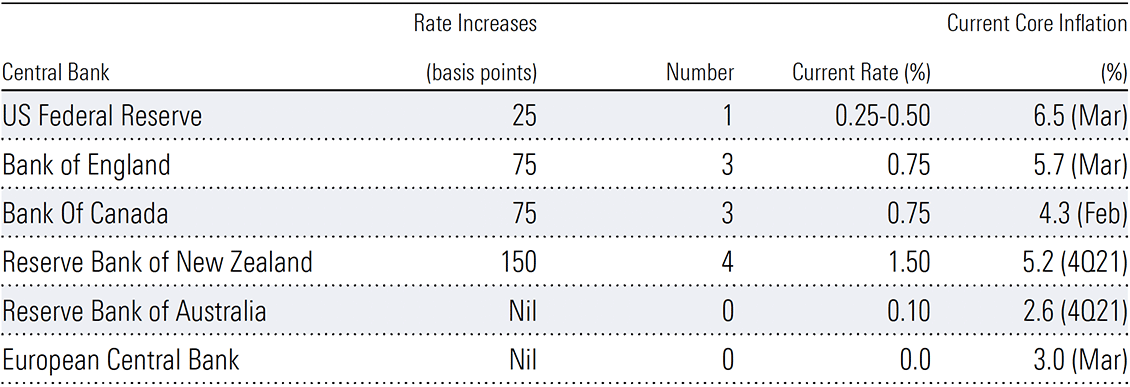

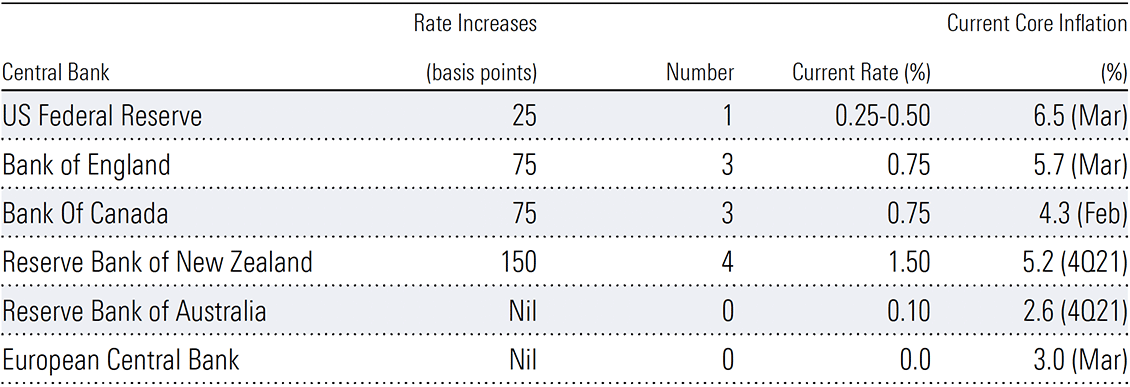

Philip Lowe is no lemming. Nor the European Central Bank president Christine Lagarde. The Reserve Bank (RBA) governor and his French compatriot have not followed central banks in the United States, the United Kingdom, Canada, or New Zealand over the inflation cliff. They have steadfastly held fire, mouthing Fleetwood Mac’s Go Your Own Way.

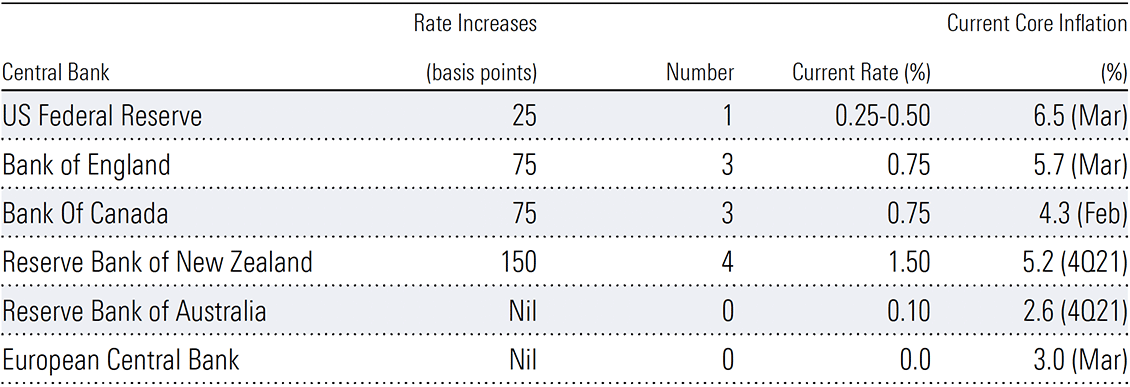

The lemmings have raised rates to varying degrees. So far, the US Federal Reserve (the Fed) has been the most conservative, with its 25-basis point increase in March. However, the fireworks are expected to begin in early May.

