The footy season is over Down Under, following the National Rugby League grand final on October 6 and the Australian Football League decider the Saturday prior. I am aware the A-League Soccer season is about to begin. However, in Australia, “footy” is more commonly thought of as a winter escapade, played with balls that are oval-shaped.

What am I going to do now on weekends? Bother my wife and the kids? Go to BBQs talking to people I don’t like? Wander around Bunnings spending money I don’t have? Visit restaurants paying for nouveau cuisine I don’t want?

To deal with footy withdrawal symptoms, I have instead assembled a rugby league dream team of stocks—a “Brian’s Equitable XI”, if you will. One where the key requirements of each position are matched with companies exhibiting similar attributes within an investment context.

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

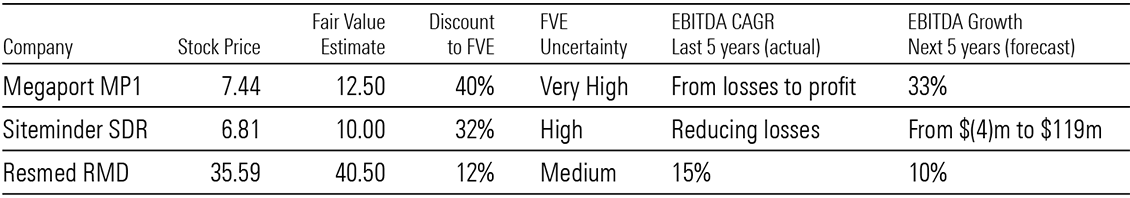

Unsurprisingly, fair value uncertainty ratings are Very High for data centre and cloud services provider Megaport, and High for hotel commerce platform Siteminder. However, the remarkable ascent of sleep apnea treatment company Resmed (which we still consider as showing value and have selected in the team) shows the evolution of a growth company and the remarkable contribution it can make to a portfolio.

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

Unsurprisingly, fair value uncertainty ratings are Very High for data centre and cloud services provider Megaport, and High for hotel commerce platform Siteminder. However, the remarkable ascent of sleep apnea treatment company Resmed (which we still consider as showing value and have selected in the team) shows the evolution of a growth company and the remarkable contribution it can make to a portfolio.

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

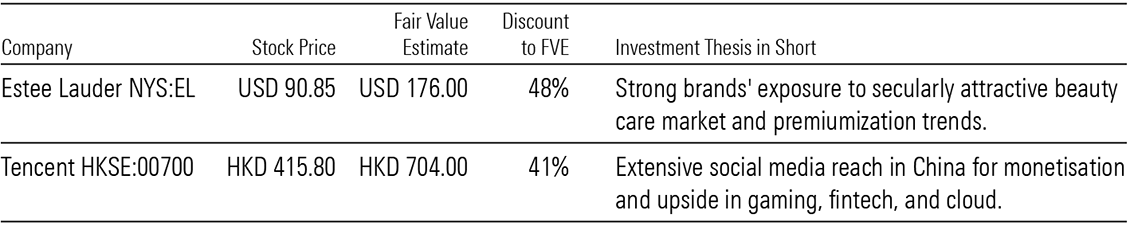

I could have nominated current tech-darlings such as Nvidia, Apple, Meta or whatever others that make up the ridiculous acronyms on NASDAQ (FANG, FAANG, MAMAA). Instead, I have gone with prestige beauty product maker The Estee Lauder Companies and Chinese Internet/social media giant Tencent, both trading at attractive discounts to our fair value estimates. The former because I see them lying around everywhere in our house, and the latter because my sons seem to be on some Tencent platform whenever they’re lying around the house.

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

I could have nominated current tech-darlings such as Nvidia, Apple, Meta or whatever others that make up the ridiculous acronyms on NASDAQ (FANG, FAANG, MAMAA). Instead, I have gone with prestige beauty product maker The Estee Lauder Companies and Chinese Internet/social media giant Tencent, both trading at attractive discounts to our fair value estimates. The former because I see them lying around everywhere in our house, and the latter because my sons seem to be on some Tencent platform whenever they’re lying around the house.

