Globally the vaccine rollout continues, with an accompanying drop in infections, and recovery in oil demand. Each week oil inventories have declined further pushing prices higher. Brent crude currently sits near US$75 per barrel, a circa 10% increase on a month ago. Generally, we expect the dynamic to continue for the next 18 months with steadily increasing demand allowing for a gradual return of OPEC+ volumes and some US growth.

The latter is likely to limit oil price appreciation in the longer-term. A major risk to energy demand is that emerging markets vaccination rates lag, which might hinder demand growth. Also, increasing Delta variant infections could slow the US and European recoveries. However, outside of a delayed full reopening in the UK, no material setback has yet occurred. Also, vaccines are largely effective in preventing severe illness or hospitalisation.

On the supply side, an accelerated return of Iran volumes would pose a risk, but we still see the situation as manageable. As such, supply/demand dynamics support current price levels for the near-term. Longer-term our midcycle Brent crude price forecast remains US$60 per barrel from 2023. This remains the sweet spot in our opinion, sufficient incentive to drive the investment required for supply to meet demand, without overstimulating US shale production, which would lead to oversupply.

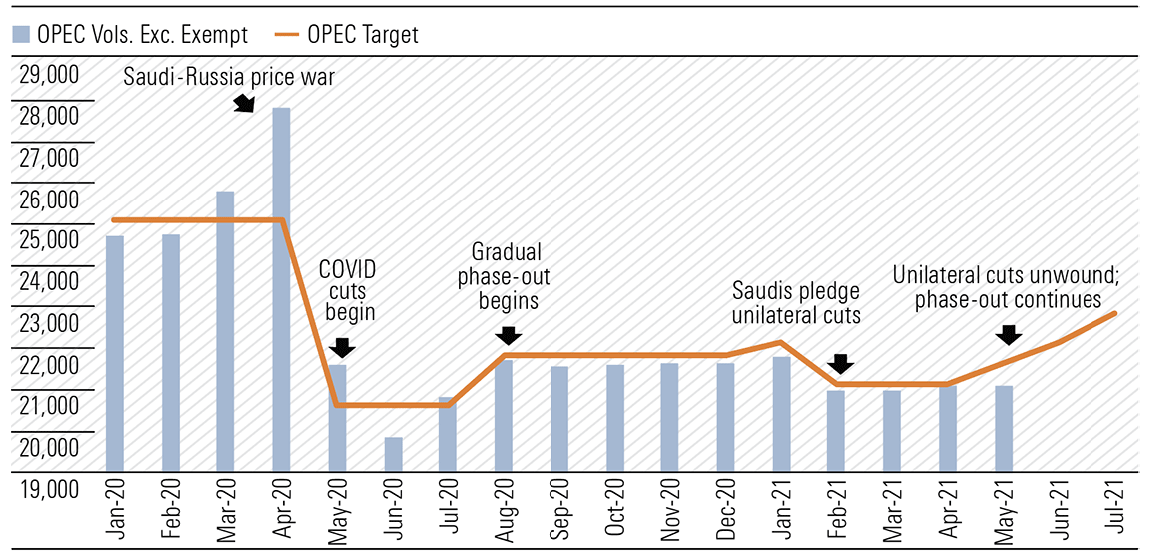

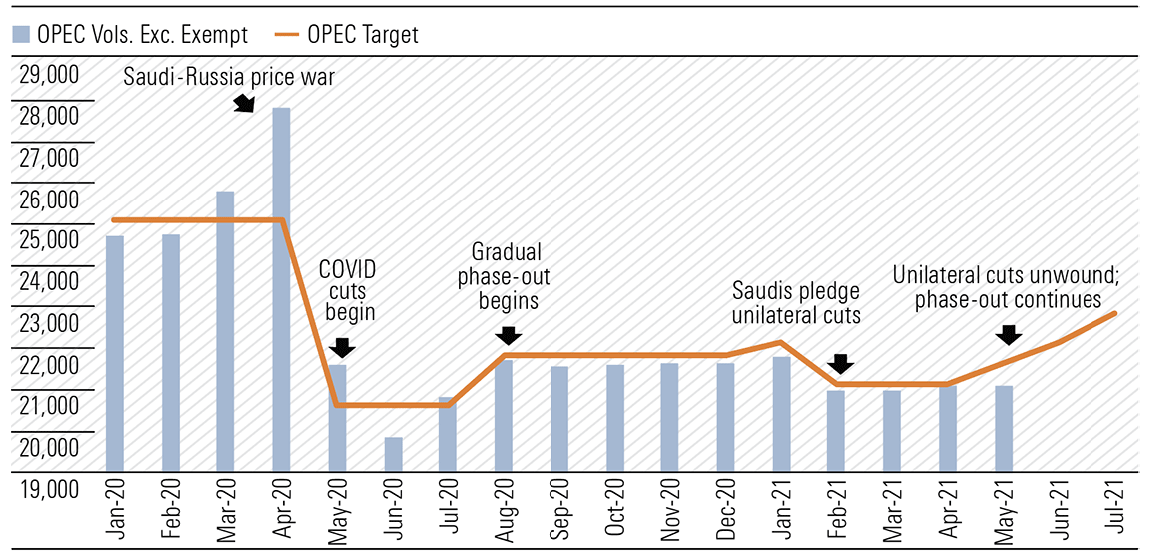

The global vaccine rollout means we still expect global crude consumption to exceed 2019 levels by 2022 at 100.4 million barrels per day (mmb/d) rising to 103.7 mmb/d by 2025, growing in lockstep with economic recovery. OPEC is going forward with planned additions of 450 thousand barrels per day in July and has marginally increased its 2021 estimate of world oil demand to 96.6 mmb/d. The cartel’s production total is just above 21.0 mmb/d, and we forecast an incremental 1.6 mmb/d and 4.6 mmb/d, respectively, in 2021 and 2022 from OPEC+. Ongoing sanctions on Iran are suppressing its output by around 2 mmb/d, and recent elections there have not necessarily made the path forward clearer. But with both sides of the table fatigued and indicating a willingness to resolve matters soon, we would expect production to be back online within the next couple of years.

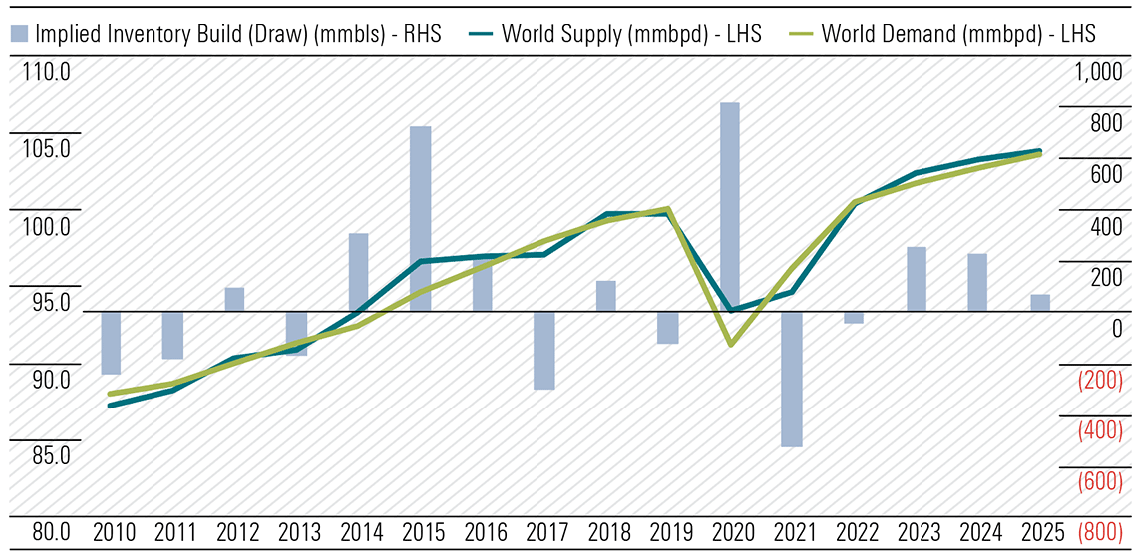

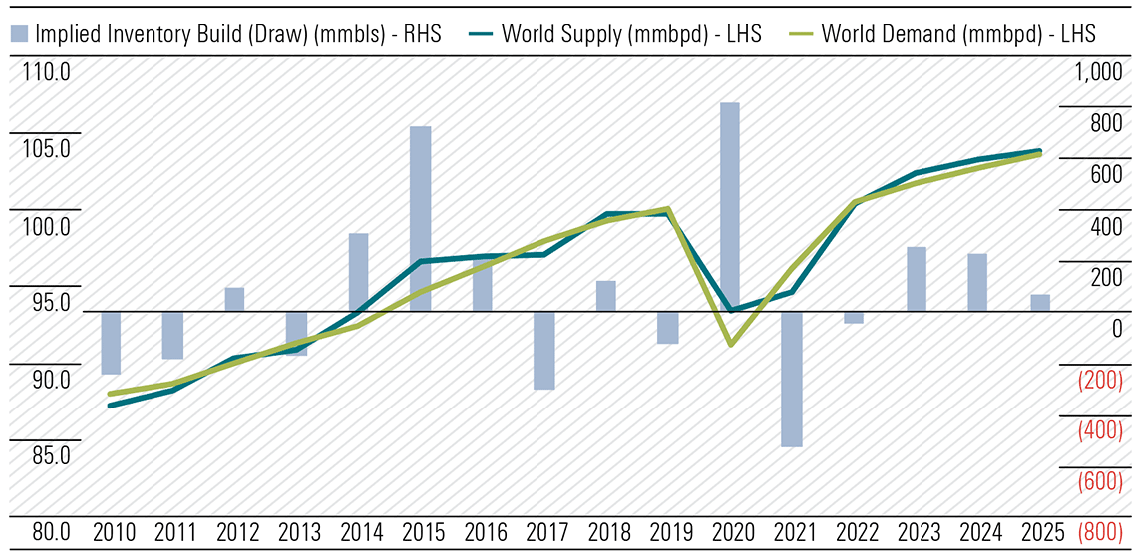

Our global supply estimate for 2021 is 94.7 mmb/d, previously 95.1 mmb/d. Inventories should normalise rapidly (see Exhibit 1) as global supply falls 1.5 mmb/d short of demand in 2021. The market remains tight, with swing producers, OPEC+ and US shale, reluctant to bring additional capacity online to cope with near-term shortfalls. But by 2022 we would expect more substantial expansion of OPEC+ volumes and more U.S. growth, cumulatively adding around 5.6 mmb/d to global production. This is in keeping with our anticipation for pull-back in pricing to our midcycle target.

Exhibit 1: Global liquids supply and demand

Source:IEA, EIA, OPEC, Morningstar. Data as of June 24, 2021.

Exhibit 2: OPEC production vs. agreed target (mbpd)

Source:IEA, EIA, OPEC, Morningstar. Data as of June 24, 2021.

Exhibit 2: OPEC production vs. agreed target (mbpd)

Source: OPEC, Reuters, Morningstar. Data as of June 25, 2021.

Domestic counters

Refining market conditions are far from back to normal, but they are getting closer. Inventory levels continue to fall while utilisation rates creep higher. In conjunction with the Federal Government’s 1.8 cent per litre Fuel Security Service Payment, investors have taken note and pushed shares closer to our fair value estimates. Viva Energy (ASX:VEA) remains somewhat undervalued in four-star territory, while Ampol (ASX:ALD) is fairly valued at three-stars.

But the equity market has not incorporated higher prices to the same extent into the upstream names, and despite recent share price rises value remains on offer across the board. Five-star rated Woodside (ASX:WPL) and Beach Energy (ASX:BPT) are cheapest, but Santos (ASX:STO) and Oil Search (ASX:OSH) at four-stars also retain appeal. STO recently began front end engineering and design work for its Dorado oil project, offshore WA. Dorado has the potential to be a prolific oil producer and free cash generator for the company. Meanwhile WPL continues to progress its potentially transformative Scarborough LNG development with long lead items recently delivered.

At nearly US$14 per million British thermal units (mmBtu) spot LNG prices are up more than four-fold versus US$2.60/mmBtu levels prevailing this time a year ago. And the implied contract price referenced to the current Brent crude price is a healthy US$10.80/mmBtu. These sharp rises are in stark contrast to the market’s hitherto comparatively muted reaction in WPL shares for example. Australian E&P earnings are heavily LNG-reliant in general, with WPL probably the most leveraged, particularly to spot pricing.

Mark Taylor, is an equity analyst at Morningstar. Any Morningstar ratings/recommendations contained in this report are based on the full research report available from Morningstar.

Source: OPEC, Reuters, Morningstar. Data as of June 25, 2021.

Domestic counters

Refining market conditions are far from back to normal, but they are getting closer. Inventory levels continue to fall while utilisation rates creep higher. In conjunction with the Federal Government’s 1.8 cent per litre Fuel Security Service Payment, investors have taken note and pushed shares closer to our fair value estimates. Viva Energy (ASX:VEA) remains somewhat undervalued in four-star territory, while Ampol (ASX:ALD) is fairly valued at three-stars.

But the equity market has not incorporated higher prices to the same extent into the upstream names, and despite recent share price rises value remains on offer across the board. Five-star rated Woodside (ASX:WPL) and Beach Energy (ASX:BPT) are cheapest, but Santos (ASX:STO) and Oil Search (ASX:OSH) at four-stars also retain appeal. STO recently began front end engineering and design work for its Dorado oil project, offshore WA. Dorado has the potential to be a prolific oil producer and free cash generator for the company. Meanwhile WPL continues to progress its potentially transformative Scarborough LNG development with long lead items recently delivered.

