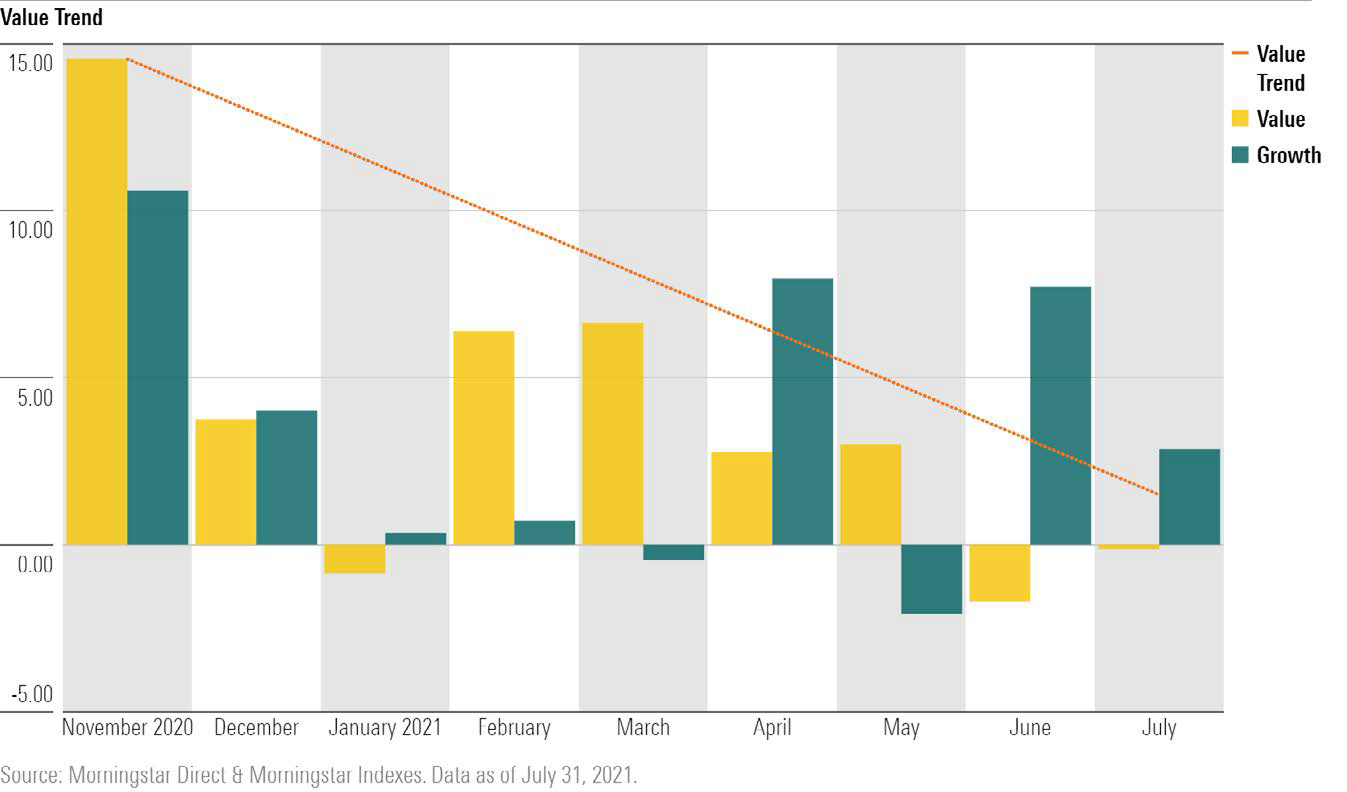

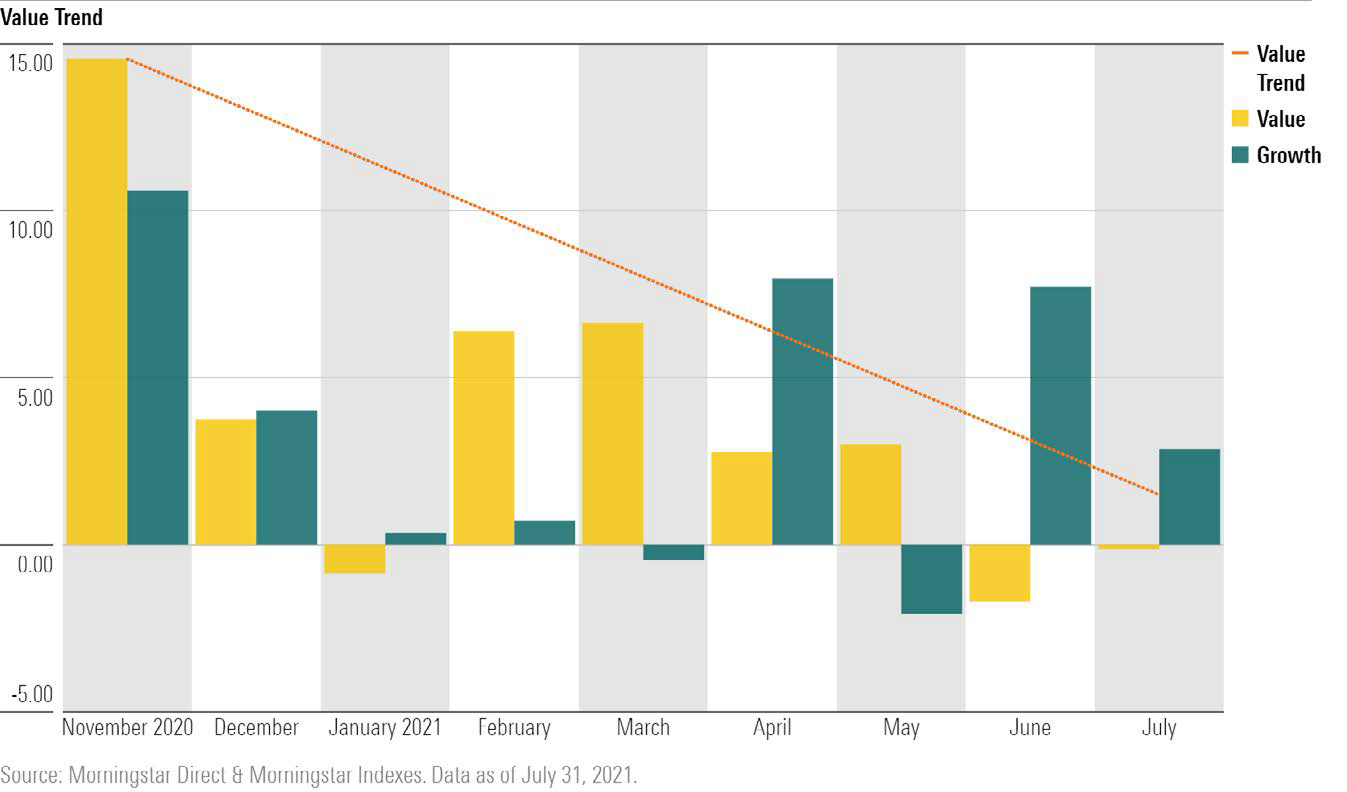

Markets have been hitting record highs. But over the past few months, the value stocks that led the US equity market since late 2020 have been losing steam.

Here’s a look at the monthly returns of the Morningstar US Growth and Value indexes, which helps to visualize the trend.

