Reserve Bank (RBA) Governor Philip Lowe fired the starter’s gun for the journey to interest rate normalisation on Tuesday. Ahead lies a steeplechase course not an obstacle-free runway. Sensibly, the official cash rate was raised by 25-basis points to 0.35%, but the RBA is still way behind the curve, after admitting to “embarrassing” forecast mistakes.

Importantly, the bank reinforced its independence by raising rates during an election campaign. But despite Lowe reiterating the bank’s actions are non-political, you can bet the decision will not be perceived that way in the current circumstances. The inflation currently affecting the cost of living is due to the clash of supply chain disruptions with overstimulated demand from necessary accommodative monetary policy and supportive fiscal policy. Neither was political and both were in the national interest.

The clear message in Lowe’s statement was the increase is the start of the process of normalising monetary policy in response to improving economic conditions, particularly in the labour market. The emergency settings of the past two years are no longer required. Normalisation suggests the official cash rate could rise to 2.5%, but the timing will depend on how conditions evolve.

Bond traders reacted swiftly to the statement and the more hawkish press conference, with yields rising sharply. The 5-year yield jumped 20 points to 3.20%, joining the 10 and 15-year yields well into 3% plus territory. At the start of the year, the 5-year yield was 1.30%. The yield curve continued to flatten. The A$/US$ cross rate firmed back above 0.71.

Source: www.federalreserve.gov

Fed officials have indicated any sales of MBS will only occur after the roll off program is well underway. As the minutes of the March meeting of the FOMC revealed, “An FOMC decision to implement a program of agency MBS sales would be announced well in advance.”

The balance sheet contraction will drain liquidity from money markets in a program that could take years. The FOMC has not set a target for the balance sheet which currently stands just shy of UD$9 trillion, with US$5.8 trillion in US Treasuries and US$2.7 trillion in MBS.

Source: www.federalreserve.gov

Fed officials have indicated any sales of MBS will only occur after the roll off program is well underway. As the minutes of the March meeting of the FOMC revealed, “An FOMC decision to implement a program of agency MBS sales would be announced well in advance.”

The balance sheet contraction will drain liquidity from money markets in a program that could take years. The FOMC has not set a target for the balance sheet which currently stands just shy of UD$9 trillion, with US$5.8 trillion in US Treasuries and US$2.7 trillion in MBS.

Source: tradingeconomics.com, U.S. Bureau of Economic Analysis

The major factor behind the contraction is a record goods trade deficit of US$339.2bn for the quarter, which reduced GDP by 3.2%. This is the largest quarterly drag since 3Q20 of 3.3%. The deficit widened by over 20% in the quarter. On a monthly basis, new records were set in January and March. January’s record was US$107.6bn, which narrowed to US$106.6bn in February and then exploded to US$125.3bn in March. The consensus estimate for March was US$105bn.

Both imports and exports reached record levels in March of US$294.6bn (+11.5%) and US$169.3bn (+7.2%), respectively, the former driven by sharp increases in industrial supplies, including petroleum products and consumer goods, including motor vehicles. This reflects the increase in real private domestic demand in the 1Q22 GDP data. The surge in imports occurred in the face of global supply chain disruption and was up almost 27% on March 2021 levels. Will excess inventory be an issue for the 2Q22 GDP read?

Other detractors to 1Q22 GDP were inventories 0.8% and government spending 0.5%.

With US imports now running at a monthly rate near US$300bn, it makes the onshoring task even more imposing. The US Secretary of the Treasury Janet Yellen has suggested US companies “friend-shore” more of their production in response to China’s ambiguous response to Russia’s invasion of Ukraine. The left-field idea is pro deglobalisation, which would see the US and its allies taking greater control over supply chains by shifting trade away from politically non-aligned competitors. In January and February, US imports from China totalled US$90bn.

GDP growth in 2Q22 is also likely to be subdued. The exit rate from 1Q22 was a negative 1% and although we may wish to ignore the impact of net exports, they are an integral part of economic activity and GDP. While private sector demand was underpinned by personal spending, the momentum is likely to wane as the personal savings rate continues to decline.

Source: tradingeconomics.com, U.S. Bureau of Economic Analysis

The major factor behind the contraction is a record goods trade deficit of US$339.2bn for the quarter, which reduced GDP by 3.2%. This is the largest quarterly drag since 3Q20 of 3.3%. The deficit widened by over 20% in the quarter. On a monthly basis, new records were set in January and March. January’s record was US$107.6bn, which narrowed to US$106.6bn in February and then exploded to US$125.3bn in March. The consensus estimate for March was US$105bn.

