The base case and economic reality

The swing factors that will influence your investments

- Geopolitics has become a greater swing factor in the past few years with the return of military conflict in eastern Europe and the Middle East. We’ve also seen more abrasive relations between China and the U.S. and upcoming elections may result in large policy shifts. These conflicts have already impacted prices, with potential knock-on effects on commodity prices including critical energy supplies. We must also weigh the economic effects of an ongoing rise in military spending in Europe, Asia and the U.S.

- Natural events impacting our physical environment and health have the potential to impact growth and inflation depending on their severity and the subsequent government responses. Extreme weather impacted energy demand in 2021 with shortfalls in solar and wind in North Asia causing higher demand and prices for gas. The pandemic had tragic health impacts and ongoing constraints on supply that impacted the economy in China from 2020 to 2022.

- Our third swing factor is the adoption of technological innovation. Only when the breakthrough discoveries of the past like the printing press, steam engines, electricity and computing were applied at scale did they enhance productivity, increase growth and ease inflationary pressures. The faster artificial intelligence is applied, the faster the effects will be felt. We are at the point now where application is expected to ramp up.

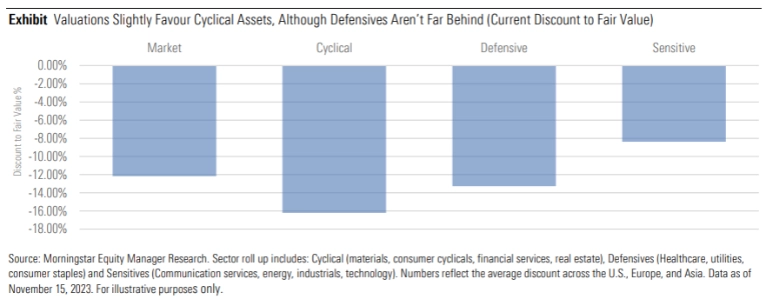

Economic challenges appear to be priced into the market