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

Both are high-quality, wide moat-rated companies whose shares are trading at decent discounts to our fair value estimates. Furthermore, their capital allocation ratings are Exemplary.

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

Both are high-quality, wide moat-rated companies whose shares are trading at decent discounts to our fair value estimates. Furthermore, their capital allocation ratings are Exemplary.

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

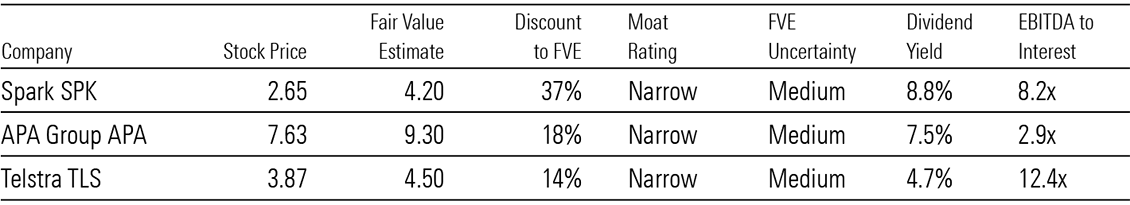

We see their earnings and cashflows as relatively resilient. As such, we believe their current attractive dividends can be maintained, particularly given the comfortable interest cover ratios.

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

We see their earnings and cashflows as relatively resilient. As such, we believe their current attractive dividends can be maintained, particularly given the comfortable interest cover ratios.

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

Both are trading at steep discounts to our fair value estimates, weighed down by excessive near-term concerns. However, our analysts are willing to look beyond them to focus on their long-term fundamentals. That is, producing oil and gas to sell at reasonable prices, and opening more stores to sell more pizzas at even more reasonable prices.

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

Both are trading at steep discounts to our fair value estimates, weighed down by excessive near-term concerns. However, our analysts are willing to look beyond them to focus on their long-term fundamentals. That is, producing oil and gas to sell at reasonable prices, and opening more stores to sell more pizzas at even more reasonable prices.

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

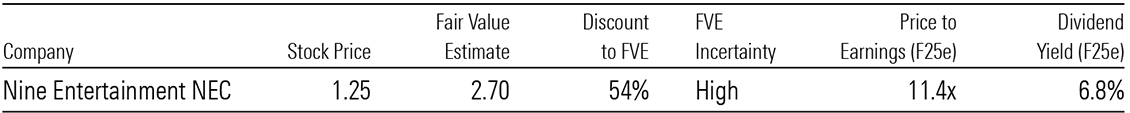

Shares in the diversified media company are trading at classic value-esque multiples and yield. The current advertising recession is hurting group earnings and investor concerns about structural headwinds are depressing earnings multiples. But the risks are more than reflected in the current bargain basement stock price, and we believe the sum of its various parts are significantly bigger than the current sub-$2bn market capitalisation value.

This rugby league dream team of stocks, “Brian’s Equitable XI”, is not intended to be an investment advice. I don’t need to bore you with a disclaimer that readers should consult their advisors and pay heed to their individual financial circumstances.

It is just a light-hearted way to examine some labels investors assign to stocks, by comparing them to how a rugby league team classifies its players according to positions.

At the end of the day, whether Growth, International, Blue-Chip, Defensive, Cyclical or Value, the aim of investing is to compound wealth over the long term, so you can do stuff with that wealth at some point in the future. You do this by buying a piece of a business below its intrinsic worth, having regard to the plethora of industry, competitive, operating and cultural dynamics it faces.

However, knowing the types of stocks that are out there can help improve portfolio diversification. It also allows better appreciation of the thematics driving certain types of stocks at different times.

Who knows? Take a look at your portfolio. You may find it contains too many flashy Fullback, Winger and Edge Forward-type stocks, and not enough Halves and Middle Forward-types. Depending on where interest rates go from here, that may be premiership-winning positioning, or wooden spoon-licking weighting.

