The actions of central banks around the world are well known—they are undertaking substantial quantitative-easing programs to support their economies. While they have control of cash rates and their bond purchases at the shorter end have been more effective at keeping rates low, further out the curve, they have not. And even in the face of central bank purchases, investors have sold longer-dated bonds and quickly driven up rates in early 2021. Unsurprisingly, this has had flow-on effects in other markets, too, particularly equities. This article explores what is going on in the bond markets now, how our fixed-interest managers have fared, and what it means for equity markets.

Key Takeaways

× Central bank yield-curve intervention globally has been across maturities, but it has been most effective at holding rates lower at the shorter end. As expectations of inflation have risen, long-end bonds have been routed.

× This environment is a turbulent time for fixed-interest managers but has allowed some active managers to show their skill, while passive managers have typically suffered.

× The sharp move in rates is spilling over into the various parts of the equity market, and investors should be vigilant about their equity style exposure to avoid being run over should the current conditions continue.

Bond Market Moves

The free market price discovery of government bonds has been distorted by central bank interventions via various quantitative-easing programs. It is an intentional outcome to manage cash rates and the shape of yield curves to support economies around the world. Much of the focus has been at the short end, but longer-dated bonds are being bought in some regions, such as Japan, too. However, as economic conditions are in the early stages of improving, investors are starting to expect rising inflation, and this is materialising in the pricing of longer-dated bonds—for example, government bonds with a duration of at least 5 years and longer. They do that by selling those bonds, which drives yields higher. This has resulted in the Australian 10-year Government Bond yield more than doubling—it has risen to above 1.60% as at the end of February 2021 from 0.80% in October 2020. Over the same period, US 10-year bonds have moved to 1.34% from 0.65%. These are eye-catching sell-offs by historic standards.

Fixed-Interest Fund Returns

Such market moves create significant headwinds for bond managers to deliver positive returns, particularly for those strategies that are benchmark-aware. The commonly used benchmarks illustrate this—the Bloomberg Barclays Global Aggregate Index has fallen 1.35% and the Bloomberg AusBond Composite 0+Y Index dropped 4.08% from 1 October to 28 February 2021. For the funds under coverage, the average bond manager in the Australian, Global, or Global/Australia categories has fallen 2.06%—in an environment where running yields are at or near all-time lows, this a meaningful loss. Relatedly, the duration of the major benchmarks has lengthened over recent years, meaning they are now more price-sensitive to changes in interest rates.

Breaking Down Performance

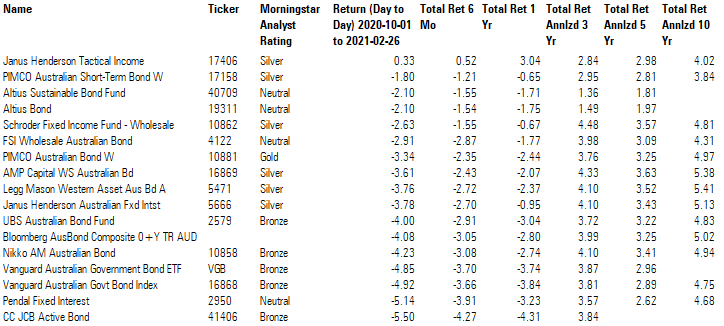

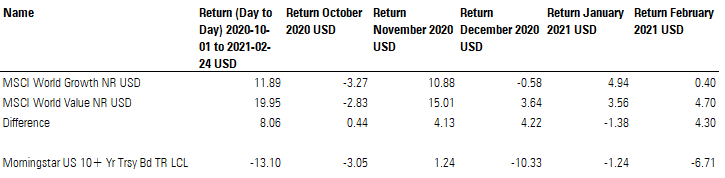

Those managers who stick mostly to government bonds, like CC JCB Active Bond 41406 and Vanguard Australian Government Bond Index 16868, have borne the brunt of this market environment. But those who run more-flexible strategies, like Janus Henderson Tactical Income 17406, or those who run much lower-duration strategies, like Pimco Australia Short Term Bond 17158, have held up relatively well. See Exhibit 1 for a full list of returns from our bonds Australia Morningstar Category. At the bottom of the table are those that have had more exposure to long-dated government bonds—for example, CC JCB Active Bond 41406 and Pendal Fixed Interest 2950. Passive strategies have a persistent exposure to long-end bonds (it is the same across all the bond categories), so it is no surprise that Vanguard Australian Government Bond delivered a negative return. Note the average manager in this group delivered a negative 3.44% return.