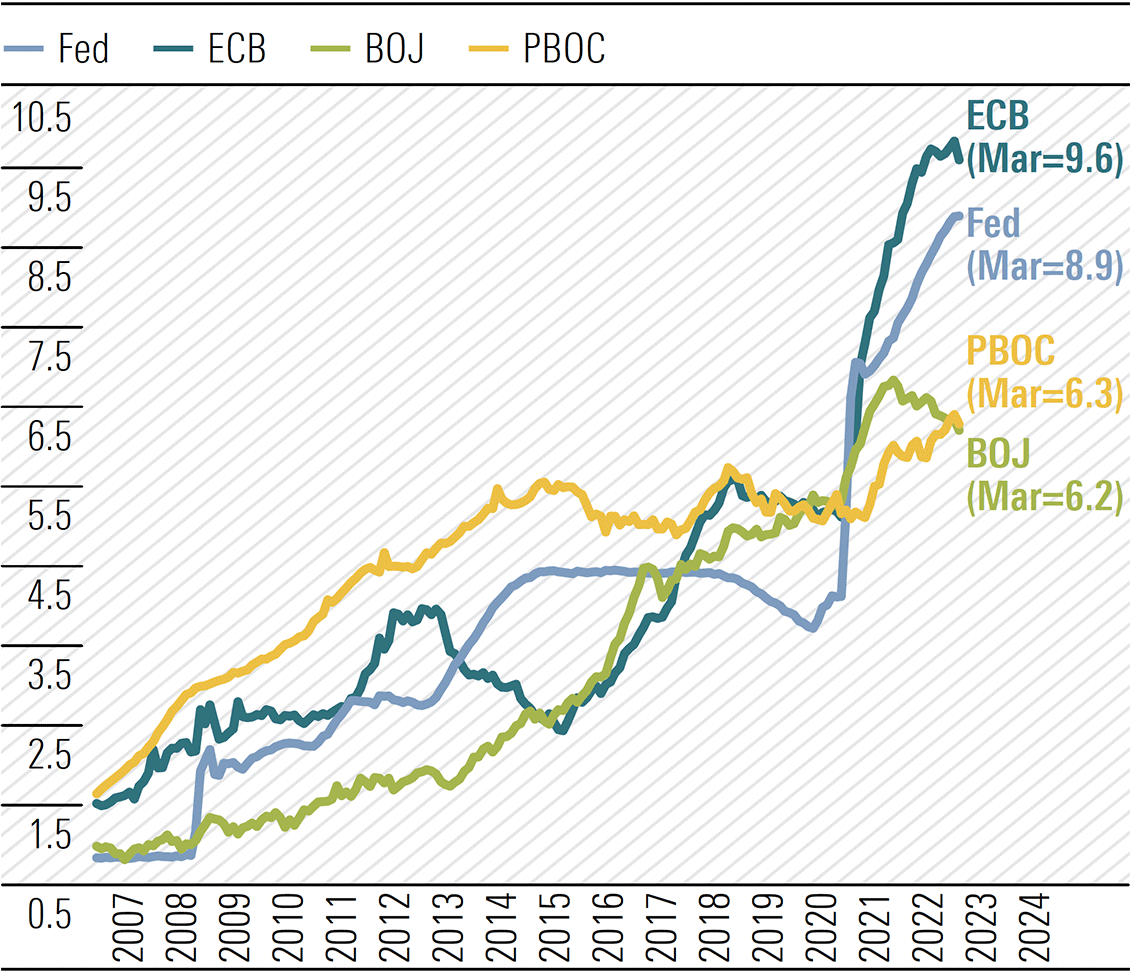

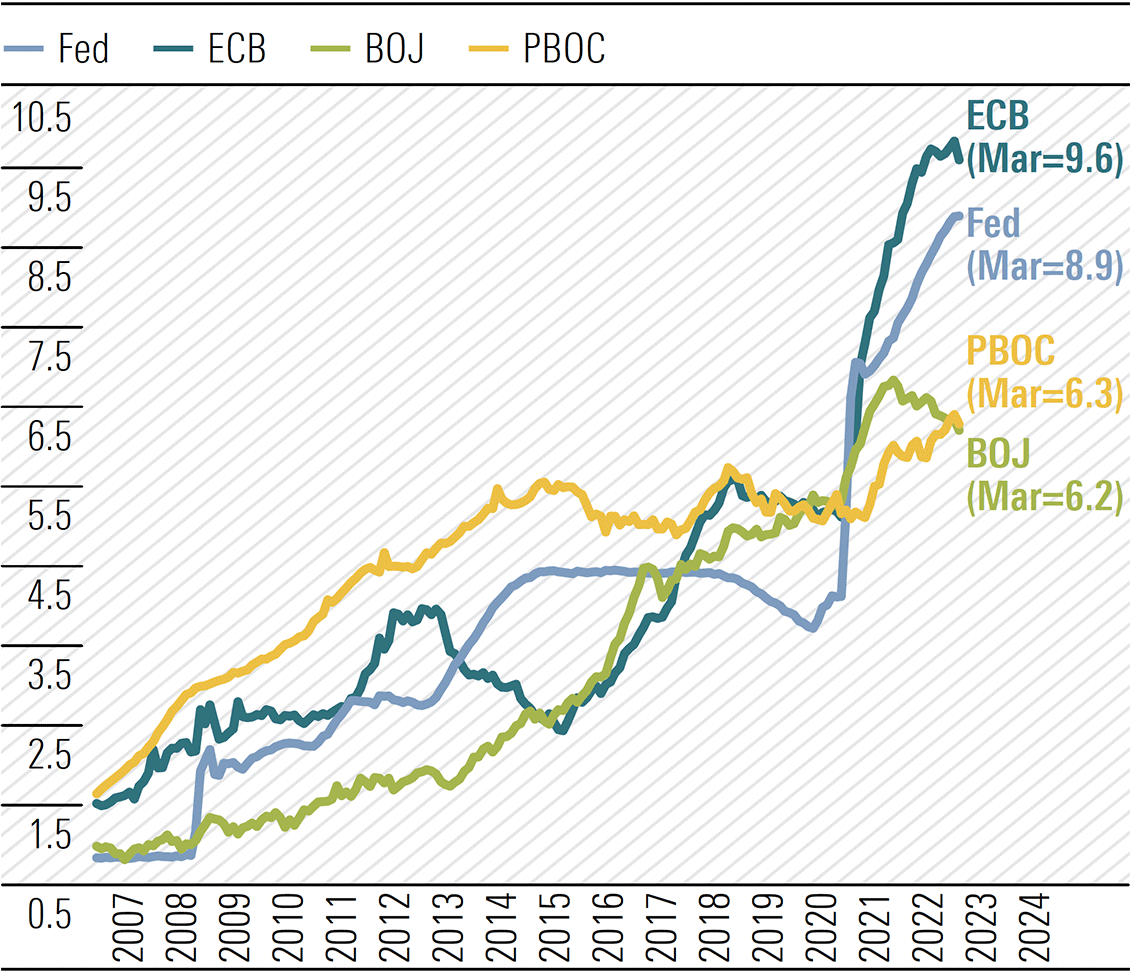

Exhibit 1: Central banks in action

Source: Morningstar

Source: Morningstar

Presumably, the “What If” question has been robustly discussed at RBA Monetary Policy meetings. Lagarde has a legitimate excuse for caution. The Russian invasion of Ukraine is likely to send the German economy, the engine room of the eurozone, into a meaningful contraction, perhaps a recession.

Sitting pat at the ECB’s meeting on 14 April, Lagarde conceded skyrocketing prices had pushed the annual Euro Area CPI for the year ended March to a record 7.5%, the fourth consecutive monthly record. She noted philosophically, “if demand were to weaken in the