Both imports and exports reached record levels in March of US$294.6bn (+11.5%) and US$169.3bn (+7.2%), respectively, the former driven by sharp increases in industrial supplies, including petroleum products and consumer goods, including motor vehicles. This reflects the increase in real private domestic demand in the 1Q22 GDP data. The surge in imports occurred in the face of global supply chain disruption and was up almost 27% on March 2021 levels. Will excess inventory be an issue for the 2Q22 GDP read?

Other detractors to 1Q22 GDP were inventories 0.8% and government spending 0.5%.

With US imports now running at a monthly rate near US$300bn, it makes the onshoring task even more imposing. The US Secretary of the Treasury Janet Yellen has suggested US companies “friend-shore” more of their production in response to China’s ambiguous response to Russia’s invasion of Ukraine. The left-field idea is pro deglobalisation, which would see the US and its allies taking greater control over supply chains by shifting trade away from politically non-aligned competitors. In January and February, US imports from China totalled US$90bn.

GDP growth in 2Q22 is also likely to be subdued. The exit rate from 1Q22 was a negative 1% and although we may wish to ignore the impact of net exports, they are an integral part of economic activity and GDP. While private sector demand was underpinned by personal spending, the momentum is likely to wane as the personal savings rate continues to decline.

Mea culpa, mea culpa

There has been a significant change in the bank’s central forecasts. In February, the central scenario was headline CPI of 3.75% for the year ended June and 3.25% for the year ended December 2022. Trimmed mean was expected to hit 3.25% for year ended June and 2.75% for the year ended December. Now, the central forecast for 2022 is for “headline inflation of around 6 per cent and underlying inflation of around 4 3/4 per cent; by mid-2024, headline and underlying inflation are forecast to have moderated to around 3 per cent. These forecasts are based on an assumption of further increases in interest rates.” At the press conference, Lowe said the assumption was that the official cash rate would be between 1.5% and 1.75% at year-end 2022 and 2.5% year-end 2023. While admitting inflation “has picked up significantly and by more than expected” and that previous forecasts were wrong, “the Board is committed to doing what is necessary to ensure that inflation in Australia returns to target over time. This will require a further lift in interest rates over the period ahead. The Board will continue to closely monitor the incoming information and evolving balance of risks as it determines the timing and extent of future interest rate increases.” The RBA’s balance sheet will be allowed to run off. Proceeds from maturing government bonds will not be reinvested and the repayment of the $188bn Term Funding Facility, $80bn by 30 September 2023 and $108bn by 30 June 2024, will see the balance sheet decline significantly. “The Board is not currently planning to sell the government bonds that the Bank purchased during the pandemic.” That certainly is the case with the $27bn purchased under the Yield Curve Control program at yields between 0.10% and 0.25%, which currently sit between 2.75-2.90%. The first increase in the official cash rate in over 11 years will likely have an adverse impact on consumer sentiment. At Lowe’s press conference, much was made of the $240bn in household savings over and above pre-pandemic levels. He noted how the average owner-occupier with a mortgage is more than two years ahead of their mortgage repayment schedule. But averages are dangerous and these savings will not be evenly distributed across households. It is likely there is a meaningful bias toward households without mortgages and therefore with little or no interest rate exposure. The household savings ratio was 13.6% in 4Q21 and is likely to fall in 1Q22 and beyond as spending options increase with the easing of restrictions and borders reopening. Forecasters are now plotting their course to a normalised cash rate of 2.5%. Westpac’s chief economist Bill Evans predicts a 40-basis point increase on 7 June lifting the rate to 0.75%. He said the surprise 25-point increase “emphasises the Board believes it has a daunting task to bring underlying inflation back from its forecast 4.75% to the top of the 2-3% band by mid-2024.” Lowe indicated the choice of a 25-point increase was to show it was a return to “business as usual” perhaps signaling future increments of 25-points could be the base case. Evans is not convinced, hence his prediction.Banks as quick as Usain Bolt off the mark

All four major banks have wasted no time after hearing Lowe’s gunshot, lifting the standard variable rate by 25-basis points. The ANZ and National Australia Bank (NAB) will implement the change on 13 May, Westpac on the 17th and Commonwealth Bank (CBA) on the 20th. I hope deposit rates rise with the same urgency, and pigs might fly over the fairies at the bottom of my garden! The big four banks were the beneficiaries of $133bn in the RBA’s $188bn Term Funding Facility providing low-cost fixed rate funding for three years, including some $63bn at 0.25% and $70bn at 0.10%. CBA was the largest beneficiary of $51bn, NAB $32bn, Westpac $30bn and ANZ $20bn. The miserly rates paid to depositors over the past two years have enabled them to fund competitive pricing in the mortgage market to protect market share. Despite their importance to overall bank funding, depositors have been roadkill. Is loyalty a one-way street or just pricing power gone mad?The Fed moves as Powell comments propel markets