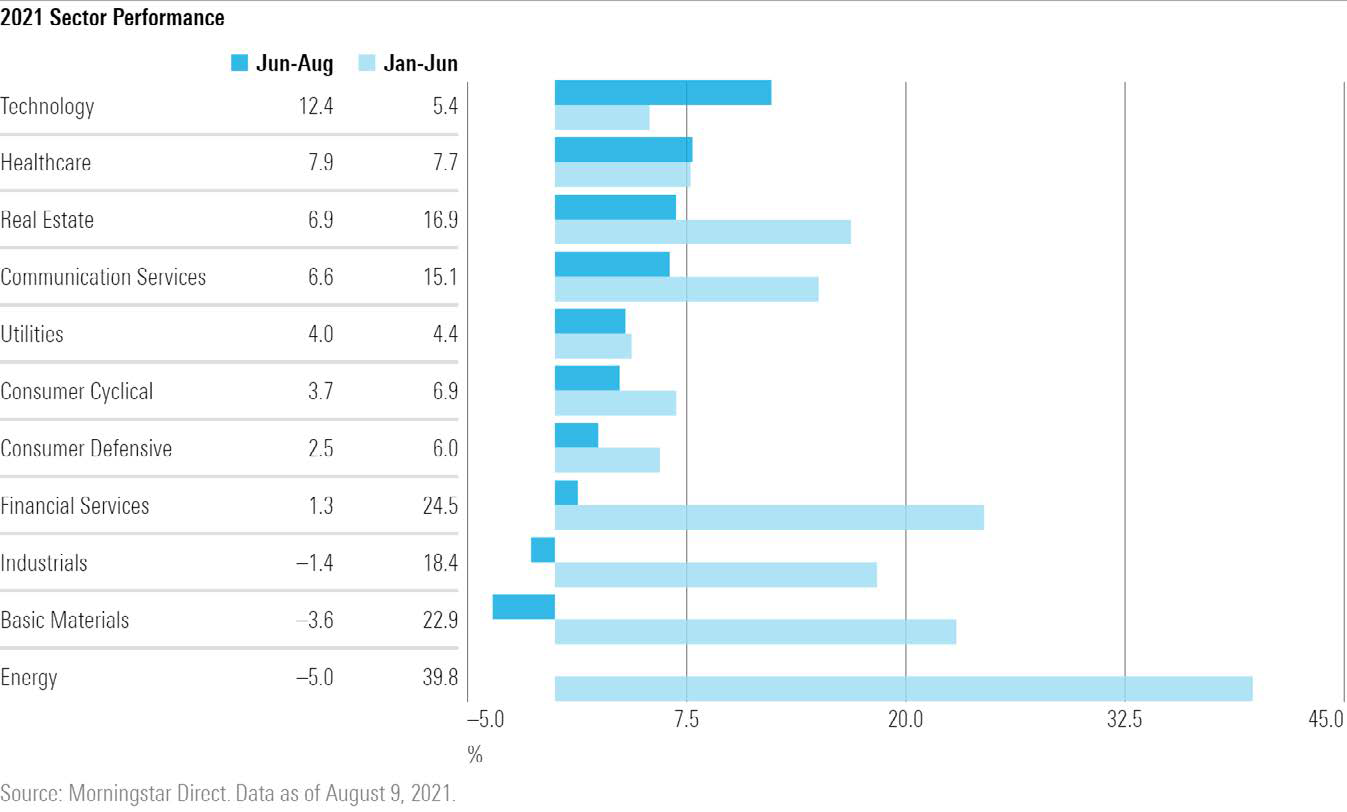

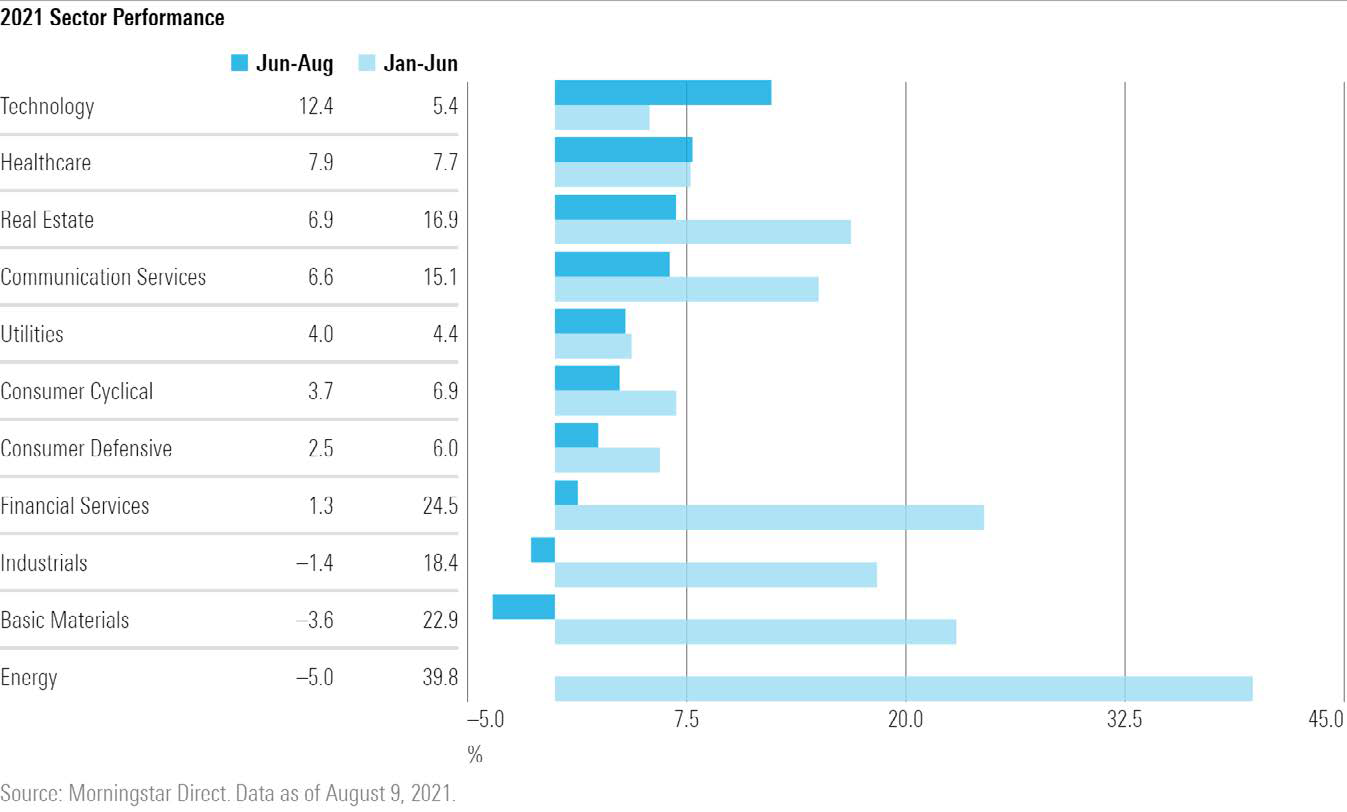

What we’ve seen since the beginning of June is that tech stocks are back on top. Technology is the highest-performing sector in the US market, up 12.4% since June 1, 2021. Energy, which formerly led the market with growth near 40% as of May this year, has tanked. The sector is down 5% since June.

What we’ve seen since the beginning of June is that tech stocks are back on top. Technology is the highest-performing