Asset Flows to Australian Sustainable Investments Slow in First Quarter 2022

The first quarter of 2022 saw sustainable assets under management decline a little, despite net positive flows, largely because of macroeconomic headwinds that included inflationary pressures, rising interest rates, and market volatility. Retail assets invested in Australasian-domiciled sustainable funds as identified by Morningstar totaled AUD 37.988 billion at the end of the first quarter 2022, which was an 8.59% decline from the previous quarter. The recent market conditions have been difficult for sustainable investors. Many sustainable strategies tend to underweight or not hold the energy sector, which has performed well, and they have been negatively impacted by exposure to technology stocks, which have undergone recent downward pricing pressure after a sustained period of strong performance growth. Despite these short-term market challenges, sustainable assets globally have been more resilient when compared with the broader market. This quarterly paper highlights recent trends within sustainable retail investments in Australia.

Key Takeaways

- At the end of first-quarter 2022, assets invested in Australasia-domiciled sustainable investments were AUD 37.988 billion, equating to an 8.59% decrease compared with the quarter ended 31 Dec 2021.

- Whilst net inflows into sustainable funds remained positive, the decline in overall total assets reflects volatile market conditions. The decline in sustainable investments' asset values is not unique to Australasia, similar trends have occurred globally. Despite this difficult quarter, total assets invested sustainably have experienced a 41% increase compared with the first quarter of 2021. Further, assets invested in Australasia-domiciled sustainable investments more than doubled in the two years since 31 March 2020.

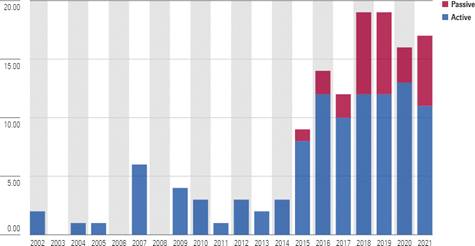

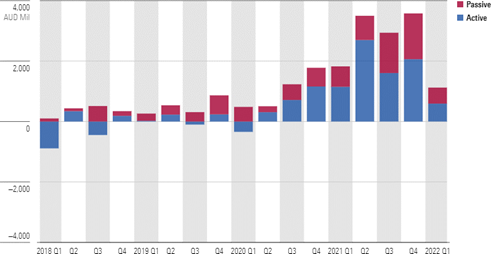

- Estimated first-quarter flows of AUD 1.122 billion were substantially lower than the previous record- breaking quarter, fourth-quarter 2021, equating to 68% less. Whilst flows were positive, weaker inflows are a trend we observed globally this quarter. Despite this, sustainable funds' inflows have held up far better than their conventional peers.

- Fifty-two percent of sustainable investments with five-year track records outperformed their peers within their respective Morningstar Categories. This is encouraging for investors looking to build environmental, social, and governance portfolios that align with their values, knowing that they won't sacrifice returns when compared with investments in mainstream funds.

- In the immediate-term, sustainable funds faced an extremely challenging first quarter, with only 26% of sustainable funds outperforming their peers within their respective categories. Performance of the broader market provides context; the S&P/ASX 200 Resources Index was up 15.4% for first four months of calendar-year 2022, compared with the broader S&P/ASX 200 Industrial Index, which had a performance outcome of negative 2.2%. With the rally in oil and gas prices, the S&P/ASX 200 Energy Index was up 31.8% year to date. Sectors that ESG strategies have traditionally favoured, such as healthcare and technology, performed particularly poorly. The S&P/ASX 200 Healthcare Index was down 8.0% over the same period, and the S&P/ASX 200 Information Technology Index was down 22.7%.

- Sustainable investors should expect short-term fluctuations compared with the broader market as portfolios will tend to have certain structural biases in order to meet their sustainable objectives.

- Morningstar has identified 150 Australasia-domiciled (Australia and New Zealand) sustainable investments through our intentionality framework. Of these, 118 employ some form of exclusion from investment in controversial areas, with a high number of funds excluding tobacco (110) and controversial weapons (103 companies that derive a significant portion of revenue from nuclear weapons, land mines, cluster munitions, and so on).

- Compared with Europe and the United States, the sustainable funds market remains relatively small in Australia. No new funds were launched in the first quarter.

- Six fund houses dominated first-quarter flows, with Dimensional (AUD 333.67 million) atop a group that included Vanguard (AUD 262.95 million), Australian Ethical (AUD 216.47 million), BetaShares (AUD 170 million), Alphinity (AUD 118.03 million), and Nanuk (AUD 97 million). All these fund houses apart from Alphinity and Nanuk have multiple sustainable investment options contributing to total flows.