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

Shares in the diversified media company are trading at classic value-esque multiples and yield. The current advertising recession is hurting group earnings and investor concerns about structural headwinds are depressing earnings multiples. But the risks are more than reflected in the current bargain basement stock price, and we believe the sum of its various parts are significantly bigger than the current sub-$2bn market capitalisation value.

This rugby league dream team of stocks, “Brian’s Equitable XI”, is not intended to be an investment advice. I don’t need to bore you with a disclaimer that readers should consult their advisors and pay heed to their individual financial circumstances.

It is just a light-hearted way to examine some labels investors assign to stocks, by comparing them to how a rugby league team classifies its players according to positions.

At the end of the day, whether Growth, International, Blue-Chip, Defensive, Cyclical or Value, the aim of investing is to compound wealth over the long term, so you can do stuff with that wealth at some point in the future. You do this by buying a piece of a business below its intrinsic worth, having regard to the plethora of industry, competitive, operating and cultural dynamics it faces.

However, knowing the types of stocks that are out there can help improve portfolio diversification. It also allows better appreciation of the thematics driving certain types of stocks at different times.

Who knows? Take a look at your portfolio. You may find it contains too many flashy Fullback, Winger and Edge Forward-type stocks, and not enough Halves and Middle Forward-types. Depending on where interest rates go from here, that may be premiership-winning positioning, or wooden spoon-licking weighting.

Fullback and wingers

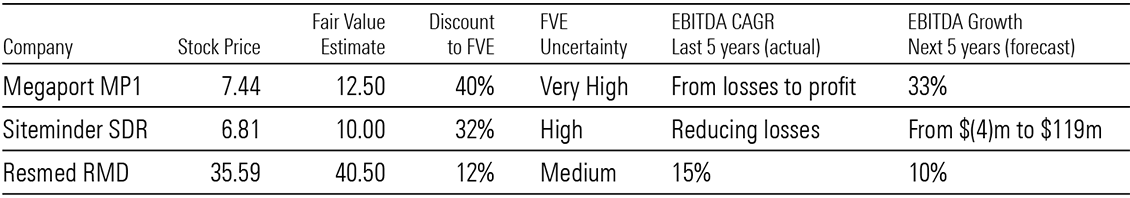

Flashy players occupy these positions, utilising blistering pace and high-flying acrobatics to bring in tries and keep the scoreboard ticking. In investment parlance, these are the Growth Stocks. They have a track record of impressive earnings increases which, most importantly, is expected to continue into the future. Their invariably ritzy earnings multiples reflect the growth potential, and their typically high fair value uncertainty ratings testify to the high variance in potential outcome. Still, these are the stocks that could provide the juice for portfolio outperformance. We have selected three stocks under our coverage to fill these positions, as can be seen in Exhibit 1, based on their strong forecast EBITDA growth outlook over the next five years.Exhibit 1: Growth stocks as fullback and wingers (in AUD)

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

Unsurprisingly, fair value uncertainty ratings are Very High for data centre and cloud services provider Megaport, and High for hotel commerce platform Siteminder. However, the remarkable ascent of sleep apnea treatment company Resmed (which we still consider as showing value and have selected in the team) shows the evolution of a growth company and the remarkable contribution it can make to a portfolio.

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

Unsurprisingly, fair value uncertainty ratings are Very High for data centre and cloud services provider Megaport, and High for hotel commerce platform Siteminder. However, the remarkable ascent of sleep apnea treatment company Resmed (which we still consider as showing value and have selected in the team) shows the evolution of a growth company and the remarkable contribution it can make to a portfolio.