sector in the US market, up 12.4% since June 1, 2021. Energy, which formerly led the market with growth near 40% as of May this year, has tanked. The sector is down 5% since June.

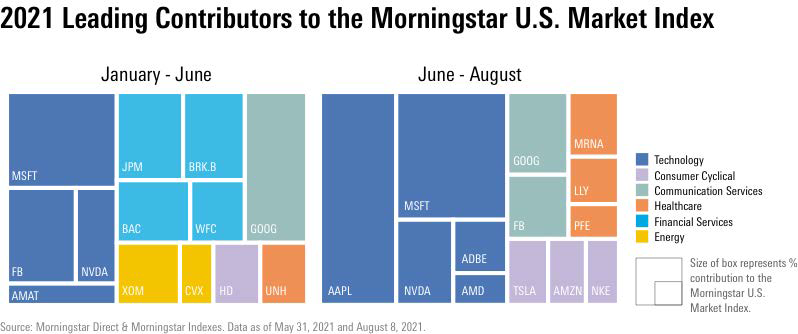

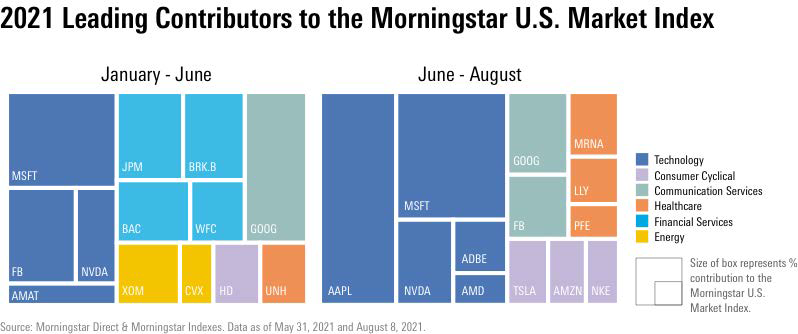

For the year to date, the top five contributors to the US equity market are all technology companies and heavy-hitter names from the FAANGs: Facebook (FB), Amazon.com (AMZN), Apple (AAPL), Netflix (NFLX), Google (GOOGL).