coming months, it would weaken inflation.” If not, the likelihood of a future CPI reading at four times the 2% annual target is a short-priced favourite.

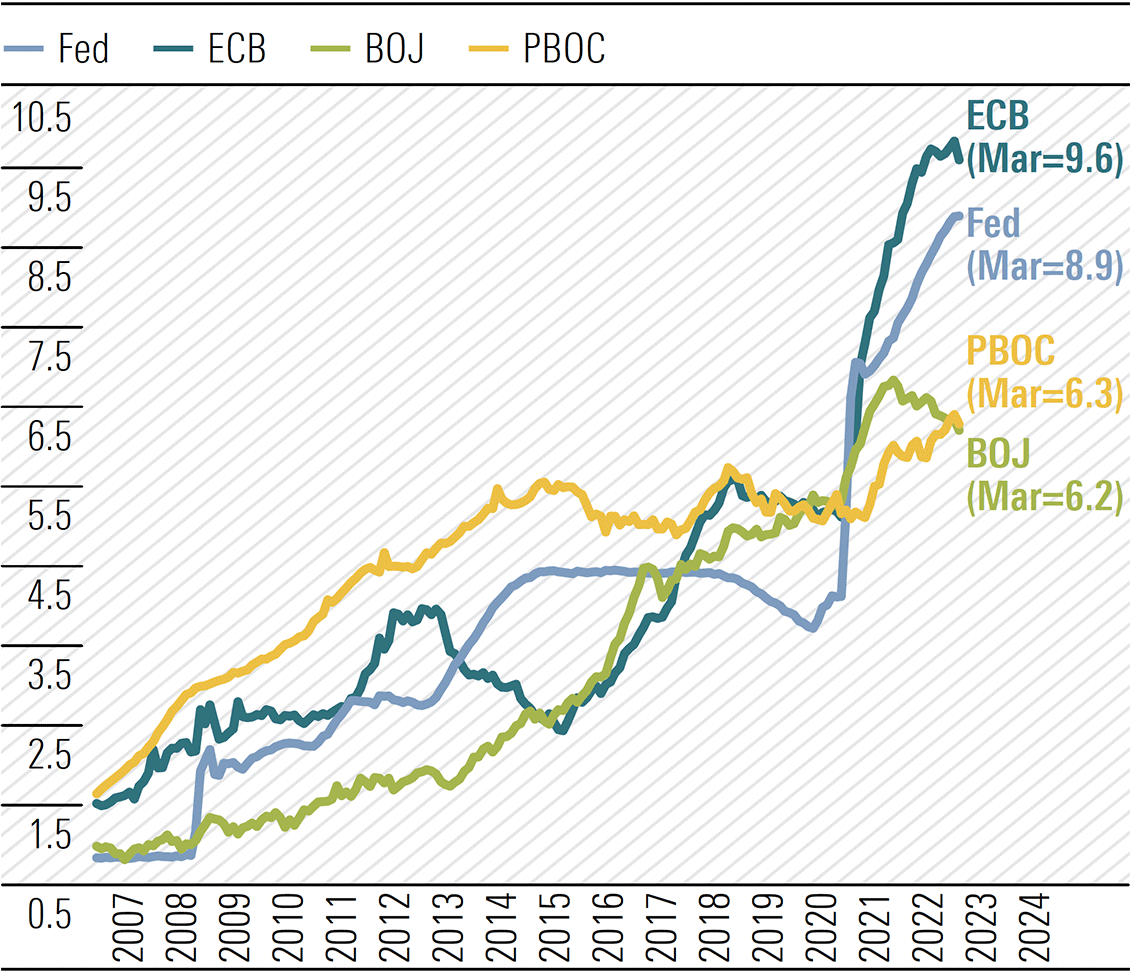

Should a meaningful economic contraction ensue what tools are at the ECB’s disposal to launch effective stimulatory action with the official interest rate at zero (unchanged since late 2016) and a bloated balance sheet? The bank is still making net monthly asset purchases but is likely to conclude the program in the September quarter. April purchases of €40bn are scheduled to slow to €30bn in May and to €20bn in June. Total assets on the balance sheet stood at US$9.6 trillion on 8 April, doubling since February 2020.