Centres

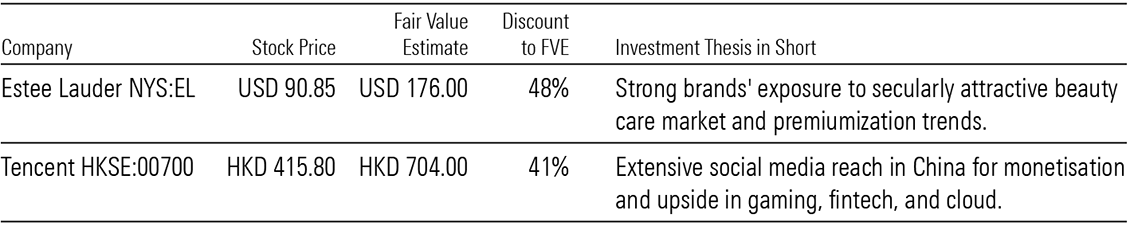

All-rounders typically play these positions. They can attack with flair, defend with stout and play out of structure to inject some X-factor. In an Australia/New Zealand portfolio, what could be more out-of-structure and X-factor-esque than International Stocks? I have been an ardent advocate of diversification via global investing to anyone who would listen, ever since discovering in my 30s there is a whole world out there beyond the ASX. With the subsequent advent of technology, proliferating trading platforms and falling commission rates, that world is open to anyone willing to shed their home bias. Scouring our global coverage universe of around 1,600 stocks, we have selected two to fill these positions. (Exhibit 2)Exhibit 2: International stocks as centres

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

I could have nominated current tech-darlings such as Nvidia, Apple, Meta or whatever others that make up the ridiculous acronyms on NASDAQ (FANG, FAANG, MAMAA). Instead, I have gone with prestige beauty product maker The Estee Lauder Companies and Chinese Internet/social media giant Tencent, both trading at attractive discounts to our fair value estimates. The former because I see them lying around everywhere in our house, and the latter because my sons seem to be on some Tencent platform whenever they’re lying around the house.

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

I could have nominated current tech-darlings such as Nvidia, Apple, Meta or whatever others that make up the ridiculous acronyms on NASDAQ (FANG, FAANG, MAMAA). Instead, I have gone with prestige beauty product maker The Estee Lauder Companies and Chinese Internet/social media giant Tencent, both trading at attractive discounts to our fair value estimates. The former because I see them lying around everywhere in our house, and the latter because my sons seem to be on some Tencent platform whenever they’re lying around the house.

Halves

These positions are almost always filled by marquee players, the playmaking lynchpins around whom whole teams are built. They are akin to Blue-Chip Stocks in an investment portfolio. As the mainstays in the portfolio, they exhibit a combination of capital appreciation potential and dividend generating capability. Critically, they possess durable competitive advantages in the industries they operate in, or an “economic moat”, such that their excess returns over cost of capital can compound over the long term. It just happens there are two stocks in our Australia and New Zealand Best Ideas list that fit these criteria: Australia’s dominant liquor retailer Endeavour Group and Australia’s homegrown Brambles which is now the world’s largest supplier of reusable wooden pallets. (Exhibit 3)Exhibit 3: Blue-chip stocks as halves (in AUD)

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

Both are high-quality, wide moat-rated companies whose shares are trading at decent discounts to our fair value estimates. Furthermore, their capital allocation ratings are Exemplary.

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

Both are high-quality, wide moat-rated companies whose shares are trading at decent discounts to our fair value estimates. Furthermore, their capital allocation ratings are Exemplary.

Middle forwards

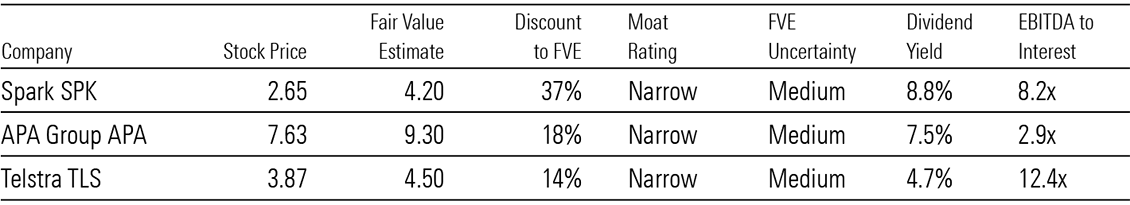

This position is the bedrock of the team. They are filled by big, non-nonsense players who plough their heads into places I wouldn’t put my mother-in-law’s feet. And when the going gets tough, they can be relied upon to hold the fort defensively and make the hard yards offensively. That sounds like big-cap, Defensive/Income Stocks in a portfolio. They may not be sexy. But with solid balance sheets and reliable cashflows by virtue of their defensive business traits, they can be counted on to provide portfolio stability and generate dividend income. Telecom and infrastructure are the prototype industries to find such stocks, and we have selected integrated telcos Spark New Zealand and Telstra, as well as gas infrastructure company APA Group as the picks. (Exhibit 4)Exhibit 4: Defensive/income stocks as middle forwards (in AUD)

