outperformed the index and the category average in each calendar year."

Nine of the ten worst performing funds are value-orientated funds.

Source: Morningstar Direct

The Bronze-rated manager returned -10.89 per cent in 2020, underperforming the S&P/ASX 200 index by -12.29 per cent. The portfolio managers run a high-conviction value strategy with a portfolio of just 12-30 stocks, adopting a long-term approach will inherently incur volatile annual returns through the cycle.

"The fund is placed in the first quartile among category peers, over 10 years to 31 Aug 2020, though this disguises an occasionally rocky ride," Macmillan says.

"The strategy’s value skew saw it struggle in the global financial crisis, falling 35 per cent in 2008, and even though it recovered strongly in 2009, it still landed in the fourth quartile that year. However, the team had a great run from 2011 to 2014 when it outperformed the index and the category average in each calendar year."

Nine of the ten worst performing funds are value-orientated funds.

Source: Morningstar Direct

Source: Morningstar Direct

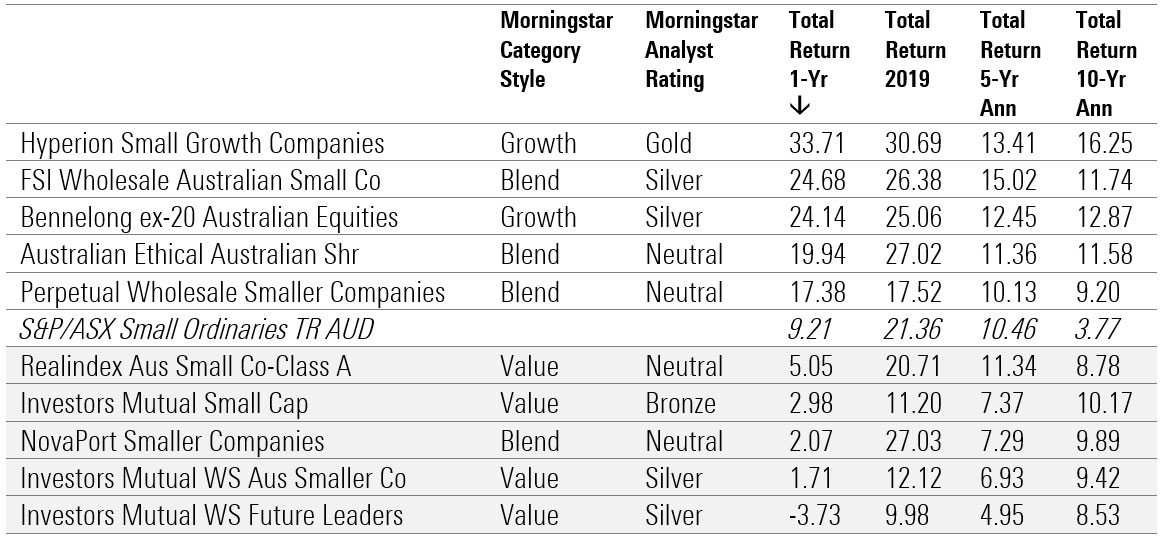

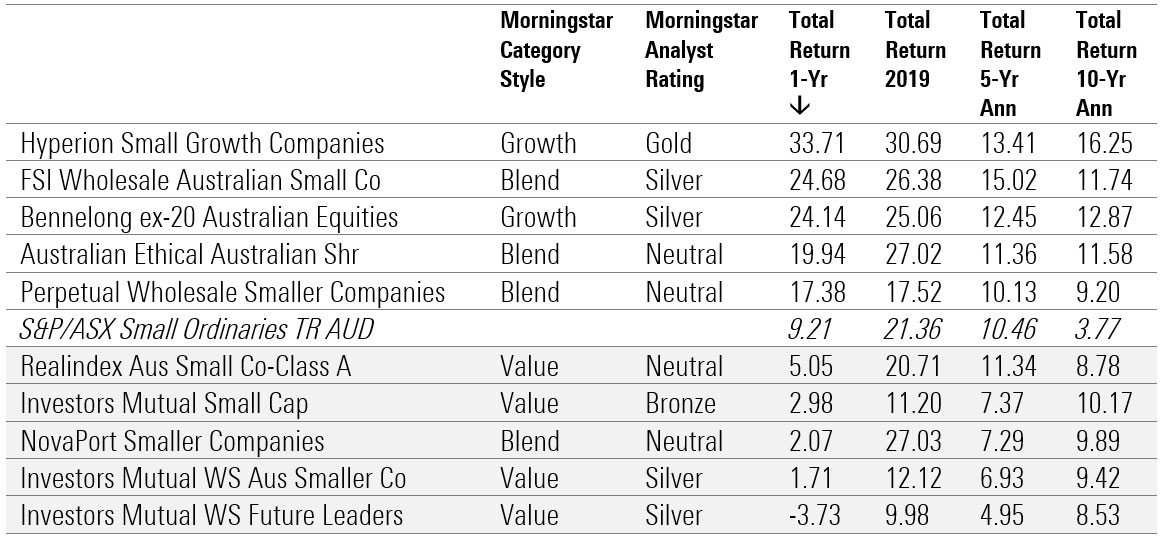

Australia Equity Small/Mid Cap

Hyperion similarly outperformed its peers and the index in the small/mid cap category. The gold-rated Hyperion Small Growth Companies fund returned 33.71 per cent, helped by holdings in Hub24, Pushpay Holdings and Xero. "The investment process is differentiated by its genuine long-term approach, seeking to identify high-quality companies with enduring competitive advantages that can grow into large total addressable markets over time," Malseed says. "This approach is well-suited to the Australian small-cap segment and tends to skew towards technology and healthcare names, as well as consumer discretionary stocks." Portfolio managers have delivered strong long-term performance, achieving top-quartile results over the trailing one-, three-, five-, and 10-year periods. Investors Mutual WS Future Leaders underperformed the index in 2020 due to its value-style. The strategy was also hampered by stocks calls in sectors particularly impacted from persistent coronavirus restrictions, most notably, prominent holdings in Crown Resorts, Event Hospitality and Entertainment, and Skycity Entertainment. Morningstar fund analyst Chris Tate, however, notes that Investors Mutual Australia Smaller Companies has delivered exceptional long-term returns, beating the benchmark and peers over a variety of market cycles. "[The fund] has historically delivered particularly strong performance in down markets, achieving an outstanding downside-capture ratio of around 48 per cent for the 18 years to May 2020," he says. "However, this downside protection was not evident in the first half of 2020 as it was in past sell-offs." 2020 proved a difficult year for active managers to outperform with an index-tracking ETF featuring in the top 10. Over the 10 years to May 2020, most active managers have handily beaten small-cap indexes. Source: Morningstar Direct