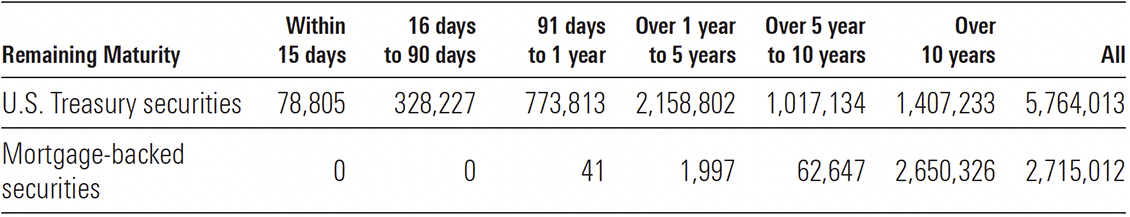

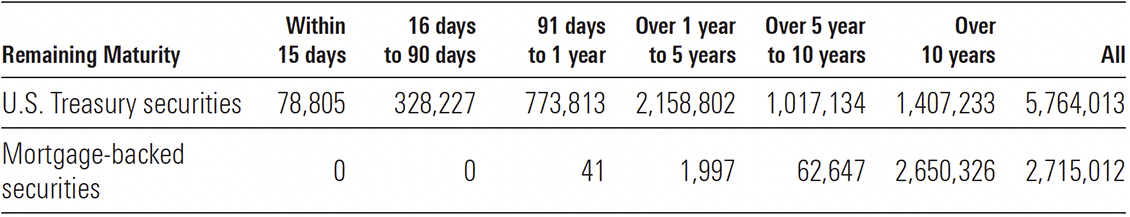

As expected, the US Federal Reserve’s Open Market Committee (FOMC) raised the target range for the federal funds rate by 50-basis points to 0.75%-1.0%, while anticipating “that ongoing increases in the target range will be appropriate.” The 50-point increase was the largest since 2000. But it is not always what the committee does, but what the chairman says that gets financial markets attention. At the press conference, the Fed chairman Jerome Powell provided commentary that ignited market interest. “I think we have a good chance to have a soft or softish landing or outcome, if you will. So, a 75-basis point increase is not something the Committee is actively considering. I think expectations are that we will start to see inflation flattening out.” The market bet Powell would deliver, and a strong relief rally ensued, continuing the extreme volatility of recent weeks. Bond yields fell in the short and middle of the curve. The US$ slumped. The Dow Jones, S&P 500 and Nasdaq recorded gains of 2.8%, 3.0% and 3.2%, respectively. It is stating the obvious that inflation will flatten out. Prices will not continue to rise at current rates, but the damage has already been done. Spending power has been meaningfully reduced and prices are likely to remain high, without necessarily continuing to rise at past rates. But interest rates are set to rise as the tightening cycle is in its infancy. This will impact consumer spending behaviour as disposable income is eroded. The US personal savings rate is already below pre-pandemic levels at 6.2%. Powell’s “soft or softish landing” is predicated on the belief “households and businesses are in very strong financial shape”. Households usually spend income and wages growth, while strong, is still uncomfortably below headline and core inflation. While the market jumped on Powell’s comments, the FOMC statement had some sobering lines. “The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The implications for the U.S. economy are highly uncertain. The invasion and related events are creating additional upward pressure on inflation and are likely to weigh on economic activity. In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions. The Committee is highly attentive to inflation risks.” “In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.” Quantitative tightening (QT) will begin on 1 June at an initial monthly rate of US$47.5bn for three months. Then the Fed will allow a maximum of US$95bn to roll off the balance sheet without reinvestment of proceeds of maturing securities. The monthly roll off will comprise US$65bn of US Treasuries and US$30bn of mortgage-backed securities (MBS). While the Fed has sufficient short-dated maturities in US Treasuries to accommodate the roll off, it has no MBS maturities of less than one year. Consequently, this will necessitate selling some of the US$2.7 trillion MBS, which would have an impact on debt markets.Exhibit 1: Maturity distribution of securities, loans, and selected other assets and liabilities, April 27, 2022

Source: www.federalreserve.gov

Fed officials have indicated any sales of MBS will only occur after the roll off program is well underway. As the minutes of the March meeting of the FOMC revealed, “An FOMC decision to implement a program of agency MBS sales would be announced well in advance.”