For the year to date, the top five contributors to the US equity market are all technology companies and heavy-hitter names from the FAANGs: Facebook (FB), Amazon.com (AMZN), Apple (AAPL), Netflix (NFLX), Google (GOOGL).

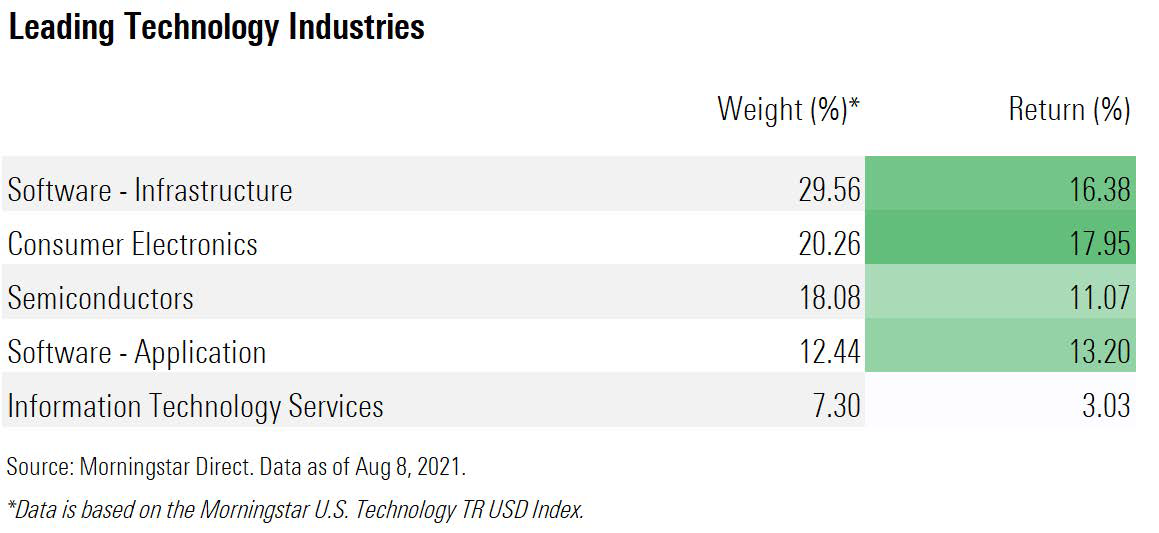

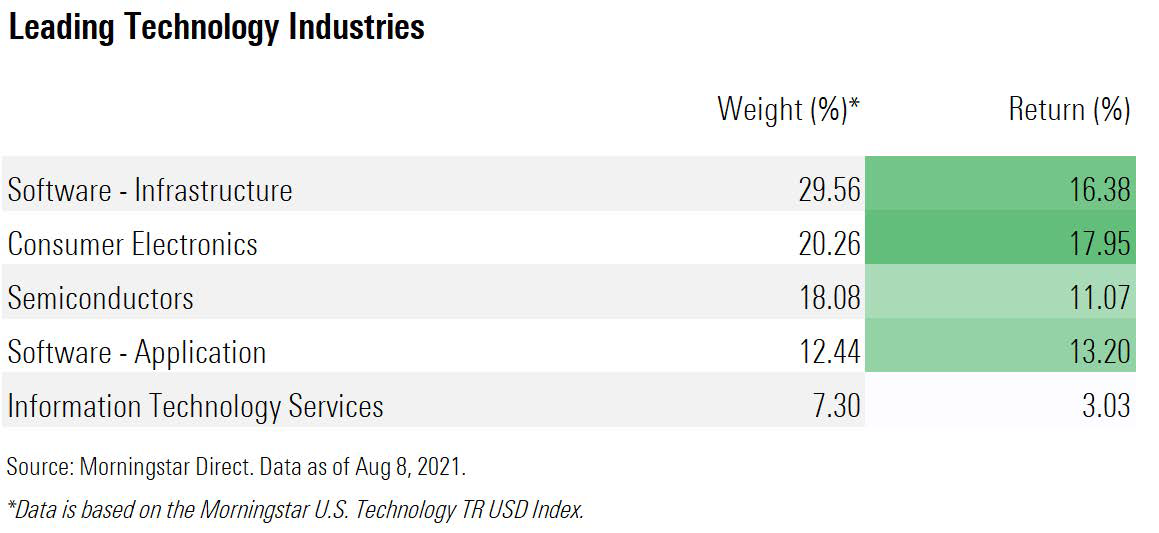

Within the technology space, leading industries include software infrastructure and applications, consumer electronics, and semiconductors.

Within the technology space, leading industries include software infrastructure and applications, consumer electronics, and semiconductors.

With technology picking up speed, the composition of the top of the market is changing. From January through May, technology companies contributed to 1.3% of the Morningstar US Market’s total return. Since June, they’ve contributed 2.9%, more than doubling their slice of the pie.

With technology picking up speed, the composition of the top of the market is changing. From January through May, technology companies contributed to 1.3% of the Morningstar US Market’s total return. Since June, they’ve contributed 2.9%, more than doubling their slice of the pie.