Source: Morningstar Direct

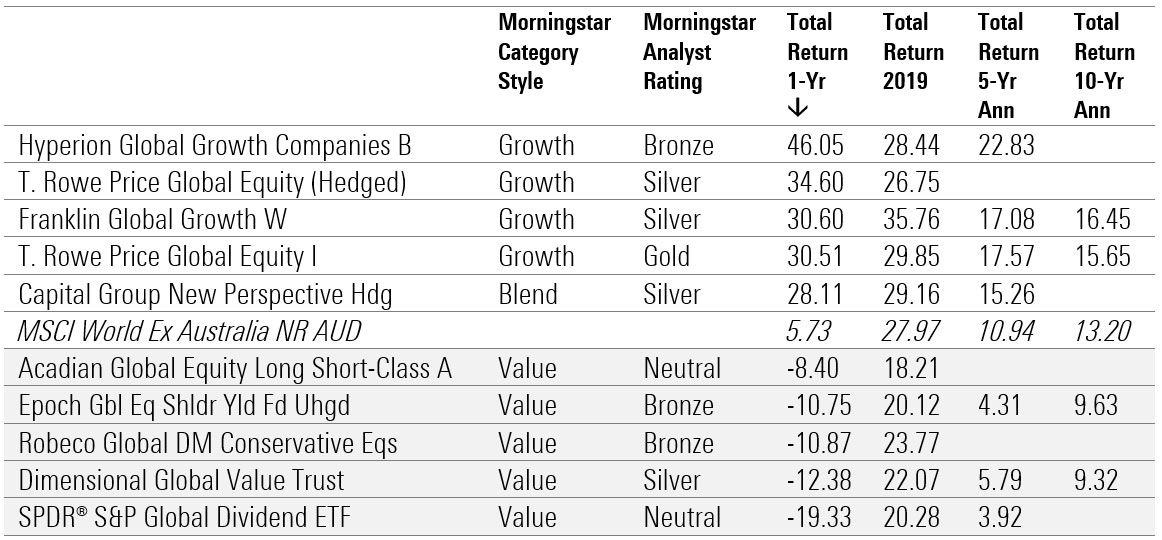

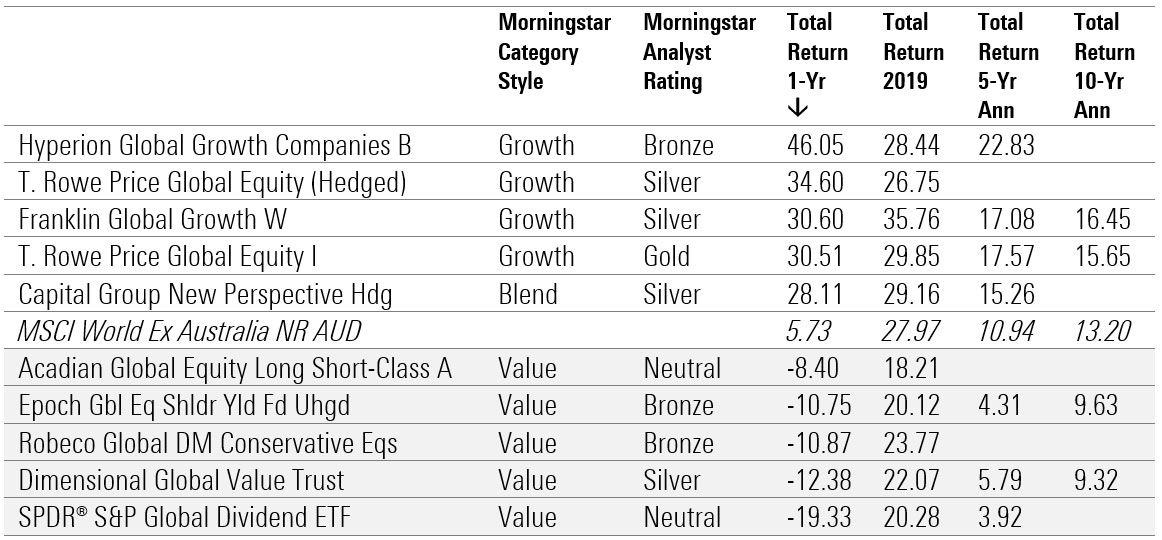

Global Equity Large Cap

Hyperion's outperformance extended to overseas markets, topping the global equity large cap category. Managers of the Hyperion Global Growth Companies fund seek high-quality, global businesses with long-term structural growth and have a clear focus on capital preservation and quality of management. A healthy cash stake helped, as did strong absolute performance from top holdings like Amazon.com, PayPal, Alphabet, and Microsoft. Still, the concentrated, 20-stock portfolio isn’t for the faint of heart, says Franz. "The fund maintains significant biases towards technology, discretionary, and non-bank financial names, which push the portfolio to extreme growth multiples relative to the MSCI World Index and world large growth Morningstar Category peers," he says. "Nearly all the portfolio’s holdings carry Morningstar Economic Moat ratings, and its aggregate portfolio profitability metrics (profit margins and return on capital) are far above the benchmark and peer group." BetaShares Global Sustainability Leaders ETF also featured in the top 10 with a return of 24.92 per cent for the year thanks to large exposures to healthcare and tech stocks and evasion of energy and mining. With oil prices collapsing in the early part of 2020 and climate change concerns accelerating, energy stocks have been among the worst performers – and many of these oil giants have compounded investor pain by announcing dividend cuts. Source: Morningstar Direct