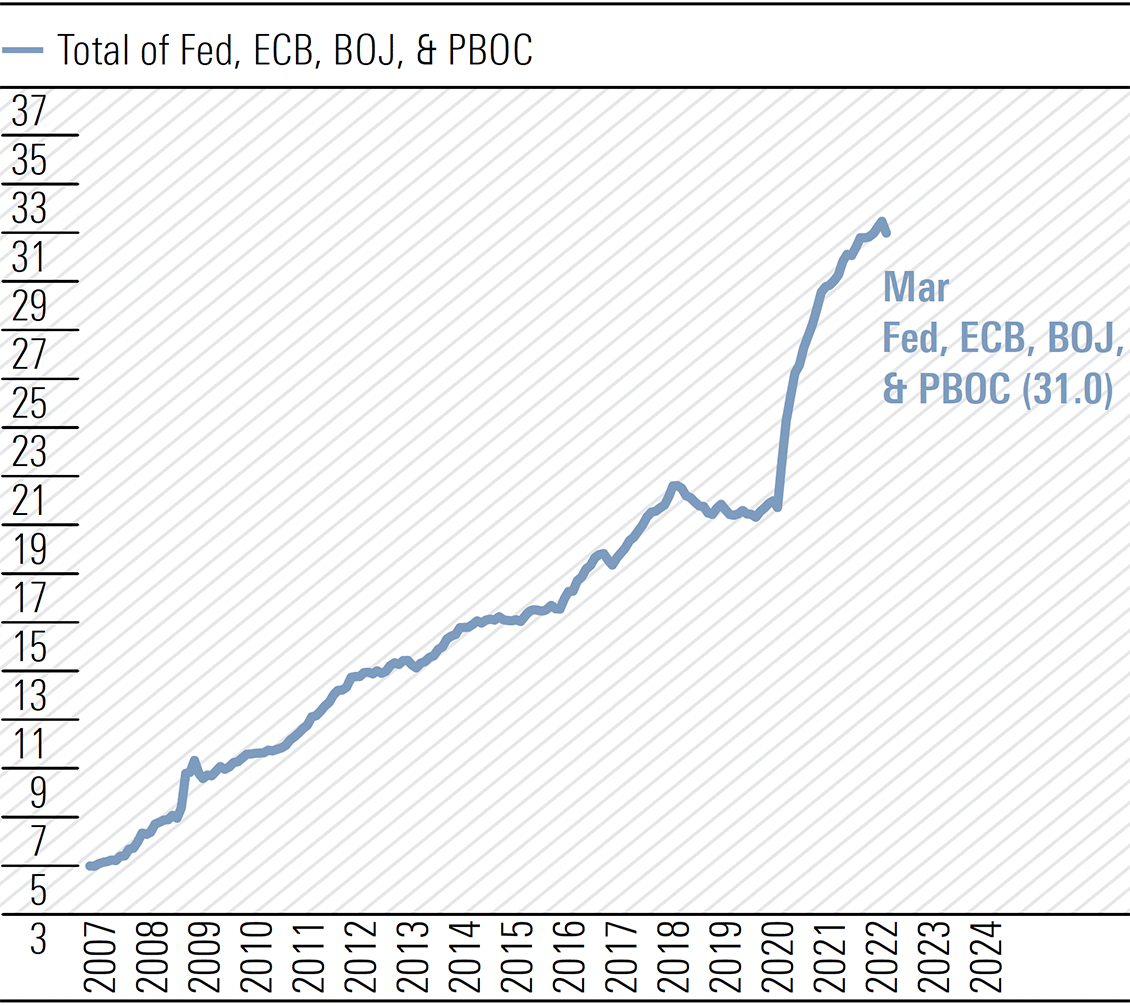

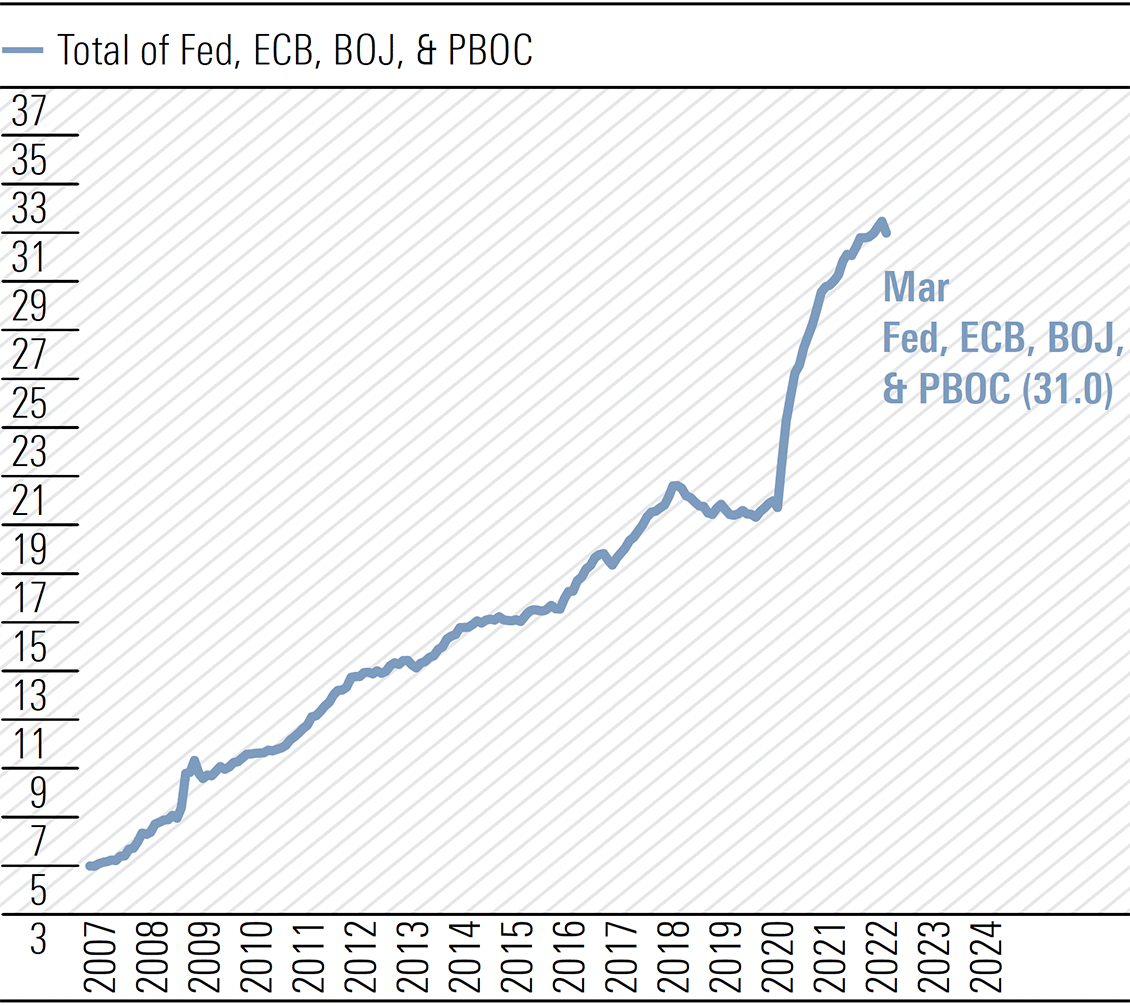

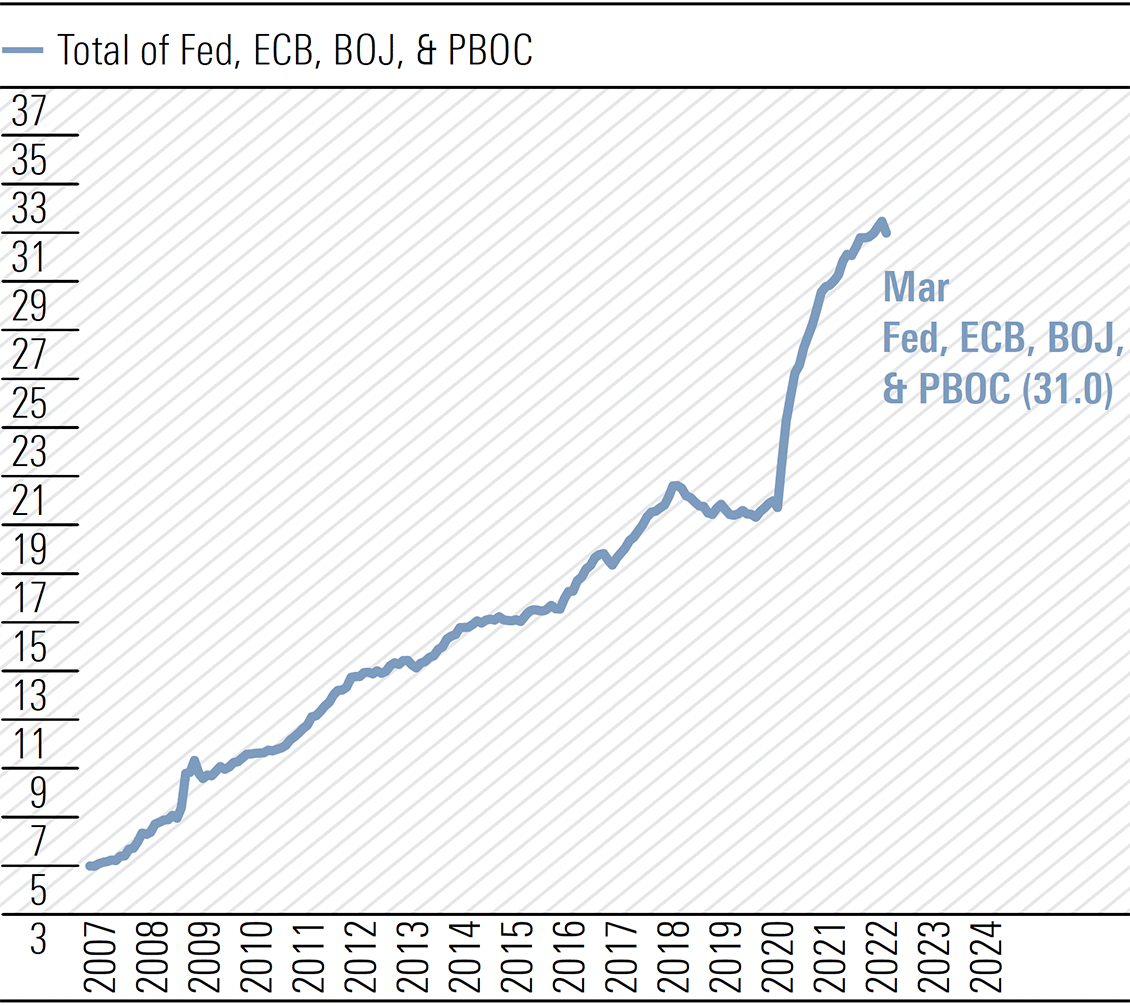

The combined total assets of the big four central banks—The Fed, ECB, Bank of Japan, and Peoples Bank of China—have increased from US$5 trillion in 2007 to a massive US$31 trillion today. Unwinding will be equally massive and fraught with risk.

Exhibit 2: Major Central Banks: Total assets ($trillion, nsa)

Source: Haver Analytics, yardeni.com

Exhibit 3: Major Central Banks: Total assets ($trillion, nsa)

Source: Haver Analytics, yardeni.com

Exhibit 3: Major Central Banks: Total assets ($trillion, nsa)

Source: Haver Analytics, yardeni.com

Source: Haver Analytics, yardeni.com

Global growth slowing

The RBA is in a similar, if not as dire position. It does not have a recession on its doorstep. But there is increasing commentary around possible contractions in the northern hemisphere’s major developed economies later in 2022 and into 2023.

The International Monetary Fund (IMF) has downgraded its global growth forecast in the wake of the Russian/Ukraine conflict which “has triggered a costly humanitarian crisis that demands a peaceful resolution.” Simultaneously, the “economic damage from the conflict will contribute to a significant slowdown in global growth in 2022 and add to inflation.”

Global growth is now forecast to slow from an estimated 6.1% in 2021 to 3.6% in 2022 and 2023. This is 0.8% and 0.2% lower for 2022 and 2023 than projected in January. Beyond 2023, global growth is forecast to decline to about 3.3% over the medium term. Inflation forecasts have been upgraded due to war-induced commodity price increases and the knock-on impact on a wider spectrum of goods and services.

