After a year of massive changes sometimes its ok not to make changes.

Google released its Year in Search report last month. The most popular Google search item in Australia in 2020 was unsurprisingly “US election”, followed by “Coronavirus”, “NBA” and naturally, “Zoom”. Sadly, “Fires near me” made the top 10, making it two years in a row that search team has featured.

In this spirit, we’re also sharing “most popular” content. We’re looking at the most frequently viewed securities – equities, funds, and ETFs – on Adviser Research Centre over 2020.

Based on previous years there were no real surprises, the pandemic didn’t alter the way Advisers thought about Investments, continually looking at quality and value for their clients.

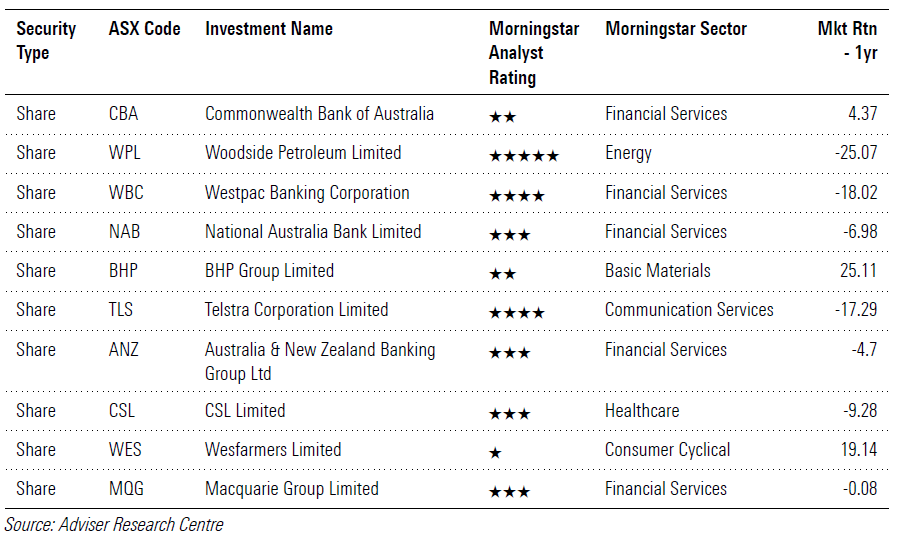

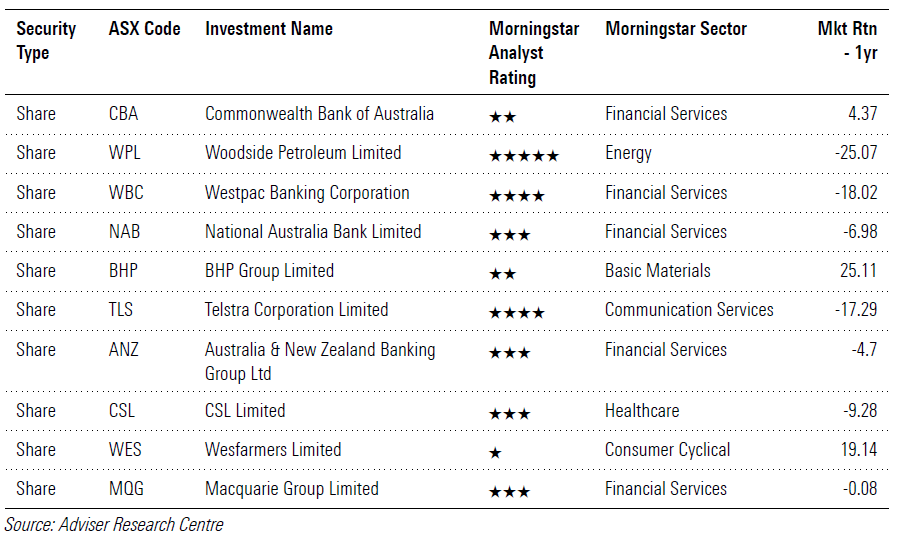

On the Equities front, not much changed from 2019, with the Banks, BHP and Telstra all featuring. The list continues to feature high-quality, large-cap companies, many of which have carved out economic moats.

Interesting to note that two stocks in the top 10 in 2019, Coles and Woolworths didn’t make the cut in 2020 even though there was panic buying and toilet paper shortages around the country.

