There have been many times in the past 25 years when exposure to the information technology sector has driven strong returns or led to deep losses. It is a volatile sector. At Morningstar, we believe that investing for the long term and diversification are keys to success. The information technology sector exposure can be a potent catalyst for long-term wealth creation, offering the potential for lasting growth and innovation-led returns. The resurgent first quarter of 2023 for the sector has elevated investors’ exuberance for the tech-oriented thematic exchange-traded funds, as these ETFs have rallied so far this year through May 2023. However, investors should be wary of the historical volatility of the sector before jumping on the bandwagon. Notably, when equity markets globally were reeling under worsening macroeconomic conditions in 2022, IT stocks experienced a substantial decline (MSCI World Information Technology Index declined 25% versus a 12% decline for MSCI World Index), underpinning our view that thematic ETFs may not present a prudent and rationale investment case because of the concentration risk and volatility associated with this dynamic sector.

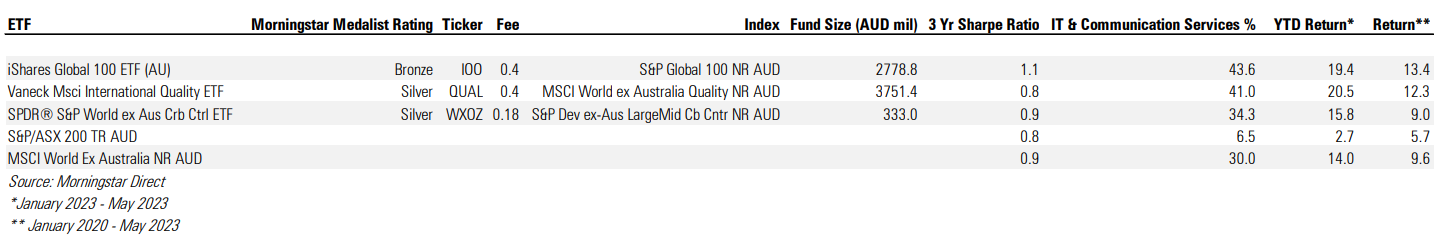

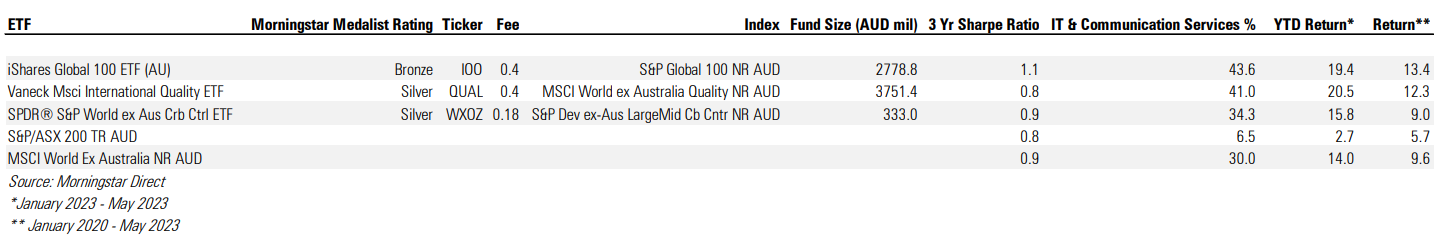

Instead, a more sensible approach to accessing the IT sector is through ETFs with better-diversified portfolios that favour the tech sectors. So, while investors may wish to pursue exposure to the technology sector, we consider doing so as part of an overall global investment strategy. Here are our picks of ETFs that provide significant tech exposure within their diversified portfolios:

These exchange-traded funds earn Morningstar Medalist Ratings of Silver and Bronze.

Let’s start with the Silver-rated VanEck MSCI International Quality ETF (QUAL). For investors seeking exposure to high-quality global equities, including a significant allocation to the tech sector at a competitive fee of 0.40% per year, QUAL is a strong choice. QUAL fully replicates the portfolio of the MSCI World ex-Australia Quality Index. This approach yields a portfolio that has notable differences with the MSCI World ex-Australia Index in two broad areas: It tilts toward more large-cap growth names and has different allocations to sectors and geographies. Technology and healthcare are overweight, while financials are underweight, as their leveraged balance sheets often do not fit the quality parameter of the strategy. We view this composition as sensible for diversifying a typical Australian core equity exposure portfolio, which is dominated by financials and materials stocks.