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

We see their earnings and cashflows as relatively resilient. As such, we believe their current attractive dividends can be maintained, particularly given the comfortable interest cover ratios.

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

We see their earnings and cashflows as relatively resilient. As such, we believe their current attractive dividends can be maintained, particularly given the comfortable interest cover ratios.

Edge forwards

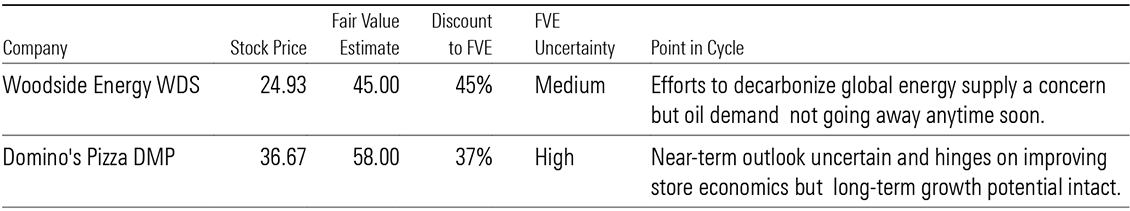

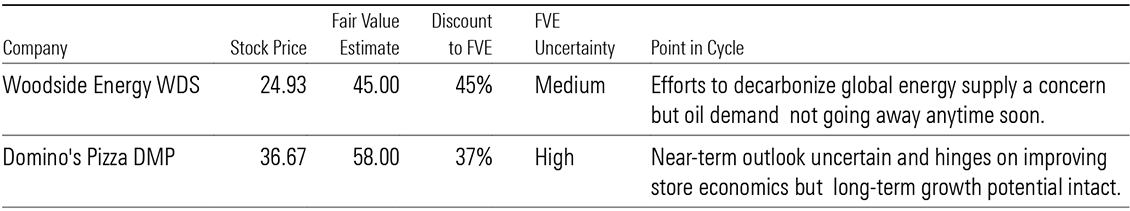

Edge forwards in rugby league are similar to centres in terms of attacking flair and defensive prowess. When the momentum is on the team’s side, they can run riot, given their size, skills and athleticism. However, because they are so big, these edge forwards can also go MIA at times when the pace of the game is too frantic or when the team’s back is against the wall. In other words, they sound like Cyclical Stocks. When the industry tailwinds are blowing and tides are rolling in, these stocks can do no wrong. But when the tides turn, the dry spell can be frustratingly long. And just when investors give up on them, as low earnings multiples coincide with bottom-of-cycle earnings and they are demonised as “value traps”, these cyclical stocks rise again as tides come back in. Energy and discretionary retail are the classic cyclical sectors, and we have selected two stocks therein to fill this position. They are oil and gas producer Woodside and pizza outlets and franchise services provider Domino’s Pizza. (Exhibit 5)Exhibit 5: Cyclical stocks as edge forwards (in AUD)

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

Both are trading at steep discounts to our fair value estimates, weighed down by excessive near-term concerns. However, our analysts are willing to look beyond them to focus on their long-term fundamentals. That is, producing oil and gas to sell at reasonable prices, and opening more stores to sell more pizzas at even more reasonable prices.

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

Both are trading at steep discounts to our fair value estimates, weighed down by excessive near-term concerns. However, our analysts are willing to look beyond them to focus on their long-term fundamentals. That is, producing oil and gas to sell at reasonable prices, and opening more stores to sell more pizzas at even more reasonable prices.