Exhibit 1 Bonds - Australia Category Returns

Source: Morningstar Direct. Data as of 26 February 2021.

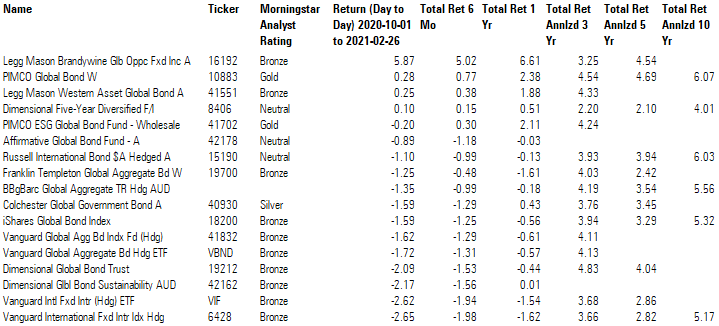

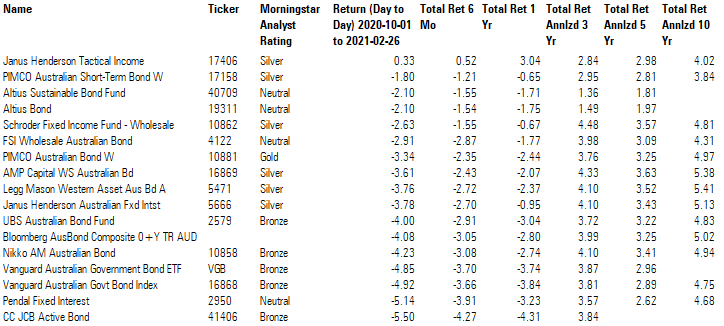

Conditions have been slightly better in the bonds-global category, as the sell-off there hasn’t been quite as aggressive compared with the local market. From an economic recovery standpoint, Australia is further down the track than most other developed nations. The average fund under coverage here fell by 0.84% only, though the numbers are skewed by a standout performance from the highly flexible Legg Mason Brandywine Global Opportunities Fixed Income Fund 16192. Exclude that fund, and the average is negative 1.26%. Other relatively strong performances have come from strategies holding significant credit exposure and consequently little exposure to long-dated government bonds—for instance, Pimco Global Bond W 10883 and Legg Mason Western Asset Global Bond A 41551. Like the Australian category, those with a heavy allocation to global government bonds have fared the worst—again, passive strategies have been a victim of the bond market rout. See Exhibit 2 for a list of global bond fund returns.

Exhibit 2 Bonds - Global Category Returns

Source: Morningstar Direct. Data as of 26 February 2021.

Conditions have been slightly better in the bonds-global category, as the sell-off there hasn’t been quite as aggressive compared with the local market. From an economic recovery standpoint, Australia is further down the track than most other developed nations. The average fund under coverage here fell by 0.84% only, though the numbers are skewed by a standout performance from the highly flexible Legg Mason Brandywine Global Opportunities Fixed Income Fund 16192. Exclude that fund, and the average is negative 1.26%. Other relatively strong performances have come from strategies holding significant credit exposure and consequently little exposure to long-dated government bonds—for instance, Pimco Global Bond W 10883 and Legg Mason Western Asset Global Bond A 41551. Like the Australian category, those with a heavy allocation to global government bonds have fared the worst—again, passive strategies have been a victim of the bond market rout. See Exhibit 2 for a list of global bond fund returns.

Exhibit 2 Bonds - Global Category Returns

Source: Morningstar Direct. Data as of 26 February 2021.

