The US economy is proving unexpectedly resistant to interest rate hikes. On a run of stronger economic data, the market now prices less than two US interest rate cuts in 2024. Our Chief US Economist, whose work we will leverage this week, expects the Federal Reserve to make more meaningful cuts over 2024 and 2025. This view is based on a multitude of factors weighing on economic growth, including delayed effects of tight monetary policy, the depletion of excess savings which were built up during the COVID crisis, and a slowdown in government stimulus as state and local surpluses are spent. But if consensus prevails and rates stay higher for longer, a recession in the US is possible.

Conventional wisdom says a weakening US economy portends a shock in Australia. But experience in recent decades suggests we may not need to accept this as given. Australia’s fiscal capacity, the Reserve Bank’s flexibility to cut rates before the Fed, and the possibility of stimulus from China may provide our economy with some insulation from global turbulence. The US matters greatly for global financial flows, but for direct trade, not so much, particularly in Australia where China is far more important.

Source: Westpac, Morningstar

Our Chief US Economist identifies four factors driving the paradoxical immunity to higher rates:

Source: Westpac, Morningstar

Our Chief US Economist identifies four factors driving the paradoxical immunity to higher rates:

Source: Board of Governors of the Federal Reserve System, Morningstar.

It’s also hard to overlook the immense fiscal stimulus, with the US government running a deficit close to 6% of GDP, around twice the pre-pandemic average.

Source: Board of Governors of the Federal Reserve System, Morningstar.

It’s also hard to overlook the immense fiscal stimulus, with the US government running a deficit close to 6% of GDP, around twice the pre-pandemic average.

Source: Australian Bureau of Statistics, Bureau of Economic Analysis, Morningstar.

But what caused the decoupling of US and Australian growth in the 2000s? And could these forces again shield our economy from turbulence in the US?

Source: Australian Bureau of Statistics, Bureau of Economic Analysis, Morningstar.

But what caused the decoupling of US and Australian growth in the 2000s? And could these forces again shield our economy from turbulence in the US?

Source: Reserve Bank of Australia, Federal Open Market Committee, Morningstar.

Source: Reserve Bank of Australia, Federal Open Market Committee, Morningstar.

Understanding the US interest-rate paradox

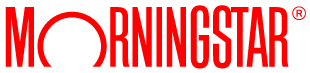

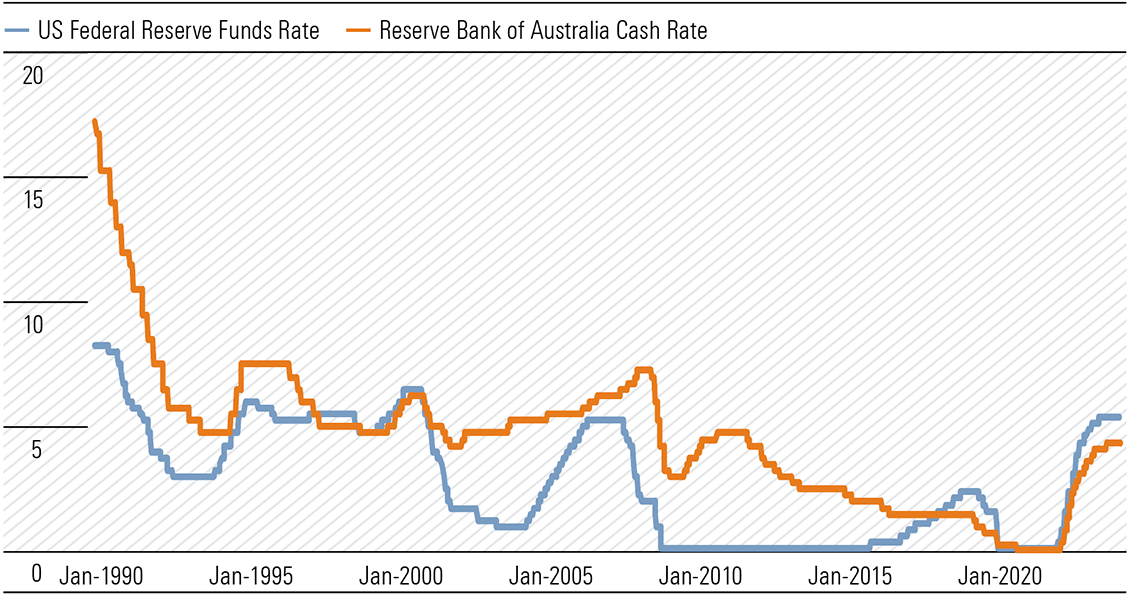

Not so long ago, many in the market were calling a US recession in 2023. From March 2022 to July 2023, the US Federal Reserve increased the federal funds rate by 5.25 percentage points, the largest and fastest rate hike cycle in 40 years. Given the Fed’s track record of ‘hard landings’, particularly during the inflation wars of the 1970s and 1980s, it seemed reasonable to assume rates would again be pushed too far, culminating in a sharp economic contraction. But we wound up with the opposite problem. Unexpectedly, US real gross domestic product growth accelerated to 2.5% in 2023 from 1.9% in 2022. And at the start of 2024, a stronger-than-expected run of economic data has unsettled markets. The concern is if inflation proves stickier than expected, near-term interest rate cuts will be delayed and shallower. (Exhibit 1) And if markets have optimistically priced in larger cuts sooner, there’s a risk asset prices will fall, particularly for interest rate sensitive industries.Exhibit 1: Market’s US rate forecast revised up on stronger economic data (%)

Source: Westpac, Morningstar

Our Chief US Economist identifies four factors driving the paradoxical immunity to higher rates:

Source: Westpac, Morningstar

Our Chief US Economist identifies four factors driving the paradoxical immunity to higher rates:

- Households accumulated excess savings during the pandemic and businesses boosted cash holdings, which are now being spent.

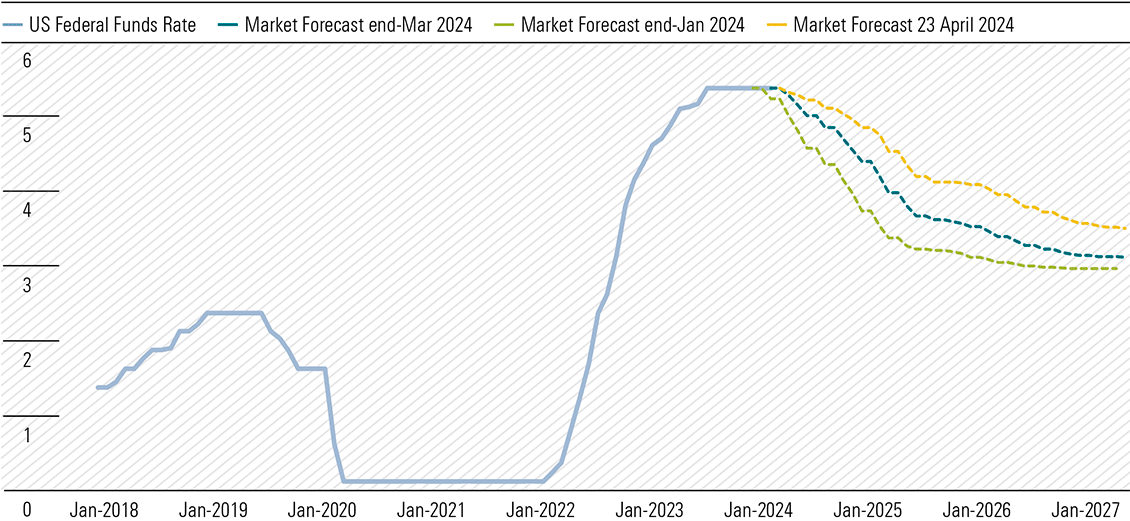

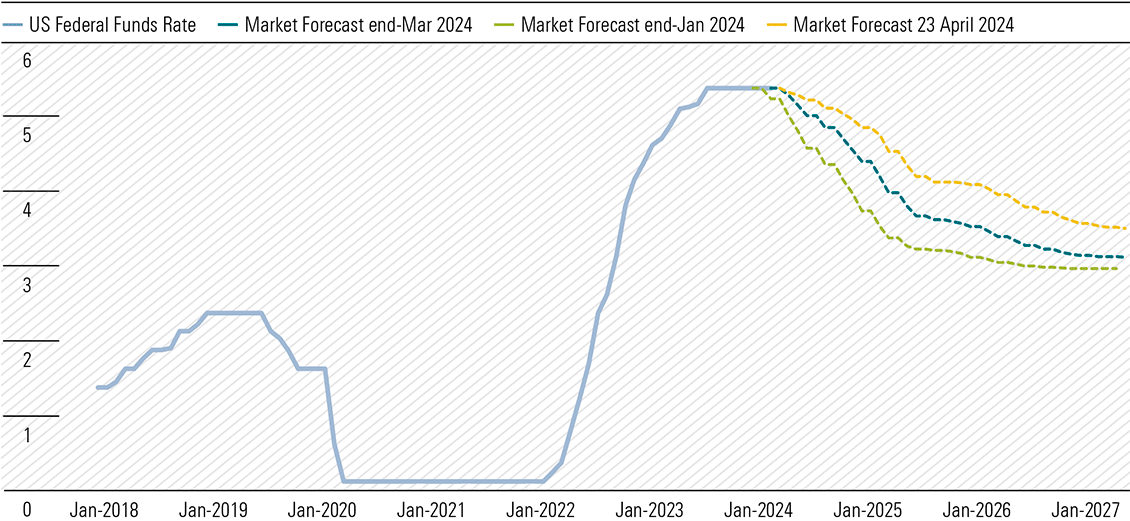

- Many borrowers are locked into low rates, including fixed rate mortgages and corporate bonds. The interest burden remains low for the private nonfinancial sector. (Exhibit 2)

- Risky asset prices held firm, causing risk premia to compress. Resilient asset prices have supported consumption through the wealth effect.

- The reduction of risky shadow banking activities has rendered the financial system less vulnerable to shocks.

Exhibit 2: Household interest burden not overwhelming by historical standards (%)

Source: Board of Governors of the Federal Reserve System, Morningstar.

It’s also hard to overlook the immense fiscal stimulus, with the US government running a deficit close to 6% of GDP, around twice the pre-pandemic average.

Source: Board of Governors of the Federal Reserve System, Morningstar.

It’s also hard to overlook the immense fiscal stimulus, with the US government running a deficit close to 6% of GDP, around twice the pre-pandemic average.

What does the paradox mean for US interest rates?

Our central case for the US economy could be characterised as a ‘soft landing’. We think growth will weaken and inflation will return to target in the near- to medium-term, providing scope for greater rate cuts than the market expects. But if Fed cuts are very modest over the next two years, as some forecasters expect, we think the risk of a US recession increases. We think private sector finances will struggle to withstand a material and permanent increase in rates above pre-pandemic levels. Balance sheets are too large and asset prices too high to be compatible with a new normal of higher rates. If the Fed holds rates high for too long, a recession could be on the cards. While it’s not our central case, it is worth considering what might happen in Australia if the ‘higher for longer’ scenario prevails, and a US recession ensues.How might a US recession affect Australia?