- When it comes to sustainable investing, active strategies are favoured over passive, although in the first quarter of 2022 the passive/active allocations were more evenly distributed, with 53% of flows going to active sustainable funds. When looking at total assets invested, 70% of assets are invested actively.

- The Australian Securities and Investment Commission has identified climate-related disclosures for listed companies and greenwashing as part of their corporate governance priorities in 2022.

- As stated in a recent global research report "Investing in Times of Climate Change 2022," beyond Europe, China, and the United States, Morningstar categorises all other countries as "rest of world." Australia has the most assets invested in climate-related funds in this rest-of-world category, with USD 2,447 million across 18 funds.

Product Launches

Compared with Europe and the US, the sustainable funds market remains relatively small in Australia. There were no new sustainable funds launched in the first quarter of 2022. However, a total of 17 funds were launched in 2021. As of 31 March 2022, Australasian retail investors had access to 150 Australasia-domiciled sustainable funds.

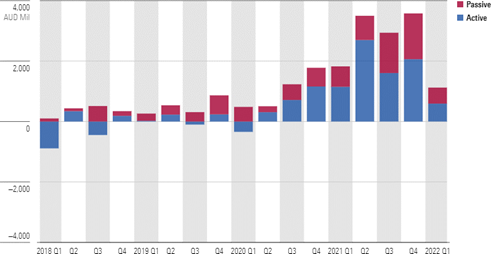

Exhibit 1 Australasia-Domiciled Sustainable Fund and ETF Launches

Source: Morningstar Direct. Data as of 31 March 2022.

Source: Morningstar Direct. Data as of 31 March 2022.

Despite the lack of new funds launched to date in 2022, the momentum of sustainable fund launches has lifted significantly since 2015. Product launches are typically slower during first quarter of the year, and this metric doesn't capture asset managers repurposing and rebranding conventional products into sustainable offerings. Finally, the sustainable funds universe does not contain the growing number of Australasian funds that now formally consider ESG factors in their security selection.

Despite the lack of new funds launched to date in 2022, the momentum of sustainable fund launches has lifted significantly since 2015. Product launches are typically slower during first quarter of the year, and this metric doesn't capture asset managers repurposing and rebranding conventional products into sustainable offerings. Finally, the sustainable funds universe does not contain the growing number of Australasian funds that now formally consider ESG factors in their security selection.

Asset Flows

Exhibit 2 Estimated Net Flows of Australasian Sustainable Investments (AUD, Mi

Source: Morningstar Direct. Data as of 31 March 2022. Excludes funds of funds.

Source: Morningstar Direct. Data as of 31 March 2022. Excludes funds of funds.

Click here to download the

Sustainable Investing Landscape for Australian Fund Investors Q1 2022 report.

Source: Morningstar Direct. Data as of 31 March 2022.

Despite the lack of new funds launched to date in 2022, the momentum of sustainable fund launches has lifted significantly since 2015. Product launches are typically slower during first quarter of the year, and this metric doesn't capture asset managers repurposing and rebranding conventional products into sustainable offerings. Finally, the sustainable funds universe does not contain the growing number of Australasian funds that now formally consider ESG factors in their security selection.

Despite the lack of new funds launched to date in 2022, the momentum of sustainable fund launches has lifted significantly since 2015. Product launches are typically slower during first quarter of the year, and this metric doesn't capture asset managers repurposing and rebranding conventional products into sustainable offerings. Finally, the sustainable funds universe does not contain the growing number of Australasian funds that now formally consider ESG factors in their security selection.

Source: Morningstar Direct. Data as of 31 March 2022.

Despite the lack of new funds launched to date in 2022, the momentum of sustainable fund launches has lifted significantly since 2015. Product launches are typically slower during first quarter of the year, and this metric doesn't capture asset managers repurposing and rebranding conventional products into sustainable offerings. Finally, the sustainable funds universe does not contain the growing number of Australasian funds that now formally consider ESG factors in their security selection.

Despite the lack of new funds launched to date in 2022, the momentum of sustainable fund launches has lifted significantly since 2015. Product launches are typically slower during first quarter of the year, and this metric doesn't capture asset managers repurposing and rebranding conventional products into sustainable offerings. Finally, the sustainable funds universe does not contain the growing number of Australasian funds that now formally consider ESG factors in their security selection.

Source: Morningstar Direct. Data as of 31 March 2022. Excludes funds of funds.

Click here to download the Sustainable Investing Landscape for Australian Fund Investors Q1 2022 report.

Source: Morningstar Direct. Data as of 31 March 2022. Excludes funds of funds.

Click here to download the Sustainable Investing Landscape for Australian Fund Investors Q1 2022 report.