The balance sheet contraction will drain liquidity from money markets in a program that could take years. The FOMC has not set a target for the balance sheet which currently stands just shy of UD$9 trillion, with US$5.8 trillion in US Treasuries and US$2.7 trillion in MBS.

Source: www.federalreserve.gov

Fed officials have indicated any sales of MBS will only occur after the roll off program is well underway. As the minutes of the March meeting of the FOMC revealed, “An FOMC decision to implement a program of agency MBS sales would be announced well in advance.”

The balance sheet contraction will drain liquidity from money markets in a program that could take years. The FOMC has not set a target for the balance sheet which currently stands just shy of UD$9 trillion, with US$5.8 trillion in US Treasuries and US$2.7 trillion in MBS.

US economy contracts in 1Q22

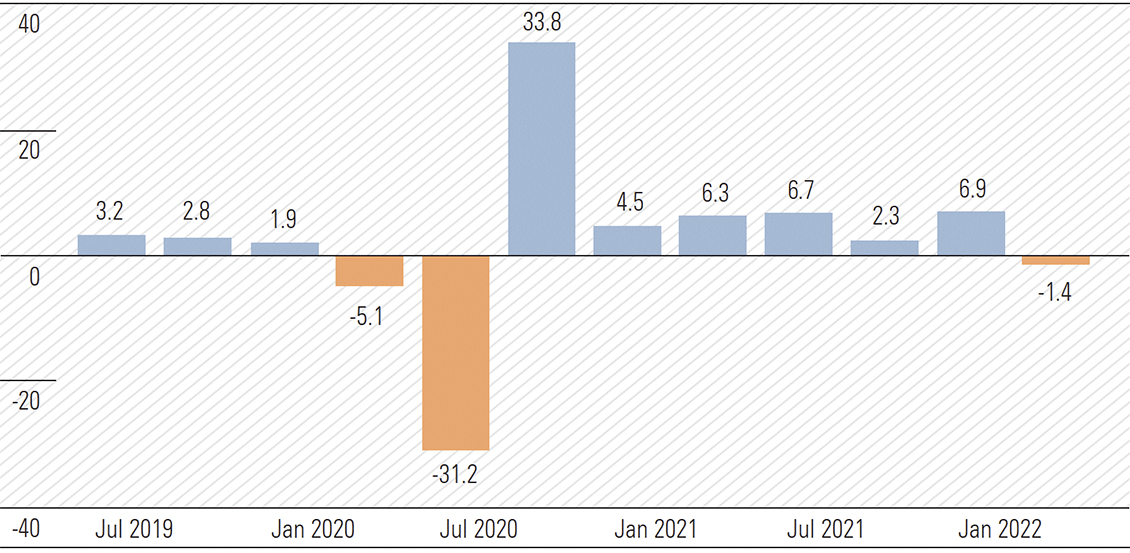

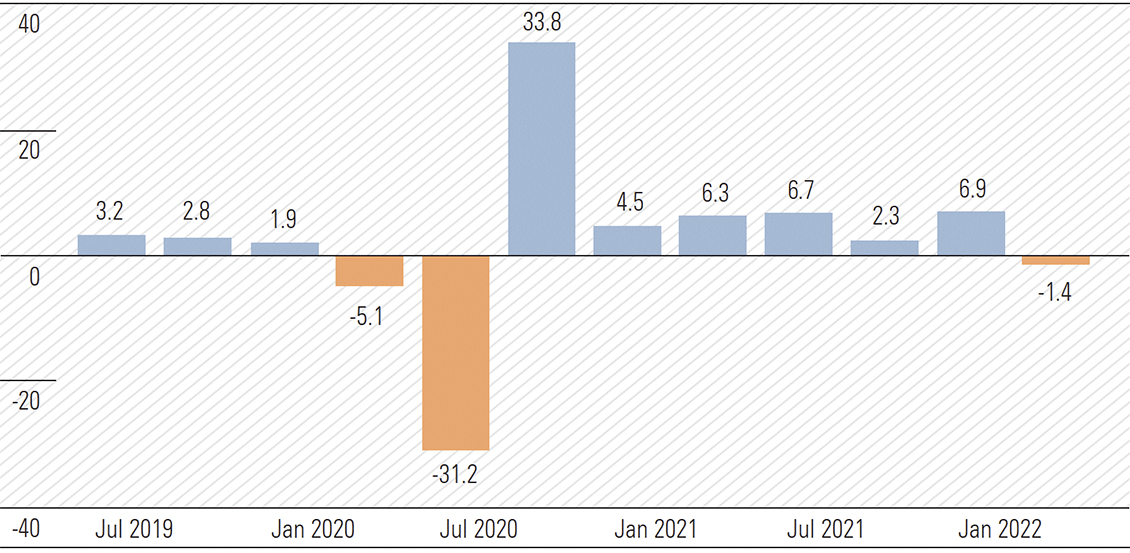

The surprise 1.4% contraction in US GDP (advance estimate) in 1Q22 was met with a yawn. Consensus expectations were for a sharp slowing in growth to 1%, from a very robust 6.9%, in 4Q21 (Exhibit 2). The “second” estimate will be released on 26 May. The reason for the nonchalant market reaction is due to solid annualised growth near 3.5% in real private domestic demand, with consumer spending growing at an annualised rate of 2.7%, residential construction 2.1%, and non-residential construction 9.2%.Exhibit 2: United States GDP growth rate (%)

Source: tradingeconomics.com, U.S. Bureau of Economic Analysis

The major factor behind the contraction is a record goods trade deficit of US$339.2bn for the quarter, which reduced GDP by 3.2%. This is the largest quarterly drag since 3Q20 of 3.3%. The deficit widened by over 20% in the quarter. On a monthly basis, new records were set in January and March. January’s record was US$107.6bn, which narrowed to US$106.6bn in February and then exploded to US$125.3bn in March. The consensus estimate for March was US$105bn.

Both imports and exports reached record levels in March of US$294.6bn (+11.5%) and US$169.3bn (+7.2%), respectively, the former driven by sharp increases in industrial supplies, including petroleum products and consumer goods, including motor vehicles. This reflects the increase in real private domestic demand in the 1Q22 GDP data. The surge in imports occurred in the face of global supply chain disruption and was up almost 27% on March 2021 levels. Will excess inventory be an issue for the 2Q22 GDP read?

Other detractors to 1Q22 GDP were inventories 0.8% and government spending 0.5%.