Advanced economy inflation is expected to hit 5.7% in 2022, while emerging markets and developing economies will clock 8.7%. The new forecasts are 1.8% and 2.8% higher than those from January. While these increases appear moderate at first blush, they are jumps of 46% and 47%, respectively.

Russia’s invasion of Ukraine has triggered a complete change in the inflation mindset and some central banks are trying to play catch up. They are switching from very accommodative monetary policy settings to ones more reflective of rising inflation which is perhaps more enduring than previously thought.

Transitory disruptions to global supply chains from the pandemic have morphed into supply disruptions of a different nature focused on the core ingredients of energy and food. Russian and Ukrainian exports of oil and gas and grain are significant on a global scale. The interruption to supply of these critical commodities from the conflict and the subsequent sanctions is not transitory and prices are likely to remain elevated for an extended period.

Why do inflation figures differ across countries?

Putting aside timing differences, the main reason inflation readings inflation readings differ between countries is idiosyncratic weightings in their respective consumer price indices. In the US CPI “basket”, Shelter is by far the largest component at 32%, followed by Food at 14% and Transport (excluding motor fuel) 8%. In Australia, Housing tops the list at 23%, Food and non-alcoholic beverages 16%, Recreation and culture 13% and Transport 11%.

It will be difficult for Australia to not be swept up in a global inflationary spiral. We are a part of a global village and dependent on imports. With only two small refineries, our level of reliance on refined petroleum products is dangerously high. Should moves toward deglobalisation gain further traction, onshoring manufacturing will have significant cost implications.

One of the concerns is the effect inflation can have across different income levels. Those on higher incomes can choose to move to lower price brackets, say from branded groceries to home brand or from 98 Ultimate to a lower premium fuel. However, those on lower incomes may already be buying home brands and E10 and have no other options available. In the December quarter, non-discretionary inflation was 4.5% against headline inflation of 3.5% and discretionary inflation of 1.9%.

Is the RBA ready to pull the trigger?

The RBA will get more inflation evidence on 27 April. A headline rate over 5% will not surprise nor a trimmed mean of 3% plus. Governor Philip Lowe would have noted UBS research revealing March quarter food inflation at Woolworths of 4.3%. Fresh food was up 4.9% due to east coast floods and dry groceries were up 3.9%. Reflecting a less affluent demographic, Coles prices increased 3.2%, with fresh up 4.6% and dry groceries 2.4%.

The minutes of the April Monetary Policy Meeting reveal more attention is being given to offshore inflationary pressures and the decisions of other central banks. The board noted “these developments have brought forward the likely timing of the first increase in interest rates”. Recall, Lowe’s previous almost intransigent, “not before 2024, at the earliest.”