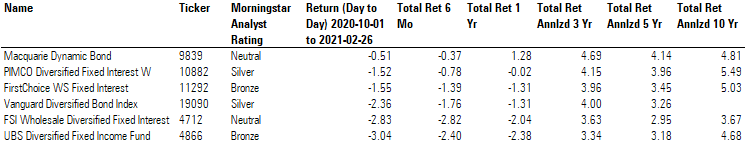

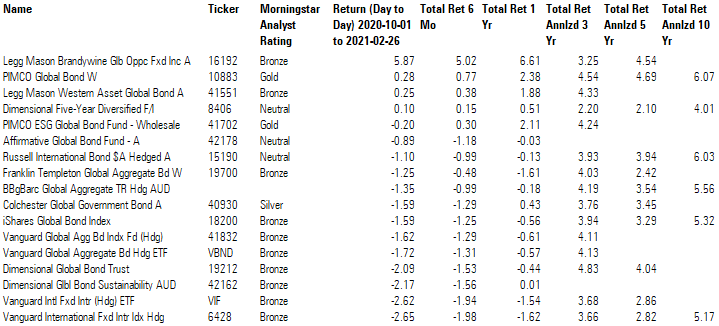

The story is obviously the same for those that have both a global and Australian remit, as shown in Exhibit 3. Macquarie Dynamic Bond 9839 and Pimco Diversified Fixed Interest 10882 have low duration portfolios with higher allocation to corporate credit, which has helped them outperform peers. UBS Diversified Fixed Income 4866 and FSI Wholesale Diversified Fixed Interest 4712 have had an overweight duration and a lower exposure to corporate bonds, which explains their underperformance.

Exhibit 3 Bonds - Global/Australia Category Returns

Source: Morningstar Direct. Data as of 26 February 2021.

The story is obviously the same for those that have both a global and Australian remit, as shown in Exhibit 3. Macquarie Dynamic Bond 9839 and Pimco Diversified Fixed Interest 10882 have low duration portfolios with higher allocation to corporate credit, which has helped them outperform peers. UBS Diversified Fixed Income 4866 and FSI Wholesale Diversified Fixed Interest 4712 have had an overweight duration and a lower exposure to corporate bonds, which explains their underperformance.

Exhibit 3 Bonds - Global/Australia Category Returns

Source: Morningstar Direct. Data as of 26 February 2021.

Should Duration Be Shunned?

Some bond-fund investors may be concerned about returns of the defensive parts of their portfolios over this period and, if the 10-year yields continue to shoot higher, then further losses may be suffered. But we believe this may not be a permanent condition for the bond market, and in fact, there are several reasons to stay the course. First, long-end rates rising is a sign of good economic health. As the coronavirus vaccine rolls out, investors are forecasting a vast improvement in business conditions. This should also mean equities will benefit (more on this below), and so a well-balanced portfolio has some positive return contributors. Second, there is a well-reasoned argument that should long-end rates continue to rise, central bankers will have to step in and buy those bonds, too. Third, it is important to remember that a bond portfolio has to reinvest its assets whenever its holdings mature, often at higher interest rates. It is analogous to a continuous process of dollar-cost averaging when buying stocks. So, unless there is a sustained increase in yields, then the possibility of losing money on your bond portfolio over a three- to five-year time frame is fairly remote. See Exhibit 4 for returns of the primary global index since 1992.

Exhibit 4 Bloomberg Barclays Global Aggregate Total Return Hdg AUD - Rolling Three-Year Returns

Source: Morningstar Direct. Data as of 26 February 2021.

Should Duration Be Shunned?

Some bond-fund investors may be concerned about returns of the defensive parts of their portfolios over this period and, if the 10-year yields continue to shoot higher, then further losses may be suffered. But we believe this may not be a permanent condition for the bond market, and in fact, there are several reasons to stay the course. First, long-end rates rising is a sign of good economic health. As the coronavirus vaccine rolls out, investors are forecasting a vast improvement in business conditions. This should also mean equities will benefit (more on this below), and so a well-balanced portfolio has some positive return contributors. Second, there is a well-reasoned argument that should long-end rates continue to rise, central bankers will have to step in and buy those bonds, too. Third, it is important to remember that a bond portfolio has to reinvest its assets whenever its holdings mature, often at higher interest rates. It is analogous to a continuous process of dollar-cost averaging when buying stocks. So, unless there is a sustained increase in yields, then the possibility of losing money on your bond portfolio over a three- to five-year time frame is fairly remote. See Exhibit 4 for returns of the primary global index since 1992.

