Albert Einstein is reputed to have said: “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

As an investor, making your money work for you is the best way to increase your wealth. And the wealth you will accumulate is the result of 2 things: how long you invest and the rate of return on your investment.

You will also need psychological qualities to make the whole thing work. Qualities like being patient, disciplined, knowing the value of things, and being able to act decisively on your own reasoning (and not on the opinion of others) when the odds are in your favour.

Doing the maths

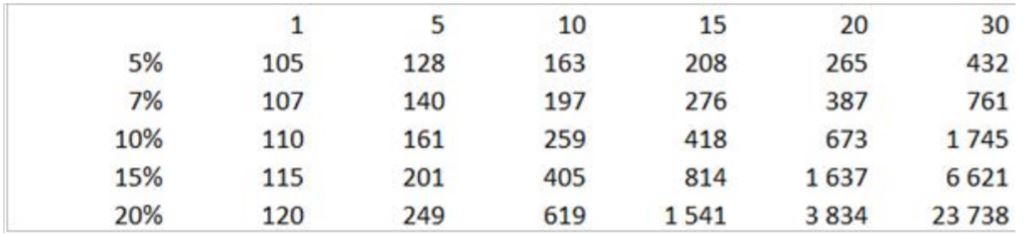

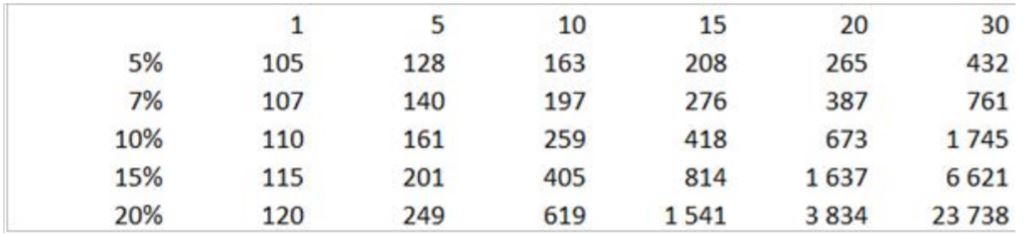

Why is compound interest so “magical”? The simple answer is: “Because it’s reinvested”. Compound interest is, simply put, interest on interest. Here’s an example. Assume you invest $100. The following table shows how much return you’d get over different lengths of time, and at varying rates of return.The power of compounding - in a table

Source: Author's calculations

If you invest $100 at 5% over 5 years, you get $128, but if you wait 10 years, that amount rises to $163. The longer you wait, the more you make! Of course, this goes even higher if you can get a higher return. For example, if you can find an investment that returns 15% for 10 years, you multiply your money by a factor of 4. If you wait for 20 years and still earn 15% a year (which is a lot), you get 16 times your money back. Twenty-percent seems like a very high unachievable return. Actually, it’s pretty rare, reserved to the most talented investors, such as Warren Buffett (the annual return of per-share market value of Berkshire Hathaway has been 20% per annum, over 55 years…).