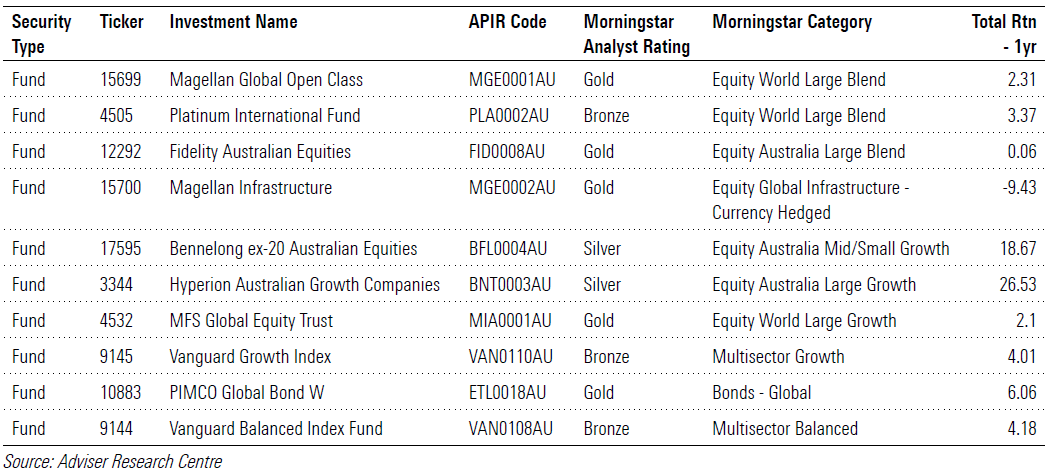

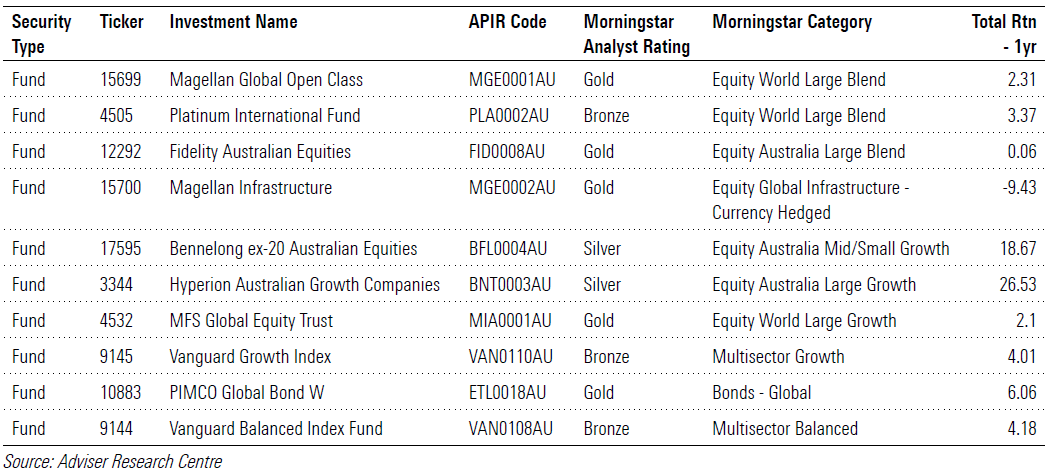

Little change in the Funds accessed by Advisers with the top 10 exactly the same as last year bar one. 2020 again dominated by the global fund managers Magellan Global, sitting on top for the 3rd year running and Platinum International sitting second. The only noticeable fund to drop out of this years top 10 was the Janus Henderson Tactical Income Fund, with Hyperion Australian Growth Companies coming in.

Little change in the Funds accessed by Advisers with the top 10 exactly the same as last year bar one. 2020 again dominated by the global fund managers Magellan Global, sitting on top for the 3rd year running and Platinum International sitting second. The only noticeable fund to drop out of this years top 10 was the Janus Henderson Tactical Income Fund, with Hyperion Australian Growth Companies coming in.