Exhibit 4 Bloomberg Barclays Global Aggregate Total Return Hdg AUD - Rolling Three-Year Returns

Source: Morningstar Direct. Data from 1 January 1990 to 26 February 2021.

The Implications for Other Markets

Bond market moves are watched by investors in all asset classes. The price of debt can change the valuation of virtually any security. So, when stocks started to fall at the same time that long-end bond yields started to rise, it was of little surprise. Valuations are determined by the discounting of future cash flows by an interest rate. Simplistically, if that rate is very low, then the valuation outcome is very high—and vice versa. The nuance here is that for growth companies that have high long-term expected cash flows compared with near-term cash flows, the sensitivity to a rise in interest rates is dramatic. Now consider those ‘super-growth’ companies that are reinvesting in their businesses such that they are not producing any free cash flow—their debt funding now becomes more expensive. So, it is a double whammy for them: Future earnings are discounted by a high rate, and their business costs have gone up.

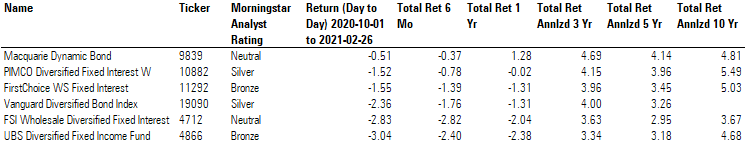

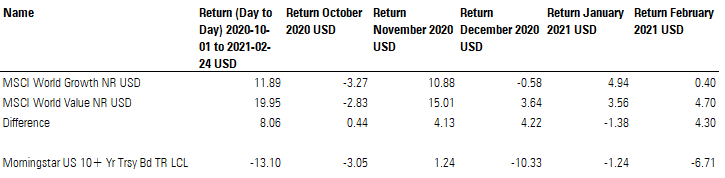

Investors have noted this fact, as value (MSCI World Value NR USD) outperformed growth (MSCI World Growth NR USD) by 8.06 percentage points over the five-month period from 1 October to 28 February 2021. This was a significant change after many years of growth outperforming value. This coincided with the return of Morningstar US 10+Yr Treasury Bond TR Hedged AUD falling by 13.21%. But if we focus on February 2021, where bond yields moved rapidly higher, the growth index was virtually flat, while the value index was up 4.70%. See Exhibit 5 for details of the period.

Exhibit 5 Global Equity Style Returns

Source: Morningstar Direct. Data from 1 January 1990 to 26 February 2021.

The Implications for Other Markets

Bond market moves are watched by investors in all asset classes. The price of debt can change the valuation of virtually any security. So, when stocks started to fall at the same time that long-end bond yields started to rise, it was of little surprise. Valuations are determined by the discounting of future cash flows by an interest rate. Simplistically, if that rate is very low, then the valuation outcome is very high—and vice versa. The nuance here is that for growth companies that have high long-term expected cash flows compared with near-term cash flows, the sensitivity to a rise in interest rates is dramatic. Now consider those ‘super-growth’ companies that are reinvesting in their businesses such that they are not producing any free cash flow—their debt funding now becomes more expensive. So, it is a double whammy for them: Future earnings are discounted by a high rate, and their business costs have gone up.

Investors have noted this fact, as value (MSCI World Value NR USD) outperformed growth (MSCI World Growth NR USD) by 8.06 percentage points over the five-month period from 1 October to 28 February 2021. This was a significant change after many years of growth outperforming value. This coincided with the return of Morningstar US 10+Yr Treasury Bond TR Hedged AUD falling by 13.21%. But if we focus on February 2021, where bond yields moved rapidly higher, the growth index was virtually flat, while the value index was up 4.70%. See Exhibit 5 for details of the period.