With the cash rate sitting at 0.10%, how does the RBA get back to the preferred single or multiple 25-basis point changes? Is an initial 40-basis point move to 0.5% an outside possibility? An increase at the May meeting during a federal election campaign would be unusual, but not completely out of the question. By waiting until the June meeting and armed with the most recent inflation data, the RBA would get further behind the curve with the November 2022 bond currently yielding 0.80% and longer-dated real yields on the cusp of turning positive.

Australia in a relatively sweet spot

Just as the information technology (IT) sector is the main influence on US equity markets, resources companies and major banks are the drivers of the market in Australia. As the Fed becomes more aggressive and official interest rates begin playing catch up with bond yields through 2022, headwinds will likely strengthen for US equity markets as valuations in the interest-rate sensitive IT sector are pressured.

The IT sector has a 28.1% weighting in the S&P 500, just over twice the second-placed Healthcare at 13.3% with Consumer Discretionary 11.8%, Financials 11.5% and Communication Services 9.6%, rounding out the top five. Materials is equal-last placed at 2.6% of the 11 sectors, while Energy sits in 8th place at 3.7%.

Financial Services (26.5%) and Basic Materials (25.2%) account for just over half of Australia’s S&P/ASX 200 following the BHP unification. Healthcare at 8.8% sits in third place, while Energy is 9th with a weighting of 4.3%. Reflecting the major difference between the US and Australian benchmarks, the Technology sector ranks second last at just 3.7%.

Given the purple patch for commodities and energy is likely to continue, the S&P/ASX 200 could outperform its US counterpart in 2022. Recall, in 2021 the S&P 500 rose 26.9%, twice the 13% increase of the S&P/ASX 200. The unification of BHP Group’s corporate structure in January resulted in its weighting in the Australian benchmark increasing from just under 7% to over 11%. The Australian market is one of the world’s most concentrated, with the top 10 companies making up 47% of the index. Year-to-date the S&P 500 is down 7.0%, while the S&P/ASX 200 is up 1.7%.

The IMF’s modest upgrade to Australia’s 2022 growth forecast from 4.1% to 4.2% was welcome and in a relative sense outstanding. Our strong commodity bias saved the day as it has done on many occasions in the past.

While China’s 1Q22 GDP growth of 4.8% beat consensus estimates of 4.4% and was up from 1Q’s 4.0% annual growth, there was a meaningful slowing in March as lockdowns hit household consumption and manufacturing activity. April data will show a worsening trend and 3Q growth will likely be meaningfully lower. March retail sales fell 3.5% year-on-year (y/y) after growth of 6.7% in January/February y/y. Industrial production increased by 5% y/y but down from 7.5% in the first two months. Fixed asset investment also slowed. March home sales by value slumped by 26.2% y/y, the biggest fall since February 2020. The March unemployment rate hit 5.8%, the highest level since May 2020.

Slowing household consumption and rising unemployment will push authorities to again inject stimulus into the economy, which will be positive for Aussie miners, at least in the near term, as construction and infrastructure will again be targeted.

Longer term our deteriorating relationship with China will be key to Australia’s GDP growth. China’s infrastructure boom post GFC saved us from a recession and again the post-pandemic stimulus also played an important role in stabilising our economy. Despite the widespread anger around Russia’s invasion of Ukraine, China has strengthened its strategic ties with the aggressor, with Bloomberg reporting Vice Foreign Minister Le Yucheng called for deepening ties in a range of fields during a meeting on Monday in Beijing. He said that a nearly 30% jump in trade between the nations during the first three months of 2022 demonstrate “the great resilience and internal dynamism of bilateral cooperation.”

Elsewhere, cashed up private enterprise (PE) groups are on the move and Australia will be a happy hunting ground. Kohlberg Kravis Robert’s $20bn bid for Ramsay Health Care with support from a consortium of Aussie super funds is a further example of the abundant cash reserves trying to find a home. With interest rates on the rise and liquidity being siphoned off, PE managers realise these reserves cannot remain idle any longer. Replenishment will be more expensive and discerning. Nothing is too large. Woolworths, Wesfarmers, Transurban, APA, and Endeavour all spring to mind. There has been speculation around Brambles, and James Hardie would not be without admirers.

Our market is close to an all time high. Given the elevated geopolitical risk and a tightening in monetary policy set to accelerate, the risk/reward ratio is not attractive for the prudent investor. Energy stocks still provide some value on a relative basis, but they have also run hard.

Source: Morningstar

Presumably, the “What If” question has been robustly discussed at RBA Monetary Policy meetings. Lagarde has a legitimate excuse for caution. The Russian invasion of Ukraine is likely to send the German economy, the engine room of the eurozone, into a meaningful contraction, perhaps a recession.

Sitting pat at the ECB’s meeting on 14 April, Lagarde conceded skyrocketing prices had pushed the annual Euro Area CPI for the year ended March to a record 7.5%, the fourth consecutive monthly record. She noted philosophically, “if demand were to weaken in the coming months, it would weaken inflation.” If not, the likelihood of a future CPI reading at four times the 2% annual target is a short-priced favourite.

Should a meaningful economic contraction ensue what tools are at the ECB’s disposal to launch effective stimulatory action with the official interest rate at zero (unchanged since late 2016) and a bloated balance sheet? The bank is still making net monthly asset purchases but is likely to conclude the program in the September quarter. April purchases of €40bn are scheduled to slow to €30bn in May and to €20bn in June. Total assets on the balance sheet stood at US$9.6 trillion on 8 April, doubling since February 2020.