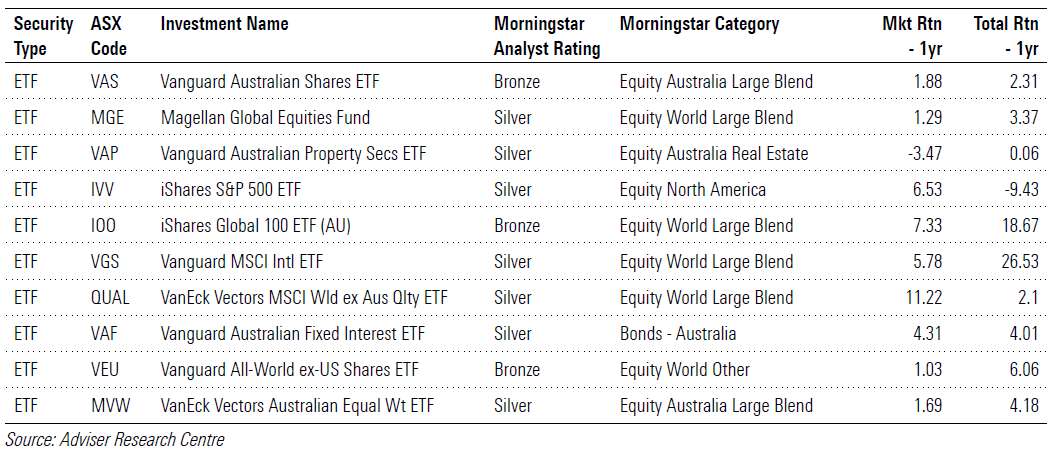

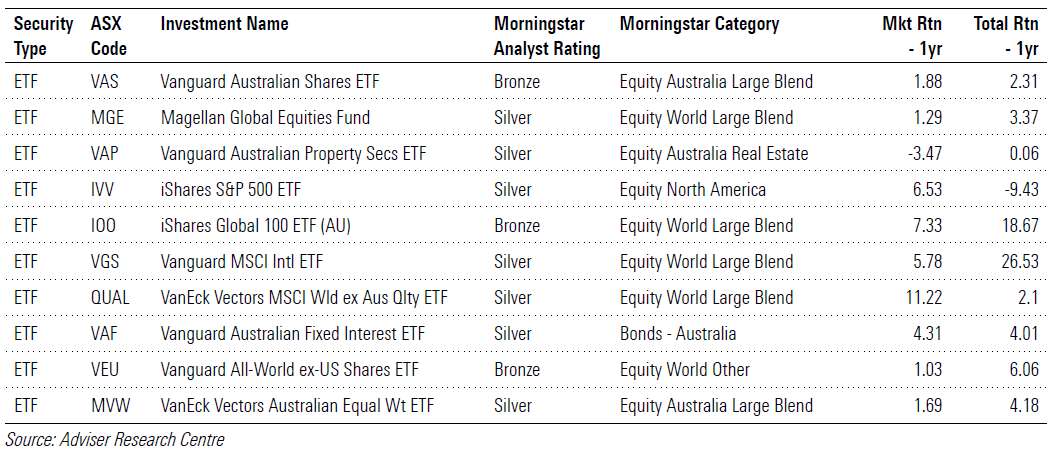

Exchange Traded Funds were again dominated by Vanguard, with Vanguard’s Australian Shares ETF (ASX: VAS) topping the list for a second year running. Magellan’s actively managed Global Equities ETF (ASX: MGE) was the favoured globally exposed ETF.

iShares and VanEck also made the top 10 as Advisers continued to seek broad international exposure from passive-ETFs.

One noticeable absentee that has been in the top 10 in the past is the SPDR S&P/ASX 200 ETF (ASX: STW) which passively tracks the S&P/ASX 200 Index.

Exchange Traded Funds were again dominated by Vanguard, with Vanguard’s Australian Shares ETF (ASX: VAS) topping the list for a second year running. Magellan’s actively managed Global Equities ETF (ASX: MGE) was the favoured globally exposed ETF.

iShares and VanEck also made the top 10 as Advisers continued to seek broad international exposure from passive-ETFs.

One noticeable absentee that has been in the top 10 in the past is the SPDR S&P/ASX 200 ETF (ASX: STW) which passively tracks the S&P/ASX 200 Index.

Morningstar provided over 300 articles to Advisers during 2020, helping you to keep informed on the current market activity, supporting you with client communication for Investors concerned about the market volatility, and our best thinking’s from some of Morningstar’s great minds and thought leaders.

Plus keeping you up to date on all the great improvements made to Adviser Research Centre over the course of the year. If you missed any of the product updates please find the two main recap documents here:

1st Half 2020 Product Release Note

2nd Half 2020 Product Release Note

While our Best Stock Ideas document that comes out at the start of each month is our most widely read document, here are the top 5 thought leadership articles that were most read in case you missed them.

Coronavirus market selloff ‘a gross overreaction’

29 quality stocks at great prices

Opportune Entry Point for Quality Healthcare Names

What Experts Say Coronavirus Means for Investors

Coronavirus effect: 11 Aussie stocks to watch

Videos are a great way to get a quick update from the team whether it be product feature updates, Webinar and training recordings or interviews with Morningstar or external thought leaders.

Here are your top 5 Videos watched in 2020:

Morningstar provided over 300 articles to Advisers during 2020, helping you to keep informed on the current market activity, supporting you with client communication for Investors concerned about the market volatility, and our best thinking’s from some of Morningstar’s great minds and thought leaders.

Plus keeping you up to date on all the great improvements made to Adviser Research Centre over the course of the year. If you missed any of the product updates please find the two main recap documents here:

1st Half 2020 Product Release Note

2nd Half 2020 Product Release Note

While our Best Stock Ideas document that comes out at the start of each month is our most widely read document, here are the top 5 thought leadership articles that were most read in case you missed them.

Coronavirus market selloff ‘a gross overreaction’

29 quality stocks at great prices

Opportune Entry Point for Quality Healthcare Names

What Experts Say Coronavirus Means for Investors

Coronavirus effect: 11 Aussie stocks to watch

Videos are a great way to get a quick update from the team whether it be product feature updates, Webinar and training recordings or interviews with Morningstar or external thought leaders.