Exhibit 5 Global Equity Style Returns

Source: Morningstar Direct. Data as of 26 February 2021.

We acknowledge the above is a very short time period, but if long-end rates continue to climb, it could be a turning point for the growth-value dispersion that has moved ever wider since 2010. For those investors positioned in growth-oriented equity portfolios, we would encourage a more balanced approach across equity styles.

Portfolio Construction

We recommend investors not completely shun duration in their bond portfolios. Good portfolio construction uses the typically zero or negative correlation that equities have with bonds. Furthermore, long-end rates will provide the best protection should equity markets wobble. For those wishing to avoid the risk of rising rates, combining an active strategy (that is benchmark-aware) with a highly rated flexible-bond manager can be a prudent approach.

On the other side of the portfolio, equity returns have been very strong in recent months, and it may have pushed investor portfolios' growth/defensive asset splits away from targets. In this case, a portfolio rebalance might be in order. As mentioned above, see which equity funds have moved the most and ensure there is appropriate balance across the equity investment styles.

Source: Morningstar Direct. Data as of 26 February 2021.

We acknowledge the above is a very short time period, but if long-end rates continue to climb, it could be a turning point for the growth-value dispersion that has moved ever wider since 2010. For those investors positioned in growth-oriented equity portfolios, we would encourage a more balanced approach across equity styles.

Portfolio Construction

We recommend investors not completely shun duration in their bond portfolios. Good portfolio construction uses the typically zero or negative correlation that equities have with bonds. Furthermore, long-end rates will provide the best protection should equity markets wobble. For those wishing to avoid the risk of rising rates, combining an active strategy (that is benchmark-aware) with a highly rated flexible-bond manager can be a prudent approach.

On the other side of the portfolio, equity returns have been very strong in recent months, and it may have pushed investor portfolios' growth/defensive asset splits away from targets. In this case, a portfolio rebalance might be in order. As mentioned above, see which equity funds have moved the most and ensure there is appropriate balance across the equity investment styles.

Source: Morningstar Direct. Data as of 26 February 2021.

Conditions have been slightly better in the bonds-global category, as the sell-off there hasn’t been quite as aggressive compared with the local market. From an economic recovery standpoint, Australia is further down the track than most other developed nations. The average fund under coverage here fell by 0.84% only, though the numbers are skewed by a standout performance from the highly flexible Legg Mason Brandywine Global Opportunities Fixed Income Fund 16192. Exclude that fund, and the average is negative 1.26%. Other relatively strong performances have come from strategies holding significant credit exposure and consequently little exposure to long-dated government bonds—for instance, Pimco Global Bond W 10883 and Legg Mason Western Asset Global Bond A 41551. Like the Australian category, those with a heavy allocation to global government bonds have fared the worst—again, passive strategies have been a victim of the bond market rout. See Exhibit 2 for a list of global bond fund returns.

Exhibit 2 Bonds - Global Category Returns

Source: Morningstar Direct. Data as of 26 February 2021.

Conditions have been slightly better in the bonds-global category, as the sell-off there hasn’t been quite as aggressive compared with the local market. From an economic recovery standpoint, Australia is further down the track than most other developed nations. The average fund under coverage here fell by 0.84% only, though the numbers are skewed by a standout performance from the highly flexible Legg Mason Brandywine Global Opportunities Fixed Income Fund 16192. Exclude that fund, and the average is negative 1.26%. Other relatively strong performances have come from strategies holding significant credit exposure and consequently little exposure to long-dated government bonds—for instance, Pimco Global Bond W 10883 and Legg Mason Western Asset Global Bond A 41551. Like the Australian category, those with a heavy allocation to global government bonds have fared the worst—again, passive strategies have been a victim of the bond market rout. See Exhibit 2 for a list of global bond fund returns.

Exhibit 2 Bonds - Global Category Returns

Source: Morningstar Direct. Data as of 26 February 2021.