Our next ETF to highlight is the Bronze-rated iShares Global 100 ETF (IOO). IOO remains a solid choice for Australian investors seeking exposure to global equities. The fund tracks the S&P Global 100 Index, which consists of around 100 large-cap global equities from the S&P Global 1200 Index, maintaining a representative sector mix of the world economy. Allocations within the fund express sector tilt, particularly toward IT. IT and communications services together (around 40%) represent the largest allocation, followed by healthcare (12%), consumer staples (12%), and consumer discretionary (11%).

Finally, it is SPDR S&P World ex Australia Carbon Control ETF WXOZ that makes it to the list of our preferred ETF choices. WXOZ is a suitable option for environmental, social, and governance factor-oriented core global equity exposure, with tech sector inclination. The portfolio has a lower carbon intensity relative to the parent index (S&P Global Large Mid Cap Index) without losing its core features; it has an active share of around 30% and a tracking error ranging between 1.0% and 1.5%. WXOZ is well diversified, with almost 1,000 portfolio constituents, and the sector allocations are largely in line with the parent index. As such, the fund should mirror the parent index performance within a relatively low margin of tracking difference. The sector allocation comprises significant exposure to technology and healthcare—sectors that are underrepresented in the Australian market. All put together, for an increasingly efficient global equity market, WXOZ is an excellent choice considering its price advantage, liquidity, portfolio diversification, and track record of effective implementation. State Street charges just 18 basis points per year for this portfolio, easily making it a compelling ETF in the world large-blend Morningstar Category.

Let’s start with the Silver-rated VanEck MSCI International Quality ETF (QUAL). For investors seeking exposure to high-quality global equities, including a significant allocation to the tech sector at a competitive fee of 0.40% per year, QUAL is a strong choice. QUAL fully replicates the portfolio of the MSCI World ex-Australia Quality Index. This approach yields a portfolio that has notable differences with the MSCI World ex-Australia Index in two broad areas: It tilts toward more large-cap growth names and has different allocations to sectors and geographies. Technology and healthcare are overweight, while financials are underweight, as their leveraged balance sheets often do not fit the quality parameter of the strategy. We view this composition as sensible for diversifying a typical Australian core equity exposure portfolio, which is dominated by financials and materials stocks.

Our next ETF to highlight is the Bronze-rated iShares Global 100 ETF (IOO). IOO remains a solid choice for Australian investors seeking exposure to global equities. The fund tracks the S&P Global 100 Index, which consists of around 100 large-cap global equities from the S&P Global 1200 Index, maintaining a representative sector mix of the world economy. Allocations within the fund express sector tilt, particularly toward IT. IT and communications services together (around 40%) represent the largest allocation, followed by healthcare (12%), consumer staples (12%), and consumer discretionary (11%).

Finally, it is SPDR S&P World ex Australia Carbon Control ETF WXOZ that makes it to the list of our preferred ETF choices. WXOZ is a suitable option for environmental, social, and governance factor-oriented core global equity exposure, with tech sector inclination. The portfolio has a lower carbon intensity relative to the parent index (S&P Global Large Mid Cap Index) without losing its core features; it has an active share of around 30% and a tracking error ranging between 1.0% and 1.5%. WXOZ is well diversified, with almost 1,000 portfolio constituents, and the sector allocations are largely in line with the parent index. As such, the fund should mirror the parent index performance within a relatively low margin of tracking difference. The sector allocation comprises significant exposure to technology and healthcare—sectors that are underrepresented in the Australian market. All put together, for an increasingly efficient global equity market, WXOZ is an excellent choice considering its price advantage, liquidity, portfolio diversification, and track record of effective implementation. State Street charges just 18 basis points per year for this portfolio, easily making it a compelling ETF in the world large-blend Morningstar Category.

- iShares Global 100 ETF

- VanEck MSCI International Quality ETF

- SPDR S&P World ex Aus Carbon Control ETF

Let’s start with the Silver-rated VanEck MSCI International Quality ETF (QUAL). For investors seeking exposure to high-quality global equities, including a significant allocation to the tech sector at a competitive fee of 0.40% per year, QUAL is a strong choice. QUAL fully replicates the portfolio of the MSCI World ex-Australia Quality Index. This approach yields a portfolio that has notable differences with the MSCI World ex-Australia Index in two broad areas: It tilts toward more large-cap growth names and has different allocations to sectors and geographies. Technology and healthcare are overweight, while financials are underweight, as their leveraged balance sheets often do not fit the quality parameter of the strategy. We view this composition as sensible for diversifying a typical Australian core equity exposure portfolio, which is dominated by financials and materials stocks.

Our next ETF to highlight is the Bronze-rated iShares Global 100 ETF (IOO). IOO remains a solid choice for Australian investors seeking exposure to global equities. The fund tracks the S&P Global 100 Index, which consists of around 100 large-cap global equities from the S&P Global 1200 Index, maintaining a representative sector mix of the world economy. Allocations within the fund express sector tilt, particularly toward IT. IT and communications services together (around 40%) represent the largest allocation, followed by healthcare (12%), consumer staples (12%), and consumer discretionary (11%).

Finally, it is SPDR S&P World ex Australia Carbon Control ETF WXOZ that makes it to the list of our preferred ETF choices. WXOZ is a suitable option for environmental, social, and governance factor-oriented core global equity exposure, with tech sector inclination. The portfolio has a lower carbon intensity relative to the parent index (S&P Global Large Mid Cap Index) without losing its core features; it has an active share of around 30% and a tracking error ranging between 1.0% and 1.5%. WXOZ is well diversified, with almost 1,000 portfolio constituents, and the sector allocations are largely in line with the parent index. As such, the fund should mirror the parent index performance within a relatively low margin of tracking difference. The sector allocation comprises significant exposure to technology and healthcare—sectors that are underrepresented in the Australian market. All put together, for an increasingly efficient global equity market, WXOZ is an excellent choice considering its price advantage, liquidity, portfolio diversification, and track record of effective implementation. State Street charges just 18 basis points per year for this portfolio, easily making it a compelling ETF in the world large-blend Morningstar Category.

Let’s start with the Silver-rated VanEck MSCI International Quality ETF (QUAL). For investors seeking exposure to high-quality global equities, including a significant allocation to the tech sector at a competitive fee of 0.40% per year, QUAL is a strong choice. QUAL fully replicates the portfolio of the MSCI World ex-Australia Quality Index. This approach yields a portfolio that has notable differences with the MSCI World ex-Australia Index in two broad areas: It tilts toward more large-cap growth names and has different allocations to sectors and geographies. Technology and healthcare are overweight, while financials are underweight, as their leveraged balance sheets often do not fit the quality parameter of the strategy. We view this composition as sensible for diversifying a typical Australian core equity exposure portfolio, which is dominated by financials and materials stocks.

Our next ETF to highlight is the Bronze-rated iShares Global 100 ETF (IOO). IOO remains a solid choice for Australian investors seeking exposure to global equities. The fund tracks the S&P Global 100 Index, which consists of around 100 large-cap global equities from the S&P Global 1200 Index, maintaining a representative sector mix of the world economy. Allocations within the fund express sector tilt, particularly toward IT. IT and communications services together (around 40%) represent the largest allocation, followed by healthcare (12%), consumer staples (12%), and consumer discretionary (11%).

Finally, it is SPDR S&P World ex Australia Carbon Control ETF WXOZ that makes it to the list of our preferred ETF choices. WXOZ is a suitable option for environmental, social, and governance factor-oriented core global equity exposure, with tech sector inclination. The portfolio has a lower carbon intensity relative to the parent index (S&P Global Large Mid Cap Index) without losing its core features; it has an active share of around 30% and a tracking error ranging between 1.0% and 1.5%. WXOZ is well diversified, with almost 1,000 portfolio constituents, and the sector allocations are largely in line with the parent index. As such, the fund should mirror the parent index performance within a relatively low margin of tracking difference. The sector allocation comprises significant exposure to technology and healthcare—sectors that are underrepresented in the Australian market. All put together, for an increasingly efficient global equity market, WXOZ is an excellent choice considering its price advantage, liquidity, portfolio diversification, and track record of effective implementation. State Street charges just 18 basis points per year for this portfolio, easily making it a compelling ETF in the world large-blend Morningstar Category.