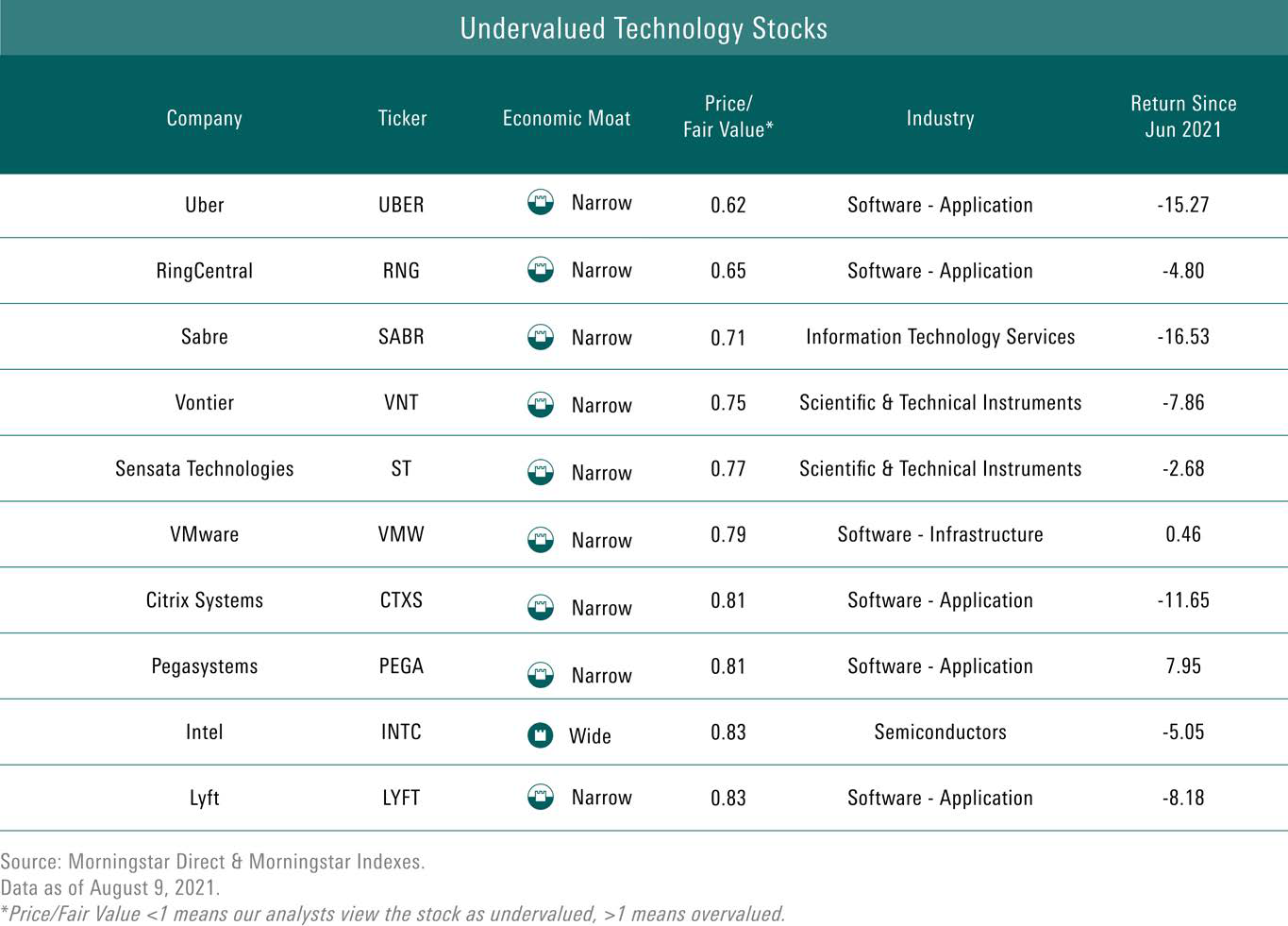

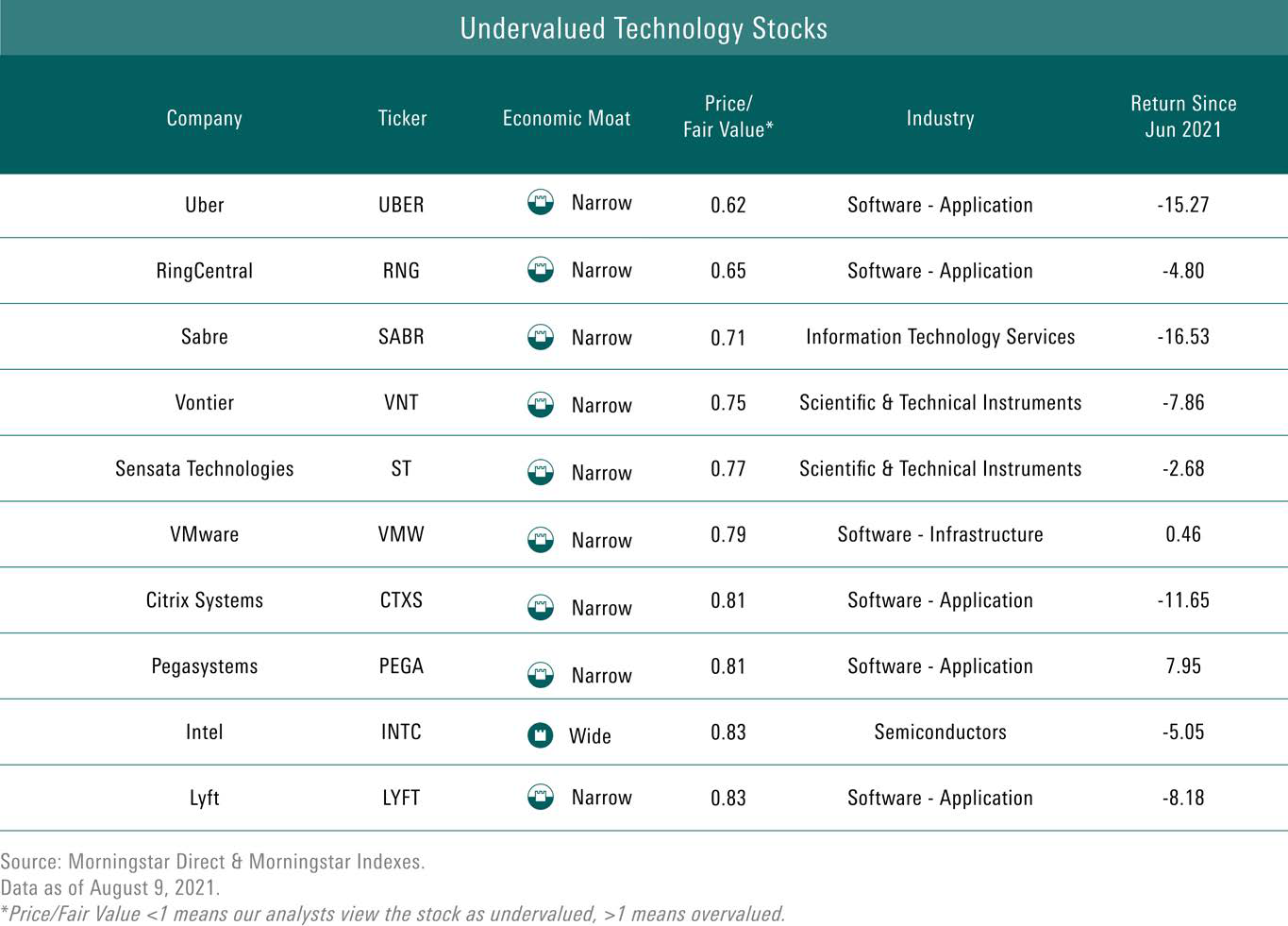

As technology stocks heat up, undervalued pockets still exist within the sector. To find them, we screened for Morningstar Economic Moat Rating, an analyst-assigned rating designated for companies with competitive advantages that lead to excess returns (advantages lasting 10 years for narrow-moat companies and 20 years for wide). We then sorted our list to find the lowest price/fair value ratios, which look the most undervalued by our analysts’ metrics. Here are the results:

As technology stocks heat up, undervalued pockets still exist within the sector. To find them, we screened for Morningstar Economic Moat Rating, an analyst-assigned rating designated for companies with competitive advantages that lead to excess returns (advantages lasting 10 years for narrow-moat companies and 20 years for wide). We then sorted our list to find the lowest price/fair value ratios, which look the most undervalued by our analysts’ metrics. Here are the results:

What we’ve seen since the beginning of June is that tech stocks are back on top. Technology is the highest-performing sector in the US market, up 12.4% since June 1, 2021. Energy, which formerly led the market with growth near 40% as of May this year, has tanked. The sector is down 5% since June.