The story is obviously the same for those that have both a global and Australian remit, as shown in Exhibit 3. Macquarie Dynamic Bond 9839 and Pimco Diversified Fixed Interest 10882 have low duration portfolios with higher allocation to corporate credit, which has helped them outperform peers. UBS Diversified Fixed Income 4866 and FSI Wholesale Diversified Fixed Interest 4712 have had an overweight duration and a lower exposure to corporate bonds, which explains their underperformance.

Exhibit 3 Bonds - Global/Australia Category Returns

Source: Morningstar Direct. Data as of 26 February 2021.

The story is obviously the same for those that have both a global and Australian remit, as shown in Exhibit 3. Macquarie Dynamic Bond 9839 and Pimco Diversified Fixed Interest 10882 have low duration portfolios with higher allocation to corporate credit, which has helped them outperform peers. UBS Diversified Fixed Income 4866 and FSI Wholesale Diversified Fixed Interest 4712 have had an overweight duration and a lower exposure to corporate bonds, which explains their underperformance.

Exhibit 3 Bonds - Global/Australia Category Returns

Source: Morningstar Direct. Data as of 26 February 2021.

Should Duration Be Shunned?

Some bond-fund investors may be concerned about returns of the defensive parts of their portfolios over this period and, if the 10-year yields continue to shoot higher, then further losses may be suffered. But we believe this may not be a permanent condition for the bond market, and in fact, there are several reasons to stay the course. First, long-end rates rising is a sign of good economic health. As the coronavirus vaccine rolls out, investors are forecasting a vast improvement in business conditions. This should also mean equities will benefit (more on this below), and so a well-balanced portfolio has some positive return contributors. Second, there is a well-reasoned argument that should long-end rates continue to rise, central bankers will have to step in and buy those bonds, too. Third, it is important to remember that a bond portfolio has to reinvest its assets whenever its holdings mature, often at higher interest rates. It is analogous to a continuous process of dollar-cost averaging when buying stocks. So, unless there is a sustained increase in yields, then the possibility of losing money on your bond portfolio over a three- to five-year time frame is fairly remote. See Exhibit 4 for returns of the primary global index since 1992.

Exhibit 4 Bloomberg Barclays Global Aggregate Total Return Hdg AUD - Rolling Three-Year Returns

Source: Morningstar Direct. Data as of 26 February 2021.

Should Duration Be Shunned?

Some bond-fund investors may be concerned about returns of the defensive parts of their portfolios over this period and, if the 10-year yields continue to shoot higher, then further losses may be suffered. But we believe this may not be a permanent condition for the bond market, and in fact, there are several reasons to stay the course. First, long-end rates rising is a sign of good economic health. As the coronavirus vaccine rolls out, investors are forecasting a vast improvement in business conditions. This should also mean equities will benefit (more on this below), and so a well-balanced portfolio has some positive return contributors. Second, there is a well-reasoned argument that should long-end rates continue to rise, central bankers will have to step in and buy those bonds, too. Third, it is important to remember that a bond portfolio has to reinvest its assets whenever its holdings mature, often at higher interest rates. It is analogous to a continuous process of dollar-cost averaging when buying stocks. So, unless there is a sustained increase in yields, then the possibility of losing money on your bond portfolio over a three- to five-year time frame is fairly remote. See Exhibit 4 for returns of the primary global index since 1992.

Exhibit 4 Bloomberg Barclays Global Aggregate Total Return Hdg AUD - Rolling Three-Year Returns

Source: Morningstar Direct. Data from 1 January 1990 to 26 February 2021.

The Implications for Other Markets

Bond market moves are watched by investors in all asset classes. The price of debt can change the valuation of virtually any security. So, when stocks started to fall at the same time that long-end bond yields started to rise, it was of little surprise. Valuations are determined by the discounting of future cash flows by an interest rate. Simplistically, if that rate is very low, then the valuation outcome is very high—and vice versa. The nuance here is that for growth companies that have high long-term expected cash flows compared with near-term cash flows, the sensitivity to a rise in interest rates is dramatic. Now consider those ‘super-growth’ companies that are reinvesting in their businesses such that they are not producing any free cash flow—their debt funding now becomes more expensive. So, it is a double whammy for them: Future earnings are discounted by a high rate, and their business costs have gone up.