At nearly US$14 per million British thermal units (mmBtu) spot LNG prices are up more than four-fold versus US$2.60/mmBtu levels prevailing this time a year ago. And the implied contract price referenced to the current Brent crude price is a healthy US$10.80/mmBtu. These sharp rises are in stark contrast to the market’s hitherto comparatively muted reaction in WPL shares for example. Australian E&P earnings are heavily LNG-reliant in general, with WPL probably the most leveraged, particularly to spot pricing.

Mark Taylor, is an equity analyst at Morningstar. Any Morningstar ratings/recommendations contained in this report are based on the full research report available from Morningstar.

Source:IEA, EIA, OPEC, Morningstar. Data as of June 24, 2021.

Exhibit 2: OPEC production vs. agreed target (mbpd)

Source:IEA, EIA, OPEC, Morningstar. Data as of June 24, 2021.

Exhibit 2: OPEC production vs. agreed target (mbpd)

Source: OPEC, Reuters, Morningstar. Data as of June 25, 2021.

Domestic counters

Refining market conditions are far from back to normal, but they are getting closer. Inventory levels continue to fall while utilisation rates creep higher. In conjunction with the Federal Government’s 1.8 cent per litre Fuel Security Service Payment, investors have taken note and pushed shares closer to our fair value estimates. Viva Energy (ASX:VEA) remains somewhat undervalued in four-star territory, while Ampol (ASX:ALD) is fairly valued at three-stars.

But the equity market has not incorporated higher prices to the same extent into the upstream names, and despite recent share price rises value remains on offer across the board. Five-star rated Woodside (ASX:WPL) and Beach Energy (ASX:BPT) are cheapest, but Santos (ASX:STO) and Oil Search (ASX:OSH) at four-stars also retain appeal. STO recently began front end engineering and design work for its Dorado oil project, offshore WA. Dorado has the potential to be a prolific oil producer and free cash generator for the company. Meanwhile WPL continues to progress its potentially transformative Scarborough LNG development with long lead items recently delivered.

At nearly US$14 per million British thermal units (mmBtu) spot LNG prices are up more than four-fold versus US$2.60/mmBtu levels prevailing this time a year ago. And the implied contract price referenced to the current Brent crude price is a healthy US$10.80/mmBtu. These sharp rises are in stark contrast to the market’s hitherto comparatively muted reaction in WPL shares for example. Australian E&P earnings are heavily LNG-reliant in general, with WPL probably the most leveraged, particularly to spot pricing.

Mark Taylor, is an equity analyst at Morningstar. Any Morningstar ratings/recommendations contained in this report are based on the full research report available from Morningstar.

Source: OPEC, Reuters, Morningstar. Data as of June 25, 2021.

Domestic counters

Refining market conditions are far from back to normal, but they are getting closer. Inventory levels continue to fall while utilisation rates creep higher. In conjunction with the Federal Government’s 1.8 cent per litre Fuel Security Service Payment, investors have taken note and pushed shares closer to our fair value estimates. Viva Energy (ASX:VEA) remains somewhat undervalued in four-star territory, while Ampol (ASX:ALD) is fairly valued at three-stars.

But the equity market has not incorporated higher prices to the same extent into the upstream names, and despite recent share price rises value remains on offer across the board. Five-star rated Woodside (ASX:WPL) and Beach Energy (ASX:BPT) are cheapest, but Santos (ASX:STO) and Oil Search (ASX:OSH) at four-stars also retain appeal. STO recently began front end engineering and design work for its Dorado oil project, offshore WA. Dorado has the potential to be a prolific oil producer and free cash generator for the company. Meanwhile WPL continues to progress its potentially transformative Scarborough LNG development with long lead items recently delivered.

At nearly US$14 per million British thermal units (mmBtu) spot LNG prices are up more than four-fold versus US$2.60/mmBtu levels prevailing this time a year ago. And the implied contract price referenced to the current Brent crude price is a healthy US$10.80/mmBtu. These sharp rises are in stark contrast to the market’s hitherto comparatively muted reaction in WPL shares for example. Australian E&P earnings are heavily LNG-reliant in general, with WPL probably the most leveraged, particularly to spot pricing.

Mark Taylor, is an equity analyst at Morningstar. Any Morningstar ratings/recommendations contained in this report are based on the full research report available from Morningstar.