The combined total assets of the big four central banks—The Fed, ECB, Bank of Japan, and Peoples Bank of China—have increased from US$5 trillion in 2007 to a massive US$31 trillion today. Unwinding will be equally massive and fraught with risk.

Exhibit 2: Major Central Banks: Total assets ($trillion, nsa)

Source: Morningstar

Presumably, the “What If” question has been robustly discussed at RBA Monetary Policy meetings. Lagarde has a legitimate excuse for caution. The Russian invasion of Ukraine is likely to send the German economy, the engine room of the eurozone, into a meaningful contraction, perhaps a recession.

Sitting pat at the ECB’s meeting on 14 April, Lagarde conceded skyrocketing prices had pushed the annual Euro Area CPI for the year ended March to a record 7.5%, the fourth consecutive monthly record. She noted philosophically, “if demand were to weaken in the coming months, it would weaken inflation.” If not, the likelihood of a future CPI reading at four times the 2% annual target is a short-priced favourite.

Should a meaningful economic contraction ensue what tools are at the ECB’s disposal to launch effective stimulatory action with the official interest rate at zero (unchanged since late 2016) and a bloated balance sheet? The bank is still making net monthly asset purchases but is likely to conclude the program in the September quarter. April purchases of €40bn are scheduled to slow to €30bn in May and to €20bn in June. Total assets on the balance sheet stood at US$9.6 trillion on 8 April, doubling since February 2020.

The combined total assets of the big four central banks—The Fed, ECB, Bank of Japan, and Peoples Bank of China—have increased from US$5 trillion in 2007 to a massive US$31 trillion today. Unwinding will be equally massive and fraught with risk.

Exhibit 2: Major Central Banks: Total assets ($trillion, nsa)

Source: Haver Analytics, yardeni.com

Exhibit 3: Major Central Banks: Total assets ($trillion, nsa)

Source: Haver Analytics, yardeni.com

Exhibit 3: Major Central Banks: Total assets ($trillion, nsa)

Source: Haver Analytics, yardeni.com

Source: Haver Analytics, yardeni.com

Source: Morningstar

Presumably, the “What If” question has been robustly discussed at RBA Monetary Policy meetings. Lagarde has a legitimate excuse for caution. The Russian invasion of Ukraine is likely to send the German economy, the engine room of the eurozone, into a meaningful contraction, perhaps a recession.

Sitting pat at the ECB’s meeting on 14 April, Lagarde conceded skyrocketing prices had pushed the annual Euro Area CPI for the year ended March to a record 7.5%, the fourth consecutive monthly record. She noted philosophically, “if demand were to weaken in the coming months, it would weaken inflation.” If not, the likelihood of a future CPI reading at four times the 2% annual target is a short-priced favourite.

Should a meaningful economic contraction ensue what tools are at the ECB’s disposal to launch effective stimulatory action with the official interest rate at zero (unchanged since late 2016) and a bloated balance sheet? The bank is still making net monthly asset purchases but is likely to conclude the program in the September quarter. April purchases of €40bn are scheduled to slow to €30bn in May and to €20bn in June. Total assets on the balance sheet stood at US$9.6 trillion on 8 April, doubling since February 2020.

The combined total assets of the big four central banks—The Fed, ECB, Bank of Japan, and Peoples Bank of China—have increased from US$5 trillion in 2007 to a massive US$31 trillion today. Unwinding will be equally massive and fraught with risk.

Exhibit 2: Major Central Banks: Total assets ($trillion, nsa)

Source: Morningstar

Presumably, the “What If” question has been robustly discussed at RBA Monetary Policy meetings. Lagarde has a legitimate excuse for caution. The Russian invasion of Ukraine is likely to send the German economy, the engine room of the eurozone, into a meaningful contraction, perhaps a recession.

Sitting pat at the ECB’s meeting on 14 April, Lagarde conceded skyrocketing prices had pushed the annual Euro Area CPI for the year ended March to a record 7.5%, the fourth consecutive monthly record. She noted philosophically, “if demand were to weaken in the coming months, it would weaken inflation.” If not, the likelihood of a future CPI reading at four times the 2% annual target is a short-priced favourite.

Should a meaningful economic contraction ensue what tools are at the ECB’s disposal to launch effective stimulatory action with the official interest rate at zero (unchanged since late 2016) and a bloated balance sheet? The bank is still making net monthly asset purchases but is likely to conclude the program in the September quarter. April purchases of €40bn are scheduled to slow to €30bn in May and to €20bn in June. Total assets on the balance sheet stood at US$9.6 trillion on 8 April, doubling since February 2020.

The combined total assets of the big four central banks—The Fed, ECB, Bank of Japan, and Peoples Bank of China—have increased from US$5 trillion in 2007 to a massive US$31 trillion today. Unwinding will be equally massive and fraught with risk.

Exhibit 2: Major Central Banks: Total assets ($trillion, nsa)

Source: Haver Analytics, yardeni.com

Exhibit 3: Major Central Banks: Total assets ($trillion, nsa)

Source: Haver Analytics, yardeni.com

Exhibit 3: Major Central Banks: Total assets ($trillion, nsa)

Source: Haver Analytics, yardeni.com

Source: Haver Analytics, yardeni.com