Investors have noted this fact, as value (MSCI World Value NR USD) outperformed growth (MSCI World Growth NR USD) by 8.06 percentage points over the five-month period from 1 October to 28 February 2021. This was a significant change after many years of growth outperforming value. This coincided with the return of Morningstar US 10+Yr Treasury Bond TR Hedged AUD falling by 13.21%. But if we focus on February 2021, where bond yields moved rapidly higher, the growth index was virtually flat, while the value index was up 4.70%. See Exhibit 5 for details of the period.

Exhibit 5 Global Equity Style Returns

Source: Morningstar Direct. Data from 1 January 1990 to 26 February 2021.

The Implications for Other Markets

Bond market moves are watched by investors in all asset classes. The price of debt can change the valuation of virtually any security. So, when stocks started to fall at the same time that long-end bond yields started to rise, it was of little surprise. Valuations are determined by the discounting of future cash flows by an interest rate. Simplistically, if that rate is very low, then the valuation outcome is very high—and vice versa. The nuance here is that for growth companies that have high long-term expected cash flows compared with near-term cash flows, the sensitivity to a rise in interest rates is dramatic. Now consider those ‘super-growth’ companies that are reinvesting in their businesses such that they are not producing any free cash flow—their debt funding now becomes more expensive. So, it is a double whammy for them: Future earnings are discounted by a high rate, and their business costs have gone up.

Investors have noted this fact, as value (MSCI World Value NR USD) outperformed growth (MSCI World Growth NR USD) by 8.06 percentage points over the five-month period from 1 October to 28 February 2021. This was a significant change after many years of growth outperforming value. This coincided with the return of Morningstar US 10+Yr Treasury Bond TR Hedged AUD falling by 13.21%. But if we focus on February 2021, where bond yields moved rapidly higher, the growth index was virtually flat, while the value index was up 4.70%. See Exhibit 5 for details of the period.

Exhibit 5 Global Equity Style Returns

Source: Morningstar Direct. Data as of 26 February 2021.

We acknowledge the above is a very short time period, but if long-end rates continue to climb, it could be a turning point for the growth-value dispersion that has moved ever wider since 2010. For those investors positioned in growth-oriented equity portfolios, we would encourage a more balanced approach across equity styles.

Portfolio Construction

We recommend investors not completely shun duration in their bond portfolios. Good portfolio construction uses the typically zero or negative correlation that equities have with bonds. Furthermore, long-end rates will provide the best protection should equity markets wobble. For those wishing to avoid the risk of rising rates, combining an active strategy (that is benchmark-aware) with a highly rated flexible-bond manager can be a prudent approach.

On the other side of the portfolio, equity returns have been very strong in recent months, and it may have pushed investor portfolios' growth/defensive asset splits away from targets. In this case, a portfolio rebalance might be in order. As mentioned above, see which equity funds have moved the most and ensure there is appropriate balance across the equity investment styles.

Source: Morningstar Direct. Data as of 26 February 2021.

We acknowledge the above is a very short time period, but if long-end rates continue to climb, it could be a turning point for the growth-value dispersion that has moved ever wider since 2010. For those investors positioned in growth-oriented equity portfolios, we would encourage a more balanced approach across equity styles.

Portfolio Construction

We recommend investors not completely shun duration in their bond portfolios. Good portfolio construction uses the typically zero or negative correlation that equities have with bonds. Furthermore, long-end rates will provide the best protection should equity markets wobble. For those wishing to avoid the risk of rising rates, combining an active strategy (that is benchmark-aware) with a highly rated flexible-bond manager can be a prudent approach.

On the other side of the portfolio, equity returns have been very strong in recent months, and it may have pushed investor portfolios' growth/defensive asset splits away from targets. In this case, a portfolio rebalance might be in order. As mentioned above, see which equity funds have moved the most and ensure there is appropriate balance across the equity investment styles.