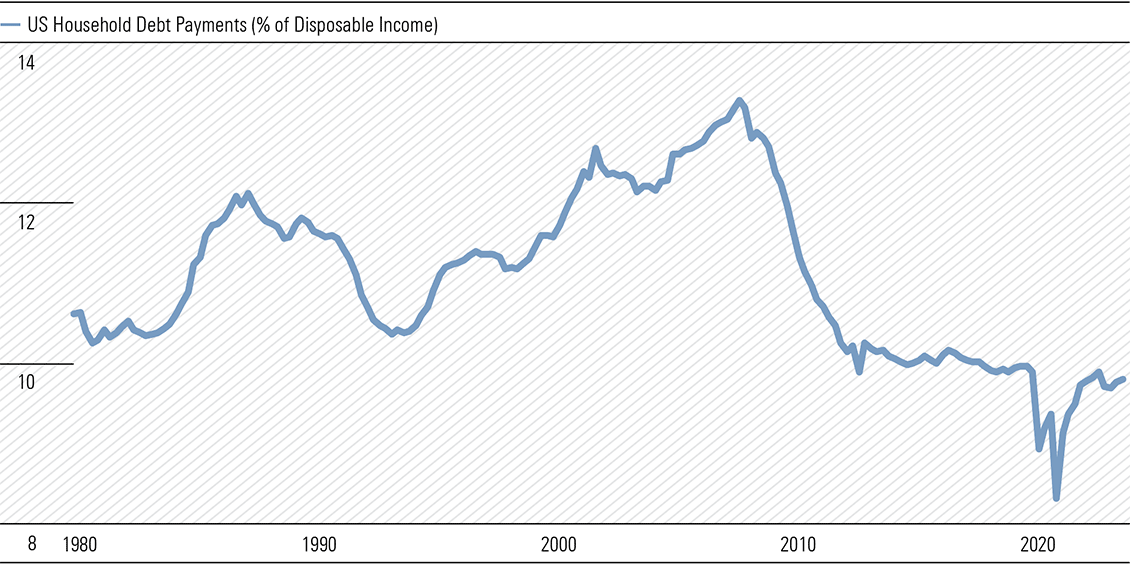

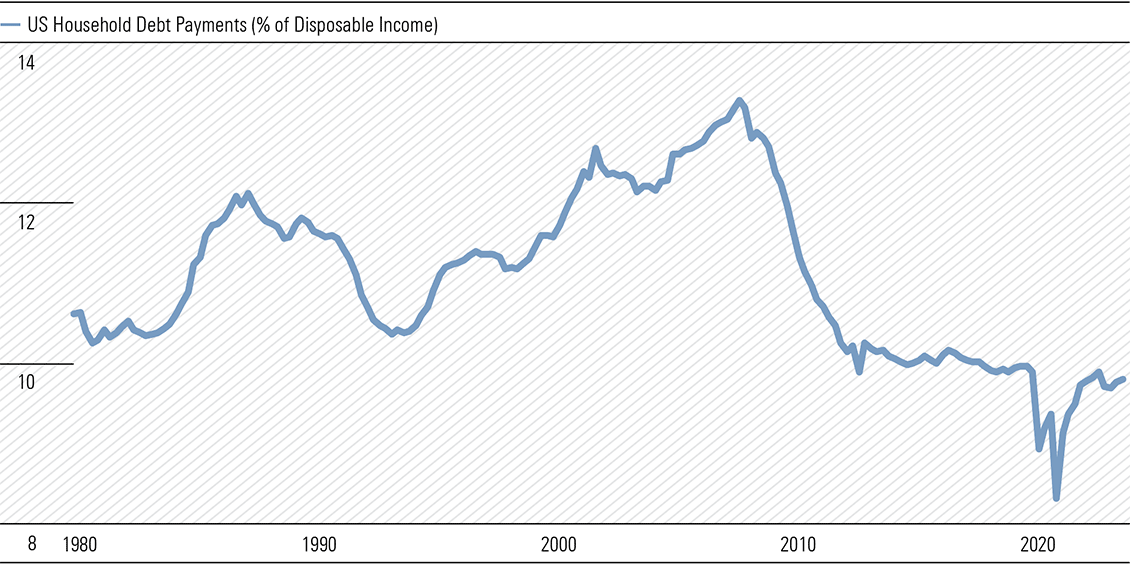

From the start of the post-war period to the end of the 20th Century, Australia’s economic performance closely correlated with the US business cycle. In particular, three deep recessions—in the mid-1970s, the early 1980s and early 1990s—were felt across both. When the US sneezed, we caught a cold. But since the early 2000s, this relationship has become more tenuous. Australia ducked recession after the dotcom bubble, and again in the global financial crisis. When we look at the historical correlation between Australian and US growth, we observe a steady increase from 1970. At the peak in 2000, growth between the two economies was almost perfectly correlated. But this subsequently weakened significantly, aside from the more recent synchronised shock of the pandemic. (Exhibit 3)Exhibit 3: Correlation between Australian and US growth weakened from early 2000s

Source: Australian Bureau of Statistics, Bureau of Economic Analysis, Morningstar.

But what caused the decoupling of US and Australian growth in the 2000s? And could these forces again shield our economy from turbulence in the US?

Source: Australian Bureau of Statistics, Bureau of Economic Analysis, Morningstar.

But what caused the decoupling of US and Australian growth in the 2000s? And could these forces again shield our economy from turbulence in the US?

China

The rise of China underpinned Australia’s economic prosperity in the decades leading up the pandemic. In particular, China’s immense stimulus program after the financial crisis, which saw around AUD 900 billion, or 11% of China’s annual GDP, spent on social welfare and infrastructure in 2009 and 2010, supercharged demand for Australia’s resources. Tourism and education were also significant sources of income. China is still ambitious, targeting 5% GDP growth in 2024. But it is unclear if authorities have the appetite, or capacity, for another big round of stimulus. Further, future public spending is unlikely to be focused on resource-intensive infrastructure and housing. This means Australia might miss out on much of the indirect support created by Chinese stimulus.Australia’s fiscal firepower

Australia’s robust fiscal position affords meaningful downside protection. While the US deficit is much higher than its long-run average, the Australian government has tightened its purse strings to repair the budget. From an AUD 134 billion cash deficit in fiscal 2020–21, more than 6% of GDP, the Commonwealth realised a surplus of AUD 22 billion in 2022–23, largely a function of higher commodity prices and income tax receipts. The treasurer has flagged we won’t see ‘big cash splashes’ in the upcoming May budget, as the government keeps its fiscal powder dry for the election year or a deteriorating global economy.Australia’s Reserve Bank is not bound to US Federal Reserve policy

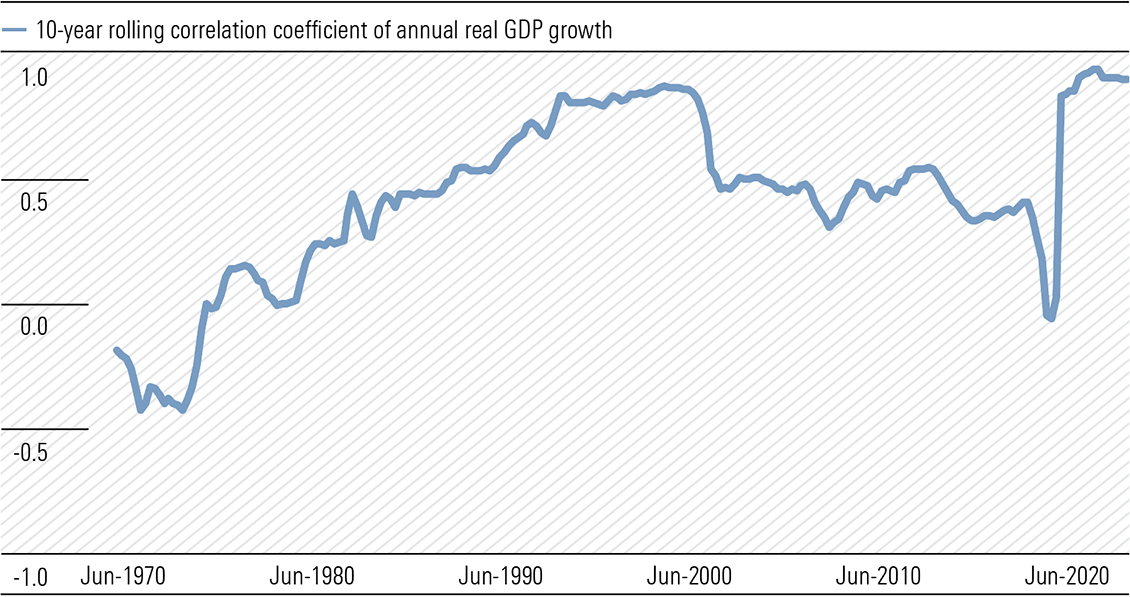

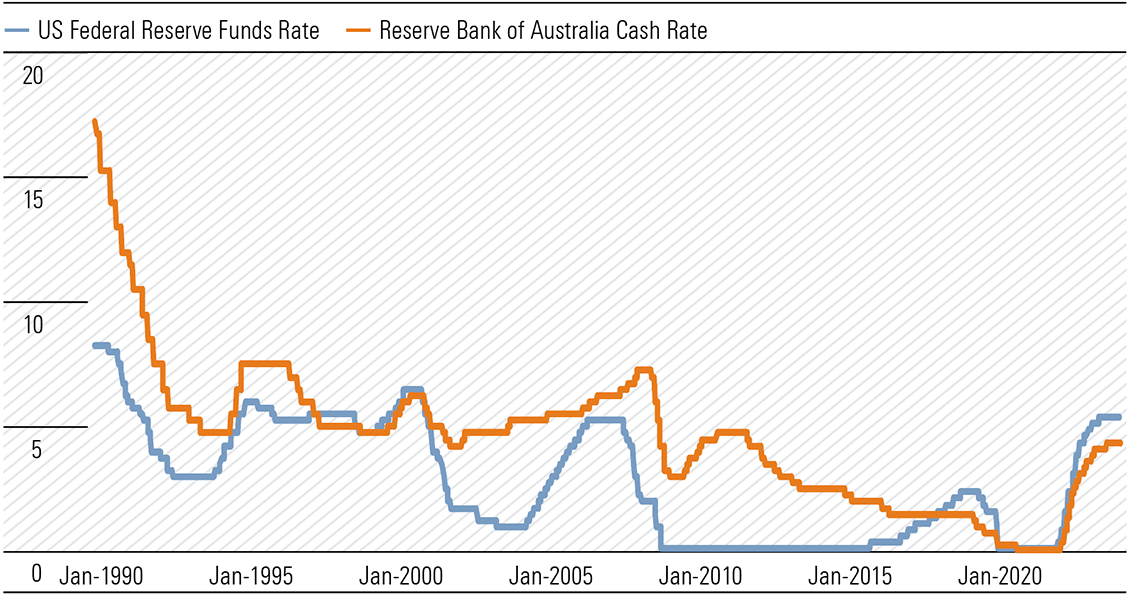

Research from the Reserve Bank suggests our historical correlation with the US business cycle was largely due to synchronised high interest rates, which triggered major recessions in the latter half of the 20th Century. But in recent years, the Reserve Bank has shown it does not necessarily follow the Federal Reserve. For example, between 2015 and 2018, the Reserve Bank cut rates while the Fed aggressively hiked. (Exhibit 4) So, if we see evidence our economy is cooling, the Reserve Bank may begin easing ahead of the Fed to manage the risk of a recession here.Exhibit 4: Australian and US policy rates share a trend but the RBA can move independently (%)

Source: Reserve Bank of Australia, Federal Open Market Committee, Morningstar.

Source: Reserve Bank of Australia, Federal Open Market Committee, Morningstar.