Source: Morningstar Direct

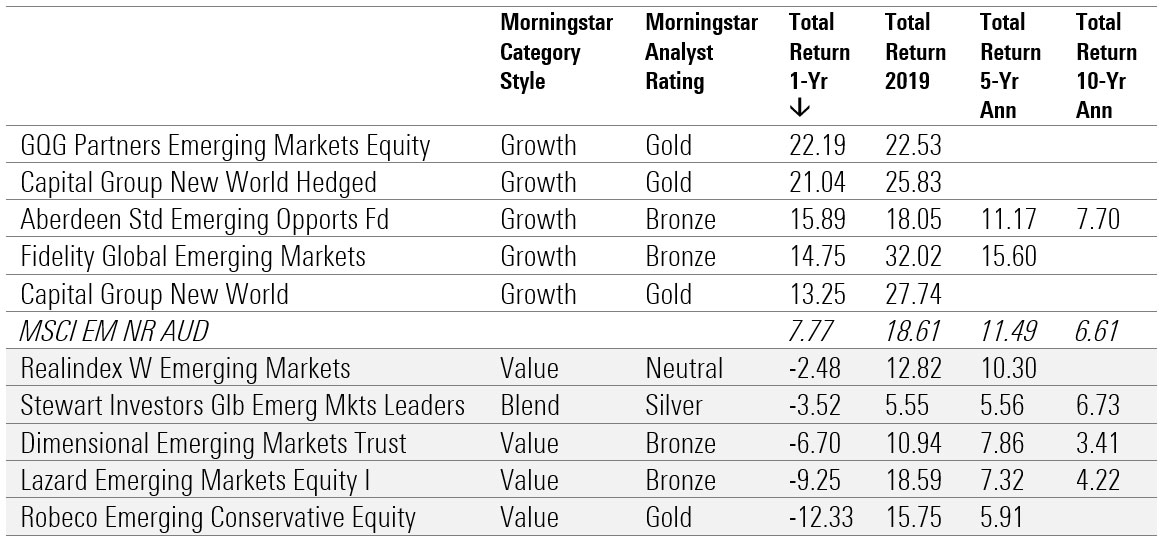

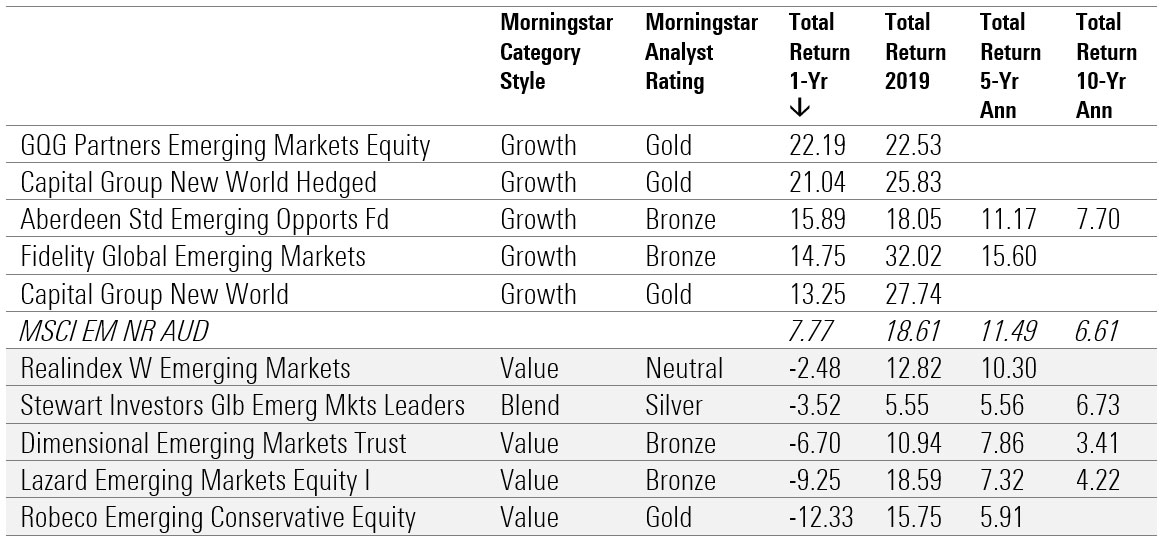

Emerging Market Equity Large Cap

GQG Partners Emerging Markets Equity had a spectacular year thanks largely to its stock-picking prowess. The portfolio featured large holdings in some of the year’s best performing stocks, including online gaming, e-commerce, and digital payments platform Sea Limited, Latin American e-commerce company MercadoLibre and Chinese alcoholic beverage company Wuliangye Yibin Co. The gold-rated fund, which is new to the Australian market, looks for companies with a manageable (if any) amount of debt; proven leadership with a record of prudent capital allocation; and a history of weathering tough economic conditions. "Portfolio manager Rajiv Jain is more interested in steady growth than the firms with the highest growth rates," says Morningstar senior fund analyst Matthew Wilkinson. "He is willing to pay relatively high prices for top notch opportunities, but if valuations seem excessive for low- or moderate-growth stocks, he turns away." Morningstar analysts say Robeco Emerging Conservative Equity's underweight position in tech and China, and overweight position in sectors and stocks that became the losers of the global lockdown, explain the strategy's underperformance. "While the strategy was expected to deliver downside protection during the corona-driven sell-off in 2020, it failed dramatically and also didn't recover much during the subsequent recovery rally," analyst Jeffrey Schumacher says. "The fund suffered from negative effects from lower exposure to Tencent, Alibaba and TSMC and from underweight technology, owning Chinese banks and Thai financials and being overweight to lockdown-sensitive, but normally low-beta Brazilian utilities which also suffered from a weak currency. "Higher allocation to small- and mid-caps versus peers/index hurt performance too." Source: Morningstar Direct

Source: Morningstar Direct