With US imports now running at a monthly rate near US$300bn, it makes the onshoring task even more imposing. The US Secretary of the Treasury Janet Yellen has suggested US companies “friend-shore” more of their production in response to China’s ambiguous response to Russia’s invasion of Ukraine. The left-field idea is pro deglobalisation, which would see the US and its allies taking greater control over supply chains by shifting trade away from politically non-aligned competitors. In January and February, US imports from China totalled US$90bn.

GDP growth in 2Q22 is also likely to be subdued. The exit rate from 1Q22 was a negative 1% and although we may wish to ignore the impact of net exports, they are an integral part of economic activity and GDP. While private sector demand was underpinned by personal spending, the momentum is likely to wane as the personal savings rate continues to decline.

Source: tradingeconomics.com, U.S. Bureau of Economic Analysis

The major factor behind the contraction is a record goods trade deficit of US$339.2bn for the quarter, which reduced GDP by 3.2%. This is the largest quarterly drag since 3Q20 of 3.3%. The deficit widened by over 20% in the quarter. On a monthly basis, new records were set in January and March. January’s record was US$107.6bn, which narrowed to US$106.6bn in February and then exploded to US$125.3bn in March. The consensus estimate for March was US$105bn.

Both imports and exports reached record levels in March of US$294.6bn (+11.5%) and US$169.3bn (+7.2%), respectively, the former driven by sharp increases in industrial supplies, including petroleum products and consumer goods, including motor vehicles. This reflects the increase in real private domestic demand in the 1Q22 GDP data. The surge in imports occurred in the face of global supply chain disruption and was up almost 27% on March 2021 levels. Will excess inventory be an issue for the 2Q22 GDP read?

Other detractors to 1Q22 GDP were inventories 0.8% and government spending 0.5%.

With US imports now running at a monthly rate near US$300bn, it makes the onshoring task even more imposing. The US Secretary of the Treasury Janet Yellen has suggested US companies “friend-shore” more of their production in response to China’s ambiguous response to Russia’s invasion of Ukraine. The left-field idea is pro deglobalisation, which would see the US and its allies taking greater control over supply chains by shifting trade away from politically non-aligned competitors. In January and February, US imports from China totalled US$90bn.

GDP growth in 2Q22 is also likely to be subdued. The exit rate from 1Q22 was a negative 1% and although we may wish to ignore the impact of net exports, they are an integral part of economic activity and GDP. While private sector demand was underpinned by personal spending, the momentum is likely to wane as the personal savings rate continues to decline.