Here are your top 5 Videos watched in 2020:

Any Morningstar ratings/recommendations contained in this report are based on the full research report available from Morningstar or your adviser. © 2021 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘class service’ have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Refer to our Financial Services Guide (FSG) for more information at www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a professional financial adviser. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.

Any Morningstar ratings/recommendations contained in this report are based on the full research report available from Morningstar or your adviser. © 2021 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘class service’ have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Refer to our Financial Services Guide (FSG) for more information at www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a professional financial adviser. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.

Little change in the Funds accessed by Advisers with the top 10 exactly the same as last year bar one. 2020 again dominated by the global fund managers Magellan Global, sitting on top for the 3rd year running and Platinum International sitting second. The only noticeable fund to drop out of this years top 10 was the Janus Henderson Tactical Income Fund, with Hyperion Australian Growth Companies coming in.

Little change in the Funds accessed by Advisers with the top 10 exactly the same as last year bar one. 2020 again dominated by the global fund managers Magellan Global, sitting on top for the 3rd year running and Platinum International sitting second. The only noticeable fund to drop out of this years top 10 was the Janus Henderson Tactical Income Fund, with Hyperion Australian Growth Companies coming in.

Exchange Traded Funds were again dominated by Vanguard, with Vanguard’s Australian Shares ETF (ASX: VAS) topping the list for a second year running. Magellan’s actively managed Global Equities ETF (ASX: MGE) was the favoured globally exposed ETF.

iShares and VanEck also made the top 10 as Advisers continued to seek broad international exposure from passive-ETFs.

One noticeable absentee that has been in the top 10 in the past is the SPDR S&P/ASX 200 ETF (ASX: STW) which passively tracks the S&P/ASX 200 Index.

Exchange Traded Funds were again dominated by Vanguard, with Vanguard’s Australian Shares ETF (ASX: VAS) topping the list for a second year running. Magellan’s actively managed Global Equities ETF (ASX: MGE) was the favoured globally exposed ETF.

iShares and VanEck also made the top 10 as Advisers continued to seek broad international exposure from passive-ETFs.

One noticeable absentee that has been in the top 10 in the past is the SPDR S&P/ASX 200 ETF (ASX: STW) which passively tracks the S&P/ASX 200 Index.

Morningstar provided over 300 articles to Advisers during 2020, helping you to keep informed on the current market activity, supporting you with client communication for Investors concerned about the market volatility, and our best thinking’s from some of Morningstar’s great minds and thought leaders.

Plus keeping you up to date on all the great improvements made to Adviser Research Centre over the course of the year. If you missed any of the product updates please find the two main recap documents here:

1st Half 2020 Product Release Note

2nd Half 2020 Product Release Note

While our Best Stock Ideas document that comes out at the start of each month is our most widely read document, here are the top 5 thought leadership articles that were most read in case you missed them.

Coronavirus market selloff ‘a gross overreaction’

29 quality stocks at great prices

Opportune Entry Point for Quality Healthcare Names

What Experts Say Coronavirus Means for Investors

Coronavirus effect: 11 Aussie stocks to watch

Videos are a great way to get a quick update from the team whether it be product feature updates, Webinar and training recordings or interviews with Morningstar or external thought leaders.

Here are your top 5 Videos watched in 2020:

Morningstar provided over 300 articles to Advisers during 2020, helping you to keep informed on the current market activity, supporting you with client communication for Investors concerned about the market volatility, and our best thinking’s from some of Morningstar’s great minds and thought leaders.

Plus keeping you up to date on all the great improvements made to Adviser Research Centre over the course of the year. If you missed any of the product updates please find the two main recap documents here:

1st Half 2020 Product Release Note

2nd Half 2020 Product Release Note

While our Best Stock Ideas document that comes out at the start of each month is our most widely read document, here are the top 5 thought leadership articles that were most read in case you missed them.

Coronavirus market selloff ‘a gross overreaction’

29 quality stocks at great prices

Opportune Entry Point for Quality Healthcare Names

What Experts Say Coronavirus Means for Investors

Coronavirus effect: 11 Aussie stocks to watch

Videos are a great way to get a quick update from the team whether it be product feature updates, Webinar and training recordings or interviews with Morningstar or external thought leaders.

Here are your top 5 Videos watched in 2020:

Any Morningstar ratings/recommendations contained in this report are based on the full research report available from Morningstar or your adviser. © 2021 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘class service’ have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Refer to our Financial Services Guide (FSG) for more information at www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a professional financial adviser. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.

Any Morningstar ratings/recommendations contained in this report are based on the full research report available from Morningstar or your adviser. © 2021 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘class service’ have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Refer to our Financial Services Guide (FSG) for more information at www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a professional financial adviser. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.