Hooker

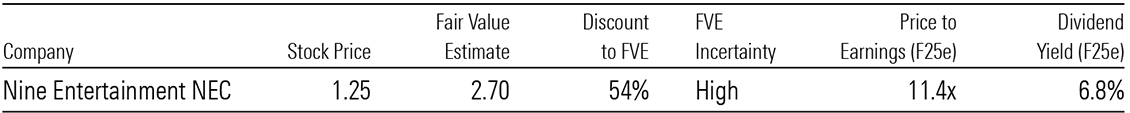

Rugby league professionals who play this position are often underappreciated. They are the short, squat ones with cauliflower ears, busted noses and yappy mouths, tackling much bigger forwards and getting trampled on in doing so. For all that trouble, they are under-remunerated compared to the flashy types who get all the glory. In the investment world, there is a name for these types—Value Stocks. They are called that because they are usually boring businesses, businesses in a turnaround or cyclical businesses at the wrong end of the cycle. Because of these reasons, they are also cheap, in terms of low earnings multiples and high dividend yields. We have selected Nine Entertainment to fill this position from our Australia and New Zealand coverage. (Exhibit 6)Exhibit 6: Value stock as hooker (in AUD)

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

Shares in the diversified media company are trading at classic value-esque multiples and yield. The current advertising recession is hurting group earnings and investor concerns about structural headwinds are depressing earnings multiples. But the risks are more than reflected in the current bargain basement stock price, and we believe the sum of its various parts are significantly bigger than the current sub-$2bn market capitalisation value.

This rugby league dream team of stocks, “Brian’s Equitable XI”, is not intended to be an investment advice. I don’t need to bore you with a disclaimer that readers should consult their advisors and pay heed to their individual financial circumstances.

It is just a light-hearted way to examine some labels investors assign to stocks, by comparing them to how a rugby league team classifies its players according to positions.

At the end of the day, whether Growth, International, Blue-Chip, Defensive, Cyclical or Value, the aim of investing is to compound wealth over the long term, so you can do stuff with that wealth at some point in the future. You do this by buying a piece of a business below its intrinsic worth, having regard to the plethora of industry, competitive, operating and cultural dynamics it faces.

However, knowing the types of stocks that are out there can help improve portfolio diversification. It also allows better appreciation of the thematics driving certain types of stocks at different times.

Who knows? Take a look at your portfolio. You may find it contains too many flashy Fullback, Winger and Edge Forward-type stocks, and not enough Halves and Middle Forward-types. Depending on where interest rates go from here, that may be premiership-winning positioning, or wooden spoon-licking weighting.

Source: Company reports and Morningstar estimates. Data as of October 16, 2024.

Shares in the diversified media company are trading at classic value-esque multiples and yield. The current advertising recession is hurting group earnings and investor concerns about structural headwinds are depressing earnings multiples. But the risks are more than reflected in the current bargain basement stock price, and we believe the sum of its various parts are significantly bigger than the current sub-$2bn market capitalisation value.

This rugby league dream team of stocks, “Brian’s Equitable XI”, is not intended to be an investment advice. I don’t need to bore you with a disclaimer that readers should consult their advisors and pay heed to their individual financial circumstances.

It is just a light-hearted way to examine some labels investors assign to stocks, by comparing them to how a rugby league team classifies its players according to positions.

At the end of the day, whether Growth, International, Blue-Chip, Defensive, Cyclical or Value, the aim of investing is to compound wealth over the long term, so you can do stuff with that wealth at some point in the future. You do this by buying a piece of a business below its intrinsic worth, having regard to the plethora of industry, competitive, operating and cultural dynamics it faces.

However, knowing the types of stocks that are out there can help improve portfolio diversification. It also allows better appreciation of the thematics driving certain types of stocks at different times.

Who knows? Take a look at your portfolio. You may find it contains too many flashy Fullback, Winger and Edge Forward-type stocks, and not enough Halves and Middle Forward-types. Depending on where interest rates go from here, that may be premiership-winning positioning, or wooden spoon-licking weighting.