What we’ve seen since the beginning of June is that tech stocks are back on top. Technology is the highest-performing sector in the US market, up 12.4% since June 1, 2021. Energy, which formerly led the market with growth near 40% as of May this year, has tanked. The sector is down 5% since June.

For the year to date, the top five contributors to the US equity market are all technology companies and heavy-hitter names from the FAANGs: Facebook (FB), Amazon.com (AMZN), Apple (AAPL), Netflix (NFLX), Google (GOOGL).

For the year to date, the top five contributors to the US equity market are all technology companies and heavy-hitter names from the FAANGs: Facebook (FB), Amazon.com (AMZN), Apple (AAPL), Netflix (NFLX), Google (GOOGL).

Within the technology space, leading industries include software infrastructure and applications, consumer electronics, and semiconductors.

Within the technology space, leading industries include software infrastructure and applications, consumer electronics, and semiconductors.

With technology picking up speed, the composition of the top of the market is changing. From January through May, technology companies contributed to 1.3% of the Morningstar US Market’s total return. Since June, they’ve contributed 2.9%, more than doubling their slice of the pie.

With technology picking up speed, the composition of the top of the market is changing. From January through May, technology companies contributed to 1.3% of the Morningstar US Market’s total return. Since June, they’ve contributed 2.9%, more than doubling their slice of the pie.

As technology stocks heat up, undervalued pockets still exist within the sector. To find them, we screened for Morningstar Economic Moat Rating, an analyst-assigned rating designated for companies with competitive advantages that lead to excess returns (advantages lasting 10 years for narrow-moat companies and 20 years for wide). We then sorted our list to find the lowest price/fair value ratios, which look the most undervalued by our analysts’ metrics. Here are the results:

As technology stocks heat up, undervalued pockets still exist within the sector. To find them, we screened for Morningstar Economic Moat Rating, an analyst-assigned rating designated for companies with competitive advantages that lead to excess returns (advantages lasting 10 years for narrow-moat companies and 20 years for wide). We then sorted our list to find the lowest price/fair value ratios, which look the most undervalued by our analysts’ metrics. Here are the results: